Records, risks, and reasons for caution (and optimism) in the markets

Redacción Mapfre

Jonathan Boyar, director of Boyar Value Group and advisor to the MAPFRE AM US Forgotten Value Fund

April 2, 2025—‘Liberation Day’—when President Donald Trump unveiled his initial tariff plan, sparking a 12% plunge in the S&P 500 over just four trading days, now feels like a distant memory after two consecutive quarters of strong gains.

In the third quarter, U.S. equities extended their post liberation day advance: the Dow Jones Industrial Average gained 5.2%, the S&P 500 rose 7.7%, the Nasdaq surged 11.2%, and the Russell 2000—an index of small-capitalization stocks—jumped 12%. It was the small-cap index’s best quarter since late 2023 and its first new all-time high since 2021.

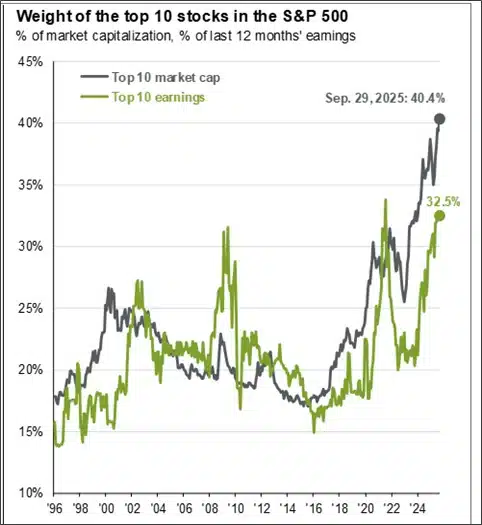

The rally, however, was uneven. The S&P 500 Equal Weight Index, which reduces the outsized influence of mega-caps, gained a respectable but more modest 4.4%. In other words, while the indices set records, much of the advance once again came from a narrow group of large-capitalization companies. Today, just 10 stocks account for more than 40% of the S&P 500—a concentration without precedent.

The Fed, politics, and policy shifts

It’s never easy to say exactly why the stock market moves, but a major driver of the market’s advance has been changing expectations about the Federal Reserve. Investors began to believe the Fed would be more willing to cut interest rates, with growing hopes for one or two more cuts (in addition to the 25-bps rate cut that took place in September) before the end of the year.

The policy debate has been anything but quiet. The Trump administration has pressed the Fed to cut rates more aggressively, even attempting to remove Governor Lisa Cook—a move that stirred fresh concerns about the central bank’s independence. For now, markets are comfortable ignoring this break from long-standing norms. But as the “Liberation Day” selloff reminded us, market direction can reverse suddenly, and investor confidence could shift just as quickly.

Earnings, consumers, and the real economy

Corporate earnings for 2Q came in ahead of expectations, and momentum is expected to carry into Q3 despite tariff headwinds. On earnings calls, many companies pointed to cost pressures from trade policy but also highlighted measures to offset the impact.

The consumer remained resilient—a key support for the economy—but cracks are forming. Lower-income households are under visible strain, and even higher-income families are beginning to feel pinched by higher borrowing costs and elevated prices in areas like housing and healthcare. This is something we continue to monitor closely.

Winners & losers

The Q3 gains were global, not just confined to the United States. Asian markets posted double-digit gains, with Japan’s Nikkei up 11.0%, Hong Kong’s Hang Seng up 11.6%, and China’s Shanghai Composite up 12.7%. Europe lagged but still delivered a respectable 3.1% gain as measured by the Stoxx Europe 600.

Commodities told a mixed story. Gold advanced 15.1% (bringing its year-to-date gain to ~45%), while oil slipped less than 1% despite ongoing geopolitical uncertainty.

Within the U.S., playing defense did not pay off, with the traditionally “safer” Consumer Staples sector the only S&P 500 sector to decline for the quarter, losing almost 3%. The best sectors for the quarter were Technology, which advanced 13.0%, and Communication Services, which gained 11.8%. It is worth noting that the MAPFRE US Forgotten Value Fund is over 20% invested in Communication Services—well above the category average.

AI, mega-caps and Alphabet

The artificial intelligence trade showed no signs of slowing. Mega-cap companies—including Apple, Alphabet, and NVIDIA—once again powered the market higher. Alphabet, which is a large position in the MAPFRE US Forgotten Value Fund, rebounded strongly (rising almost 40%) as fears over its antitrust battles and AI competition moderated. The Fund’s other AI play, Corning (a major supplier of optical fiber and other connectivity products essential to data centers), also surged nearly 60%.

Reasons to cheer, reasons to worry

The bull case for stocks remains intact: earnings growth has been strong, potential tax cuts and deregulation could bolster profits, oil prices are low (which acts like a tax cut for consumers), potential rate cuts are on the horizon, and a weaker dollar makes U.S. goods more competitive abroad.

But risks are real. Valuations are stretched by historical standards (the S&P 500 trades at 23x forward earnings, a level reached only twice this century). The economy is losing momentum—job growth is faltering, manufacturing is contracting, and housing remains weak. Meanwhile, signs of speculation are hard to ignore:

- Opendoor Technologies (which allows consumers to buy and sell their homes online) has soared nearly 400% this year, at times making up 13% of all U.S. trading volume.

- More than 90 SPACs have raised $20 billion so far in 2025—the busiest year since 2023.

- New IPOs are jumping an average of 34% on their first day of trading.

- Corporate credit markets are frothy: the yield spread on investment-grade bonds to U.S. Treasury securities fell to just 0.74% in September, the lowest since 1998, while junk-bond spreads sit at 2.75%, near 2007’s low levels. As famed credit guru Howard Marks has remarked, “the worst loans are made at the best of times.” We believe investors in both investment-grade and high-yield corporate credit are not being adequately compensated for the risks they’re taking.

Bottom line

Q3 was a quarter of contrasts: record highs and resilient earnings on one side, stretched valuations and speculative sentiment on the other. For investors, the lesson is clear—staying invested has been rewarding, but prudence is warranted.

We continue to see opportunities in carefully selected equities, particularly those outside the crowded mega-cap trade and on the smaller end of the market capitalization spectrum (60% of The Mapfre US Forgotten Value Fund is invested in stocks under $25 billion in market cap, and 38% in stocks under $10 billion). In times like these, patience, selectivity, and discipline are not just virtues—they’re necessities.