Volatility: Risk or opportunity?

Redacción Mapfre

By Javier de Berenguer Viota, analyst and fund selector at MAPFRE Gestión Patrimonial

Volatility as a risk

Volatility is defined as the dispersion of a set of returns against its average over a given period (daily, weekly, monthly, etc.). In more colloquial terms, it represents the magnitude with which the prices of financial assets vary in the markets, and it is expressed as follows:

The magnitude of these variations combines with the uncertainty surrounding future payments. So the more visible these payments are, the lesser the dispersion of the price will be, and vise versa.

This logical scheme explains why (corporate) bonds have lower historical volatility compared to shares. Bonds rank higher in order of priority, which results in an increase in the probability of payment of their flows. It would also explain why securities with low sensitivity to the economic cycle, or those with strong competitive advantages, show lower price variations compared to others that are more unpredictable. All this becomes clear when using the cash flow discount formula. This equation is the basis of valuation of almost any asset in financial markets.

In short, if the probability of payment is lower, then its volatility will be higher, thus reflecting that uncertainty. However, in practice, if the saver is patient, greater volatility also means greater returns. This means that the spotlight shifts from asset selection to investment decisions, where the saver is ultimately responsible for the resulting risk.

The role of the investor

Once an investor manages to build a diversified portfolio, the specific risk (selection of a specific asset in the market) drastically decreases. We would only have two issues to watch out for:

1. “Advisor” risk: this results from errors made in financial planning, which is normally caused by a lack of inputs (expenses that have not been taken into account, incorrect definition of objectives, etc.).

2. “Investor” risk: defined as a hasty decision-making process that deviates from the initial plan and which usually reduces returns once the duration set for the investment has been met.

We are going to focus on this second section, as it is one of the main reasons why the average investor sees returns that are lower than that of the market, or what Morningstar has called: “Investor Gap.”

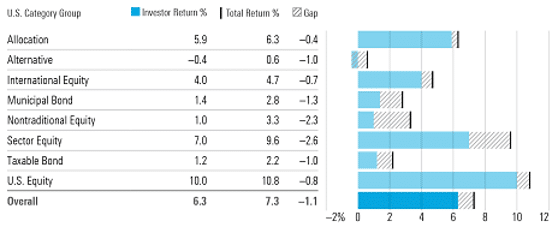

Table 1. Return gap between Investor and Asset Category (US Market)

Source: Morningstar. Data from last 10 years to 12/31/2023.

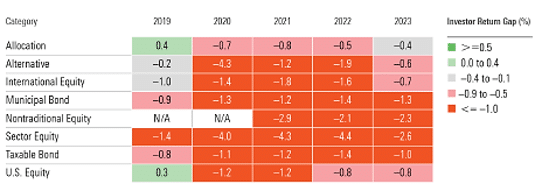

This study, now a point of reference of the company, not only shows that the average investor destroys profitability in every asset category, but that in categories with greater volatility, the erosion of the alpha is greater (thematic, sectoral), with the total average being -1.1%. The analysis also shows that this slippage recurs in all calendar years analyzed, and that the data from the latter study perfectly match those obtained in previous years.

Table 2. Investor return gap per calendar year

Source: Morningstar. Data to date: December 31, 2023.

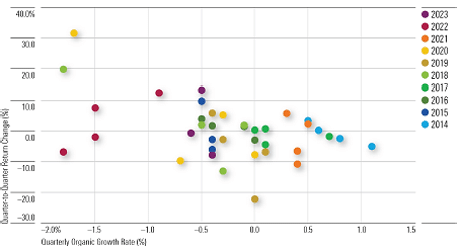

These lower returns are not due to the selection of funds and/or products, but directly points to decision-making related to market timing. This is shown in the following table, which tells us how investors tend to make poor allocation decisions, by withdrawing capital in bullish periods and vise versa. This became even more obvious in 2020, when all categories ended positively, but investors withdrew capital in every quarter of the year.

Table 3. Organic growth net flows vs Returns (quarterly period)

Source: Morningstar. Data to date: December 31, 2023.

In the document, Morningstar makes other interesting discoveries we will not detail herein, but which could be summarized as follows:

1. Investing in passive funds does not reduce the yield gap, because since they are priced in real time they are more likely to be marketed in overnight trading, and thus influenced by sentiment factors.

2. Investing with simplicity and with a clear plan tends to lead to better future returns. Have systematic contribution mechanisms, such as the Dollar Cost Average (DCA), reduces emotional exposure and prevents us from making poor decisions.

3. Multi-assets funds are a very useful tool to avoid such losses of returns. First, because they usually are usually tied to defined contribution plans (periodic contributions) and second because, in addition to being diversified, they facilitate balancing tasks, thus reducing transaction costs.

Volatility is an opportunity, because price is not the same as value

When we talk about volatility, we are referring to price variations. Although this is clear, it should be noted that the value of an asset need not fluctuate in the same way or to the same magnitude as its price. Value represents a subjective estimate (discount to present value of future cash flows) and it tends to be more stable than the price because it bases its calculation on long-term fundamentals.

Therefore, when the price falls, but the value does not, buying opportunities are generated at lower levels, which increases the theoretical returns of the investment. This, which can be applied both at the asset category level and to a specific subasset, represents the foundations on which active management is built, and it indirectly shows that markets are not efficient (price ≠ value), at least in the short term.

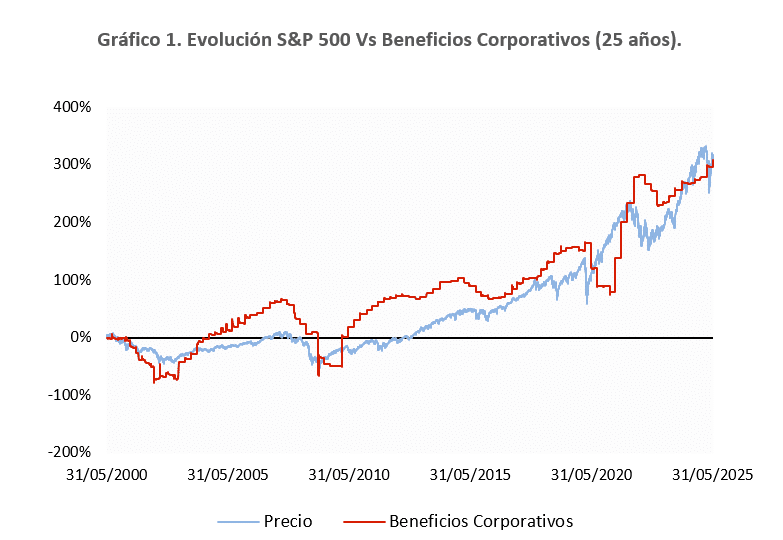

An appropriate illustration of this could be trends in the prices of an index (S&P 500) and its corporate profits. This chart shows how in short-term periods, price and profits tend to differ, while in the long-term the earnings are usually reflected in stock prices.

Source: Bloomberg, prepared internally. Data to date: May 31, 2025.

We might conclude that volatility may be either a risk or opportunity, depending on how it is used. For investors who make movements influenced by the continuous flow of news that appears on a daily basis, volatility has proven to be the most important factor in the loss of returns. In contrast, for those who are more patient, it becomes a indispensable alpha tool and a key ally for the development of their assets.