Everything you need to know about leveraging the yield curve in fixed-income investing

Redacción Mapfre

The yield curve is one of the most important indicators in fixed-income investing because it shows how the market values money over time and, more importantly, market expectations for the economy. That’s why understanding the curve’s “shape” is so critical—it can completely change the way you approach your investment strategy.

The yield curve normally slopes upward: longer-term bonds offer higher yields than short-term ones to compensate investors for taking on more duration risk. As the Bank of Spain explains, “the yield curve will normally have an upward slope, reflecting that bonds tend to have higher yields as their term increases.” In other words, under typical conditions, the yield on a 10-year bond is higher than that on a 2-year bond because investors demand an additional term premium. An upward-sloping curve signals confidence in future economic growth.

On the other hand, the yield curve can flatten or even invert. A flat curve indicates that short- and long-term yields are similar, reflecting uncertainty about the future. In an inverted curve, short-term bonds offer higher yields than long-term ones, a rare situation that usually indicates investors are anticipating an economic slowdown. In other words, in an inverted curve, the return from short-term bonds exceeds that of long-term bonds.

While not an exact science, financial experts often interpret an inverted yield curve as a sign that investors are seeking safety in long-term bonds, anticipating a potential recession.

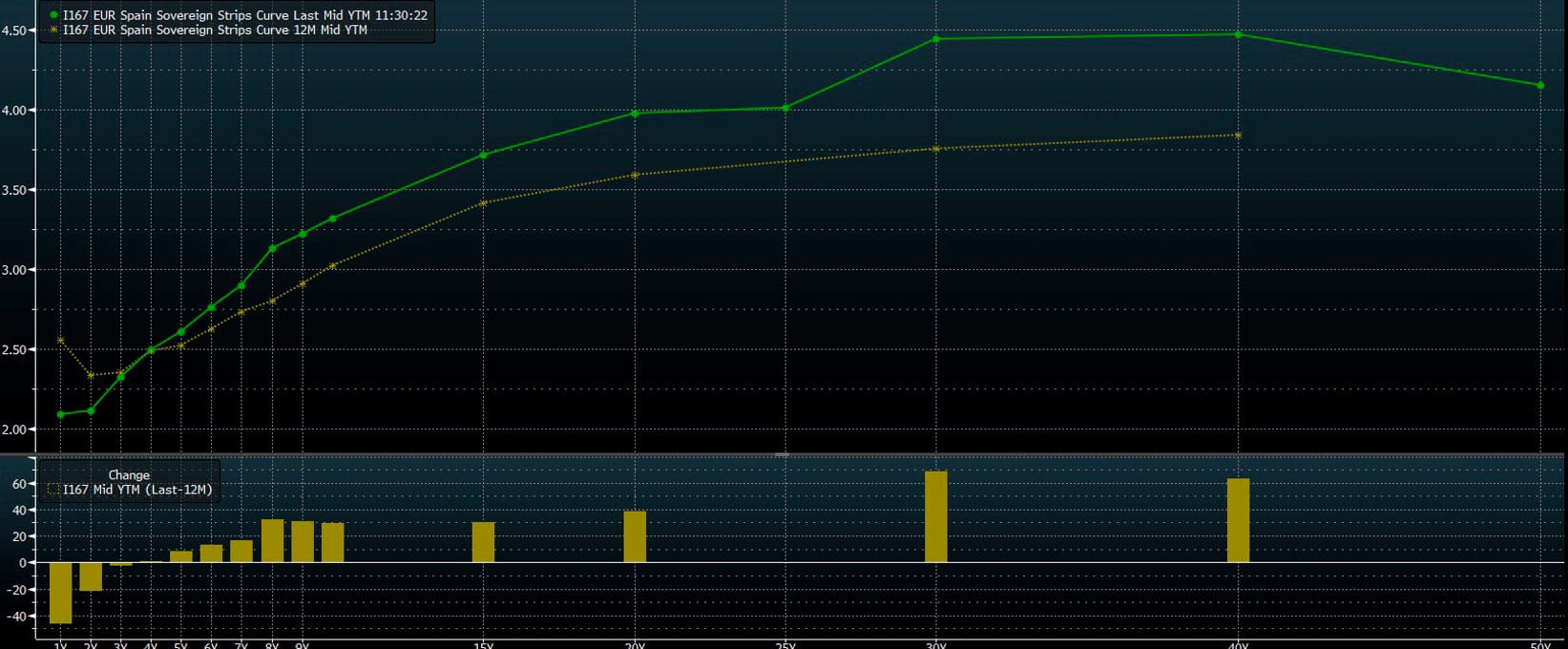

The current yield curve

As of November 24, 2025, Spain’s yield curve remains upward-sloping (normal), though it has flattened somewhat in the medium-term segments. The 3-year Spanish bond yield is approximately 2.18%, the 5-year yield is around 2.49%, and the 10-year yield is close to 3.17%–3.23%.

This curve suggests that investors still demand a substantial term premium to hold longer-term bonds, reflecting confidence that short-term interest rates are unlikely to fall sharply and may stay relatively stable. Moreover, in recent auctions, the Spanish Treasury issued 3-year bonds at 2.1% and 20-year bonds at 3.7%, further reinforcing the evidence of an increasing term premium.

Why is the yield curve important?

1. It signals expectations for future interest rates

The yield curve shows the market's expectations for the central bank's interest rate decisions in the coming years.

- Normal (steep) curve: the market anticipates higher rates in the future.

- Inverted curve: the market expects rate cuts and even a potential recession.

This is important because bond prices move in the opposite direction of interest rates. Knowing where market expectations are headed helps investors decide whether to lengthen or shorten duration.

2. It determines whether the time is right for a short- or long-term investment

The yield curve shows where the most attractive risk-adjusted returns can be found:

- If the curve is inverted, short-term bonds offer higher yields, so locking in money for the long term is generally not advisable.

- If the curve is normal (steep), long-term bonds pay significantly more, making it worthwhile to capture the term premium.

In other words, the shape of the curve dictates your duration strategy, the most important factor in fixed-income investing.

3. It reflects the state of the economy

More than just a financial tool, the yield curve acts as an economic “thermometer,” providing valuable guidance for investment decisions. As we noted earlier, it’s not infallible, but generally:

- Normal curve: a stable or expanding economy.

- Flat curve: uncertainty.

- Inverted curve: historically points to an economic slowdown.

How to take advantage of the yield curve

The shape of the yield curve provides actionable signals for investment strategy:

- Normal curve (upward-sloping): When the curve is normal and steep, long-term bonds yield substantially more than short-term bonds. In this case, extending portfolio duration can increase returns.

- Inverted curve: When the curve inverts, short-term bonds offer higher yields than long-term ones. In this scenario, it’s more profitable to invest in the short term. It’s advisable to shorten portfolio duration and avoid locking in funds at long-term rates that could decline. In other words, investors should turn to short-term bonds or money-market instruments to capture the higher yields currently available for the near term.

- Flat curve: When short- and long-term rates are nearly equal, the term premium is low, so no particular maturity stands out as advantageous. In this case, it’s common to diversify across maturities by combining short- and medium-term bonds to maintain stability while capturing some extra yield without taking on the risk of very long maturities. It may also be a good time to include other defensive or flexible assets, as fixed income alone doesn’t offer the same level of protection as a mix of maturities. In general, if the curve doesn't show a clear slope, it's usually best to use a balanced, intermediate strategy.