Fed holds rates pending trade policy

Redacción Mapfre

Eduardo García Castro, expert economist at MAPFRE Economics

The U.S. Federal Reserve decided to keep its benchmark interest rates unchanged at the 4.25% to 4.50% range for the third consecutive meeting, with unanimous support from the Federal Open Market Committee (FOMC). No changes were announced to the balance sheet reduction strategy, meaning the pace of quantitative tightening (QT) will continue as planned, with asset sales totaling 5 billion dollars per month.

In the post-meeting press conference, Chair Jerome Powell highlighted that recent data suggests economic activity continues to expand at a solid pace. He downplayed the GDP contraction observed in the first quarter, attributing it to volatility in net exports, but emphasized that uncertainty about the economic outlook has increased further. Similarly, he pointed out that the risk balance has shifted in both directions, with greater risks now associated with both higher unemployment and rising inflation, which remains slightly above the target.

Against this backdrop, Powell indicated that the appropriate course of action is to maintain a wait-and-see approach until greater clarity emerges. He refrained from offering any guidance on future policy moves. In response to criticism of the Fed’s policy direction, Powell declined to comment, instead reaffirming the institution’s focus on responding to deviations from the objectives of its mandate. This stance reinforces the Fed’s independence and avoids political speculation or controversy.

Assessment

Since the last meeting, the situation can be summarized as one of high volatility driven by trade uncertainty. However, the data provides little evidence to justify a shift in policy. Economic activity has generally remained positive, with the PMI and ISM, among other sentiment indicators, signaling continued expansion. Although there was a decline in GDP, it appears to be driven by atypical factors. The labor market shows no signs of weakening, and inflation data continues to moderate gradually, although it remains above the target. The tariff policies announced on April 2 have yet to fully materialize. Therefore, responding to them falls outside the Federal Reserve’s mandate, given the lack of clarity around the final format of these tariffs and their potential impact on the economy.

Regarding employment, there are still no signs of weakness in the labor market. The unemployment rate held steady in April at 4.2%, with 177,000 new jobs added and little change in the labor force participation rate, which showed a slight improvement—rising to 62.6% from 62.5% the previous month. From another perspective, higher-frequency data such as weekly unemployment claims showed an uptick in layoffs; however, these remain within the normal range. The JOLTS survey also showed little change, with 7.2 million job openings and a hiring rate of 3.4%, indicating a balanced labor market so far.

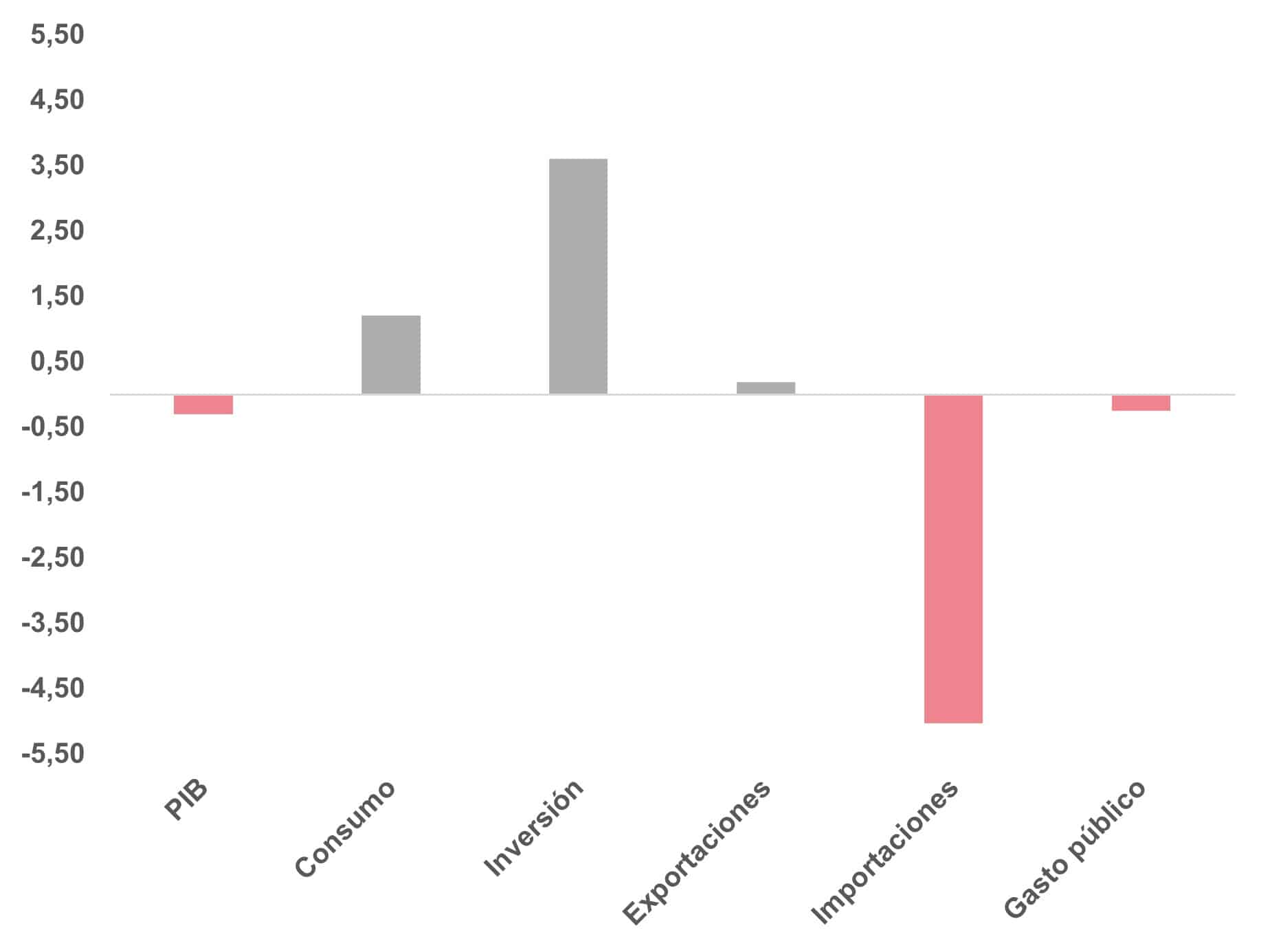

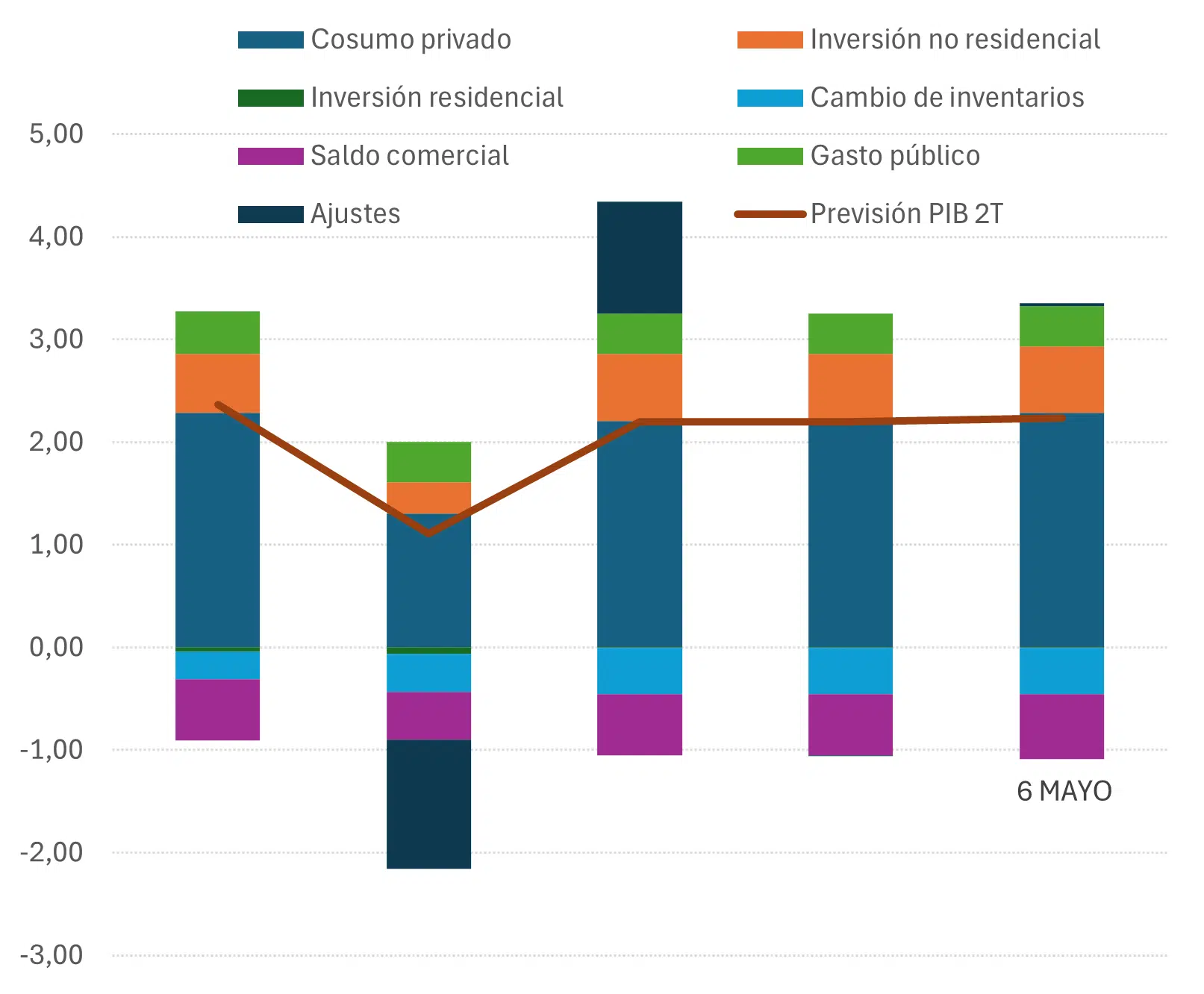

In terms of economic activity, first-quarter GDP figures showed a slight contraction (-0.3%), although they were better than preliminary estimates. The decline is mainly explained by a deterioration in net trade and lower government spending. The trade variable reflects an unusual spike in imports ahead of the implementation of new tariffs, a factor that could reverse and normalize if negotiations progress. Meanwhile, the drop in public spending was partly offset by growth in the private sector, where early signs of easing uncertainty are beginning to appear. This could positively affect consumer and business confidence (see Charts 1 and 2).

Chart 1: Contributions to GDP in the first quarter

Source: MAPFRE Economics (with BLS data)

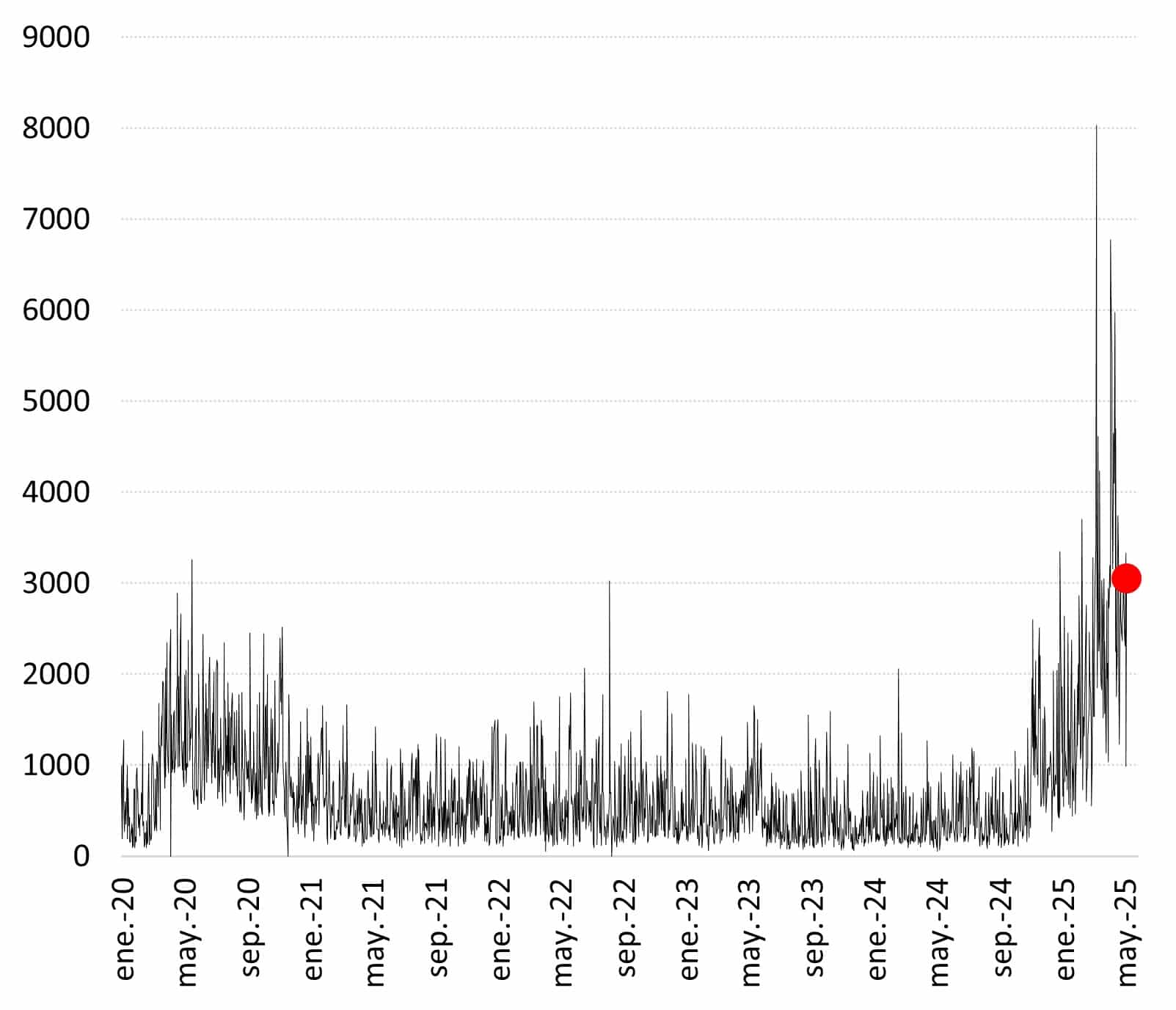

Chart 2: Uncertainty index of U.S. trade policy

Source: MAPFRE Economics (with EPU data)

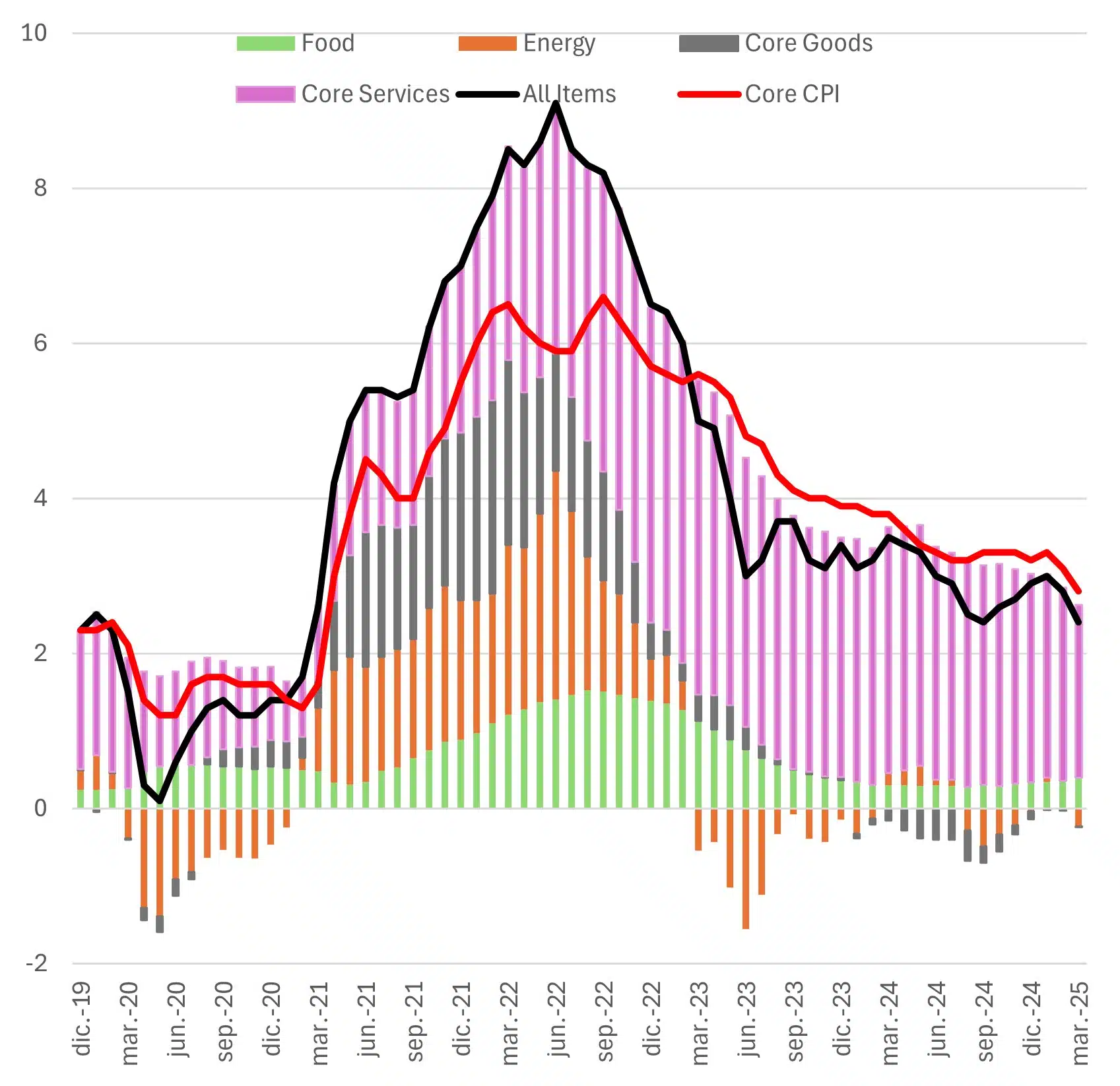

Regarding inflation, the general Consumer Price Index (CPI) fell by 0.1% month-on-month in March, bringing the annual rate to 2.4%, mainly due to lower energy prices—a trend expected to continue based on current oil and gas prices. As for the core inflation rate, which excludes energy and food, it also declined to 2.8% year-over-year, largely due to fading pressure from the services sector and stable figures in the goods sector (see Chart 3).

Chart 3: Inflation in the United States by components

Source: MAPFRE Economics (with Haver data)

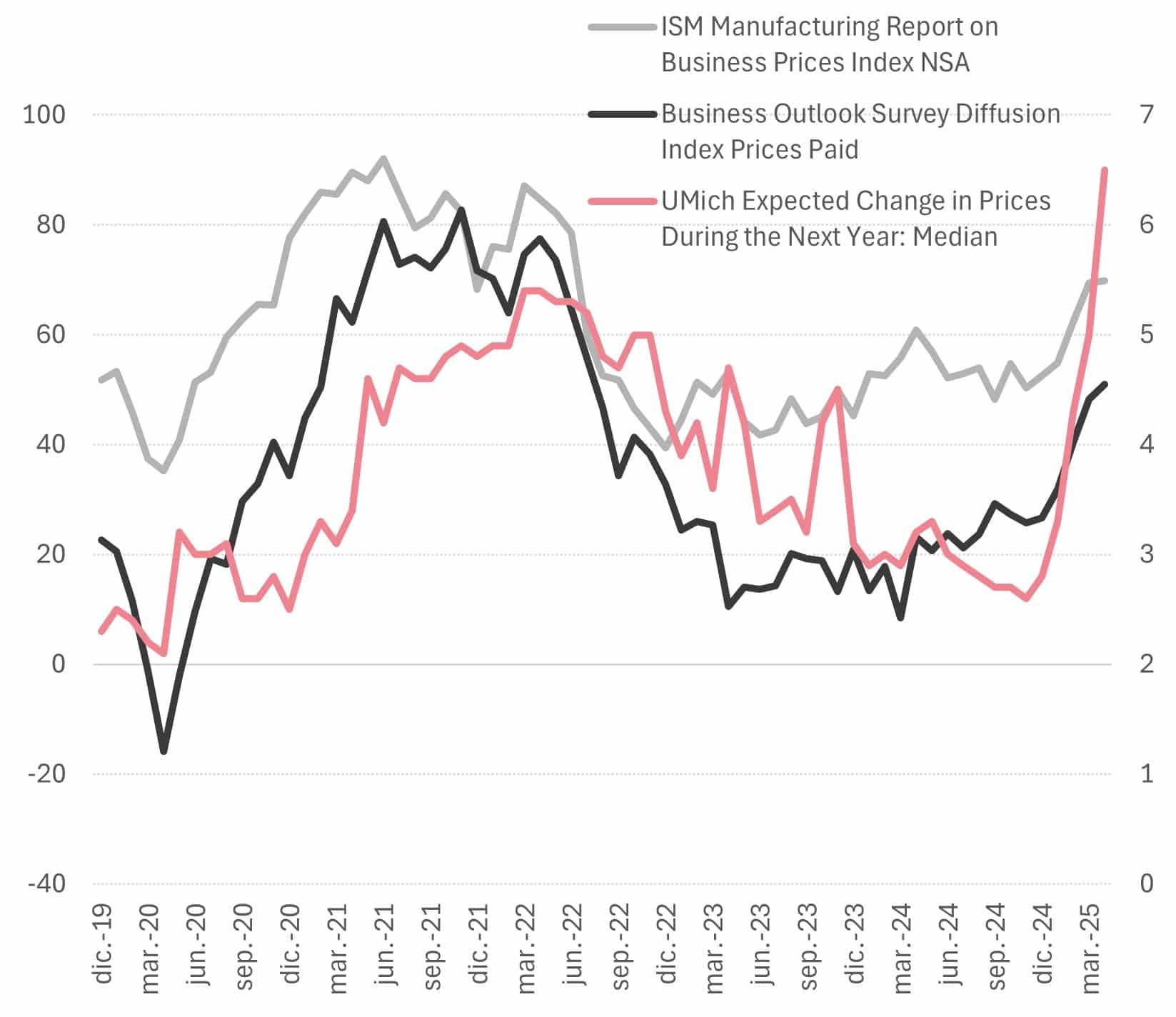

In terms of expectations, concerns about potential price increases in the future remain present, as shown by the upticks in various consumer surveys. At the same time, producer surveys align with this view, acknowledging the possibility of introducing and passing on certain tariff surcharges to final prices in the future (see Chart 4).

However, despite the lack of a consistent framework providing clarity for future spending and investment decisions, it is worth noting that some optimism seems to be growing again. This anticipates both a potential resolution of trade agreements with the United States' major partners and a consumer whose expectations diverge from actual data, as indicated by initial forecasting exercises (see Chart 5). These expectations are in line with the outlook presented in our most recent report, 2025 Economic and Industry Outlook: Second-Quarter Forecast Update.

Chart 4: Inflation expectations in the United States

Source: MAPFRE Economics (with Bloomberg data)

Chart 5: United States GDP forecasts for Q2

Source: MAPFRE Economics (based on Atlanta Fed data)

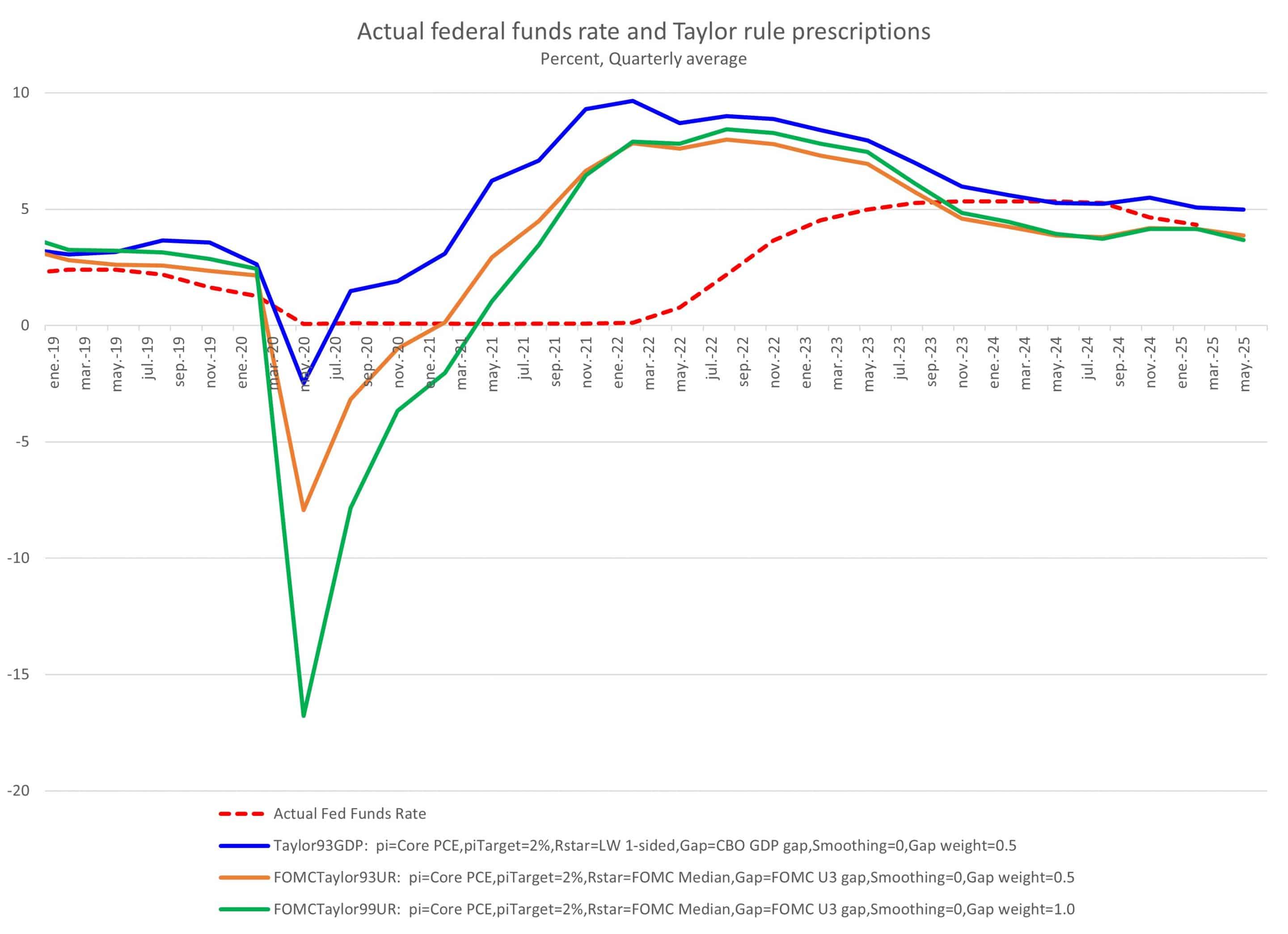

For now, the Federal Reserve is sticking to its position of not acting preemptively or responding to signs of a supply shock. It is waiting for data that might indicate a need for action. The pause until the next scheduled meeting in June, when new inflation and growth forecasts will be available, along with new information on tariffs and their potential impact, will allow for a more precise response. This idea is also reinforced by considering that, in line with economic theory, current interest rates remain within the range considered appropriate (see Chart 6).

Chart 6: Current interest rate and estimates according to the Taylor rule

Source: MAPFRE Economics (based on Atlanta Fed data)

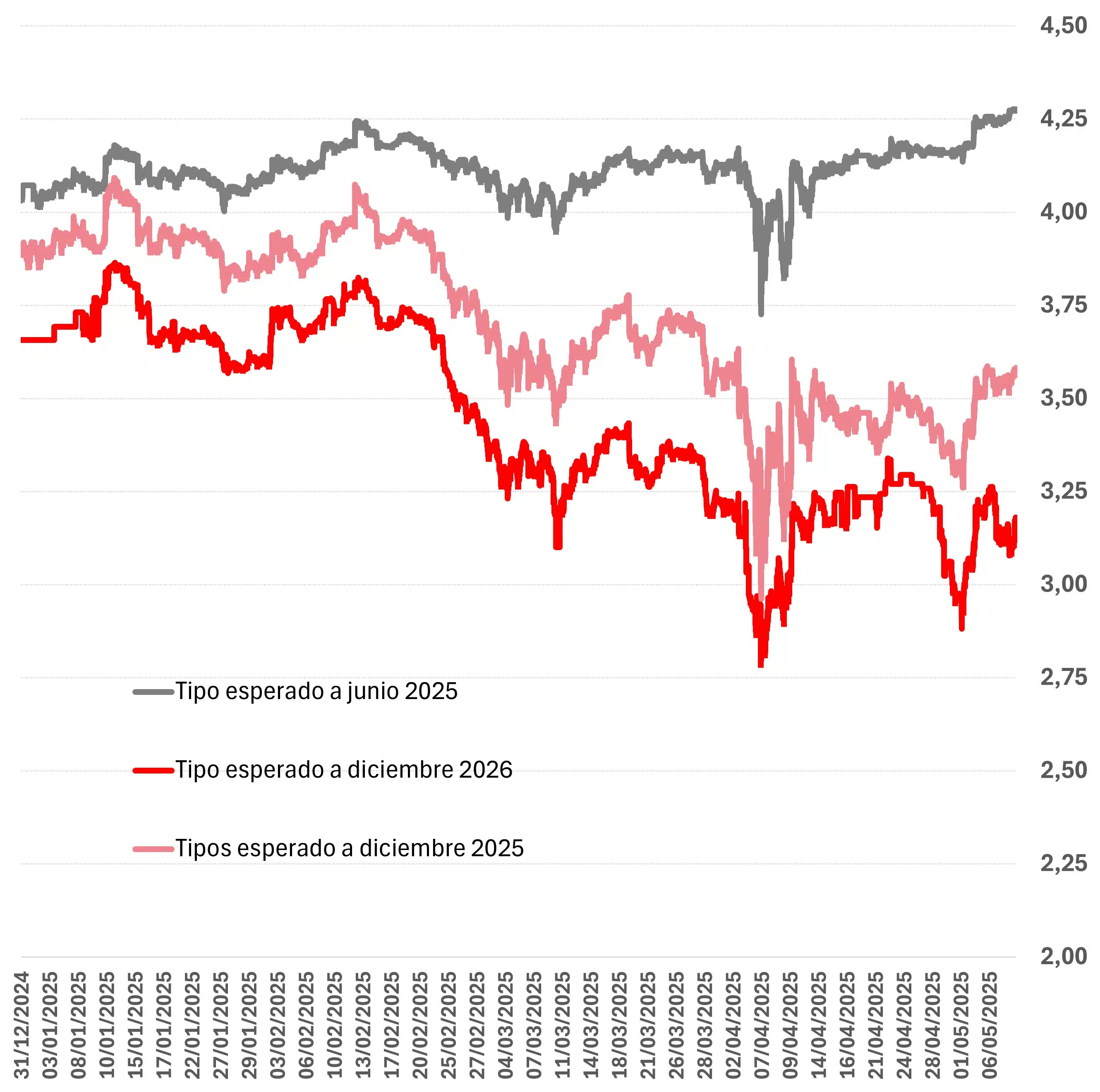

In fact, the Fed has acknowledged the increase in uncertainty for both risks, meaning that the conditions for reducing interest rates will be considered more of a reactive measure rather than a preventive one moving forward. Similarly, after recent market turbulence, the probabilities of a rate cut (as indicated by swaps) have once again aligned with the Federal Reserve's message. The curve has moderated, and June now seems likely to see another pause as the most probable option (see Chart 7).

Chart 7: SWAP-discounted interest rates

Source: MAPFRE Economics (with Bloomberg data)