Alternative assets are a good way to diversify the portfolio, and MAPFRE knows it. Since 2018, the Group has worked to have greater exposure to this area and explore new investment opportunities: as of last year, €1.35 billion had been committed to this type of asset.

News

How do interest rates affect bonds?

Fixed income is shaping up to be "the star asset" this year, although uncertainty regarding interest rate movements could put some investors off. Juan Nozal, fund manager of MAPFRE AM, explains how these movements impact bond prices and yields.

Stock markets continue their rally despite dampened expectations of rate cuts

Global stock markets continue to rise, despite the dampening of expectations as far as rate cuts go, which have shrank from six cuts to only three in the United States and two in the case of the eurozone. MAPFRE Asset Management analyzes the macro situation in its monthly report.

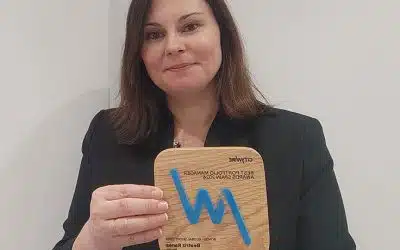

Beatriz Ranea, recognised as best fixed-income manager

Beatriz Ranea has received the best manager award in the Bonds - Global Short Term category at the 2024 Awards to the best Fund Managers and Groups, presented by specialist publication Citywire Spain, for her management of the MAPFRE Short Term Euro product.

MAPFRE’s growing commitment to the best financial agents

MAPFRE’s most valuable asset is its extensive network of agents in the markets it operates in. The Group has the largest distribution network in Spain in terms of size and capacity—part of the company’s DNA when it comes to the insurance business. .

How MGP chooses the best funds for its client

MAPFRE Gestión Patrimonial (MGP), MAPFRE’s financial advisory area, takes the selection of investment managers and funds for its clients very seriously.

Diversification and active management, essential in the current market environment

With stock market indexes at record highs and a elevated concentration in some of them, it is esential to take precautions, including diversification and active management, as advocated by MGP in its monthly report.

Annual MGP Conference: “Regulatory changes can also present an opportunity”

Investor protection and technological changes, among other factors, have forced managers and advisory firms to adapt to various regulatory changes. Although they are always seen as a burden, Miguel Ángel Segura, general manager of MAPFRE Inversión, insists that they can also be an opportunity to do things better.

“Lowering rates doesn’t seem compatible with the current state of the economy”

The ECB decided to keep the three official interest rates unchanged for the fourth consecutive time, and reinforced the message that the debate on lowering rates remains premature.

Video

MAPFRE AM Responsible Inclusion

Video

MAPFRE AM Presentation

Video

Global Bond Fund