Tech stocks account for the majority of Wall Street's gains

Redacción Mapfre

RoadMAP: Monthly Update of Markets and Investment Strategy

What happened over the past month?

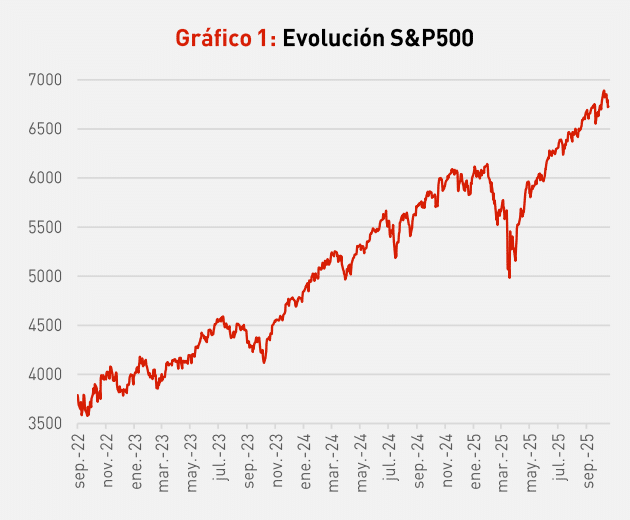

October was another month of positive returns for both equities and the main fixed-income indices. This solid performance in the capital markets was mainly driven by an upturn in economic indicators, a better-than-expected earnings season, and another interest rate cut by the Federal Reserve. The S&P 500 recorded its sixth consecutive monthly gain (something that hadn’t happened in more than four years), while the bull market that began in October 2022 for the U.S. stock market reached its third year.

Figure 1: S&P 500 performance

However, this rally, which has allowed the main U.S. index to gain more than 20% annualized over the past three years, contrasts with the weakness of the equal-weighted S&P 500, since it has been the large technology companies that have provided most of the returns. This market concentration continued in October, as the “Magnificent Seven” rose 4.9% (with Nvidia becoming the first company ever to reach a $5 trillion market capitalization), while the equal-weighted index fell 1%.

In the rest of the world, Asian stock markets stood out, led by significant gains for Japan’s Topix (+6.19%) and South Korea’s Kospi, which now ranks among the highest-returning indices of 2025 after gaining more than 70% so far this year. In Europe, movements were more limited following another pause in the ECB’s rate cuts and the lack of any fiscal stimulus strong enough to act as a catalyst to attract investors’ attention once again.

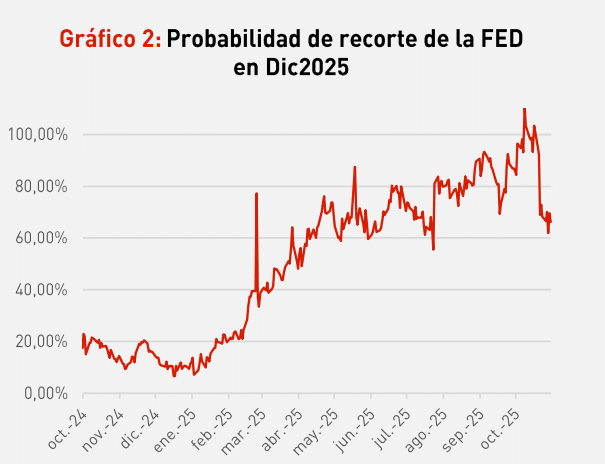

In fixed income, government bond yields fell, particularly at the longer end of the curve. The yield on the 10-year U.S. Treasury fell below 4%, even though the market now assigns a lower probability to another Fed rate cut, following statements by Chair Jerome Powell on October 29 in which he said it could not be taken for granted, given the differing views among members of the Federal Open Market Committee.

Figure 2: Probability of a Fed rate cut in December 2025

In fact, the most recent rate cut had two dissenting votes: one from Stephen Miran (in favor of a 50-basis-point cut) and another unexpected one from the President of the Kansas City Fed, who preferred to leave rates unchanged. Where there was broader consensus was in ending the Fed’s balance sheet reduction program, which began in June 2022. Recent tensions in interbank markets and the bankruptcies of several companies in private debt markets may have been behind this decision.

For its part, the European Central Bank kept the deposit rate at 2% for the third consecutive meeting and continues to avoid committing to any specific rate path. Christine Lagarde confirmed that the ECB is well positioned to face potential risks such as pressure on goods prices or the ongoing war in Ukraine. The market’s reaction was neutral, as this decision had already been fully priced in, and no further rate cuts are expected throughout 2026. Where we did see changes was in the credit rating of French sovereign bonds. S&P Global Ratings downgraded France’s rating to A+, one month ahead of the scheduled review, citing high uncertainty around public finances given the country’s limited ability to control its deficit.

As for commodities, gold closed October above $4,000 per ounce, although it suffered a sharp correction of nearly 10% over just a few days. Oil continues to trade weakly, and the U.S. dollar strengthened against the euro.

What's our take?

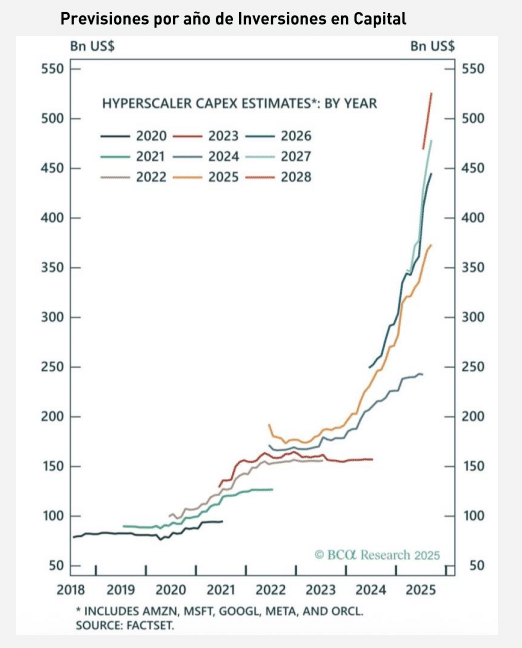

Our outlook remains constructive for risk assets overall, as companies continue to generate profits in a financial environment that is uncertain yet stable. The third-quarter earnings season has been very positive, both in terms of profit growth and in the percentage of companies exceeding expectations. The large-scale investments being made to develop and implement artificial intelligence are causing U.S. economic growth to rely increasingly on capital investment rather than consumption, where signs of strain are starting to appear, particularly among lower-income households.

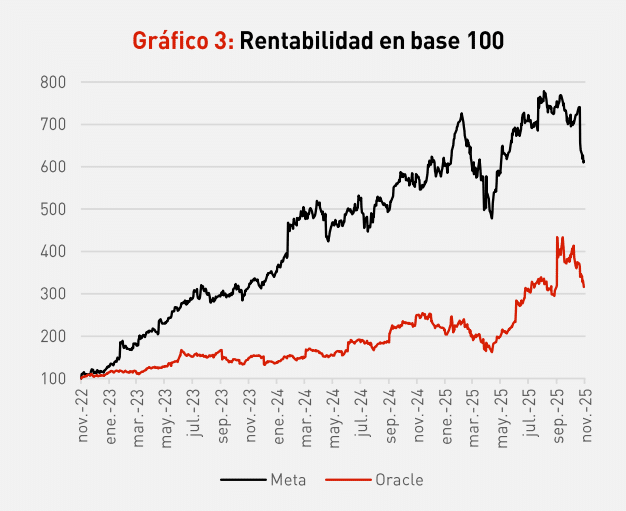

The question the market continues to ask about artificial intelligence is whether we are witnessing a new bubble. Valuations for some companies are demanding and have risen sharply in recent months, but in most cases these increases are supported by a steady upward trend in corporate earnings as well as real demand from major companies, which, after all, are the ones best positioned to understand their order flows and business evolution. Furthermore, most of these investments are financed through free cash flow. When companies turn to the debt markets for funding, their stock prices tend to suffer significant corrections (as has recently been the case with Meta, Oracle, and Alphabet). Therefore, we cannot claim that we are facing a bubble merely because some companies’ shares have risen sharply.

Figure 3: Indexed return (base 100)

The key lies in determining whether this wave of investment announcements will ultimately deliver the required returns on capital and whether the benefits will spread to the rest of the economy and other companies. On this last point, we believe the transmission has already begun. One clear example is construction machinery company Caterpillar. The company’s shares surged more than 13% after reporting stronger-than-expected earnings, supported by growing demand for its machinery used in building artificial intelligence data centers, an unmistakable example of the transmission mechanism from the purely technological sphere to more traditional industries. We expect this growth to continue expanding into other sectors, so that it is not only the major technology companies that capture the bulk of growth and sales in the coming months.

This positive view on capital investment does not come without risks. As we mentioned earlier, there is a “race” underway to determine who will emerge as the leader in artificial intelligence, and there is a growing sense of complacency, particularly among U.S. retail investors, who are increasingly active in intraday trading on equity markets. Positioning levels are high in terms of risk exposure for many investors, which could lead to episodes of volatility and sharp downward moves, especially with the main U.S. stock index at record highs.

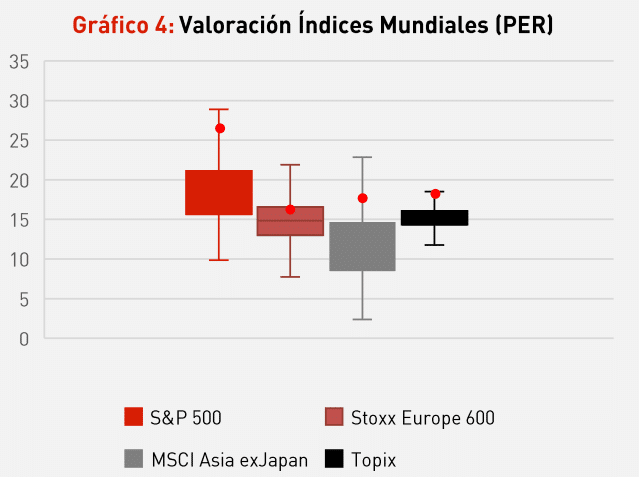

In Europe, our positioning is more neutral, given that German fiscal stimulus and higher defense spending have not provided a sufficiently attractive incentive to draw investment flows away from the United States. Valuations remain lower, but a clearer signal, such as higher earnings growth, is needed for investor appetite for the region to return after a stellar start to the year.

Figure 4: Global index valuations (P/E Ratio)

With regard to China and other Asian markets, although indices have risen considerably in recent months, we believe there is still room for further gains, given China’s technological leadership and Japan’s strong corporate results.

The situation in fixed-income markets remains far from truly attractive. Falling yields on government bonds reduce the incentive to increase duration, particularly when there is still pressure on the longer end of the curve due to the large amounts of debt and fiscal deficits many countries need to finance—especially in Europe.

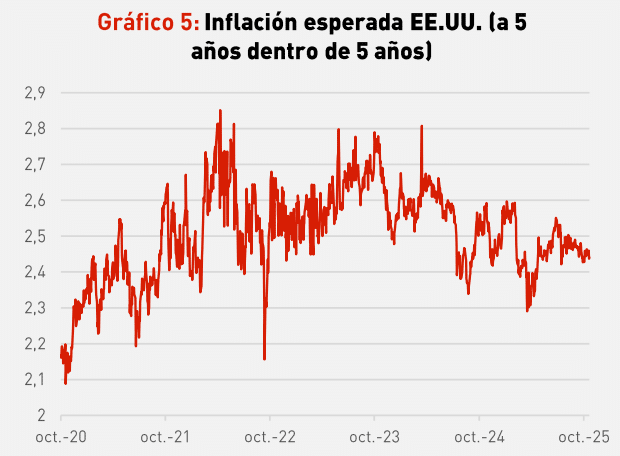

The market continues to price in more than three Fed rate cuts in 2026, something that doesn’t align well with an environment of potential nominal growth near 2% and inflation that is unlikely to fall below 2.5% next year. This is even more true if growth is boosted by AI-related investment, deregulation plans, and tax reductions in the coming months. For this reason, we believe the main risk lies in a resurgence of inflation that could derail both the Fed’s and President Trump’s plans to lower interest rates to make it cheaper to finance the large fiscal deficit accumulated by the world’s largest economy. On this point, it’s possible that some of the newly approved tariffs will be partially reversed, given the legal challenges already being reviewed by the Supreme Court during the first week of November. If those tariffs are declared unconstitutional, the U.S. Treasury would lose an additional source of revenue, further worsening the already delicate state of public finances.

Figure 5: Expected U.S. inflation (5-year forward, 5 years ahead)

As for the much-discussed remarks by the President of J.P. Morgan about the “cockroaches” discovered in private debt markets, which generated a great deal of commotion, we do not believe the situation is alarming for major U.S. banks or for financial stability overall. However, it reinforces our view that lower-quality credit segments offer little appeal. That said, we remain positive on credit rated A or higher, supported by strong balance sheets, solid corporate results, and robust investor demand seeking extra yield above that offered by government bonds.

What are we doing?

During the past month, we maintained the level of equity exposure we had reached following the recent strong performance of the main stock indices, instead of taking profits. This decision is based on a favorable short-term outlook for equity markets, even though current levels are high and many analysts’ targets have already been met. However, optimism could persist, and in a few months it may be even harder to open new positions with the market at record highs and interest rates lower. Our preference remains for the United States over Europe, with medium- and long-term exposure to Asian equities, which we believe still have upside potential.

Regarding fixed income, we expect European yield curves to remain anchored at the longer end but with upward pressure on longer-maturity bonds. For that reason, we tactically reduced portfolio duration, taking advantage of last month’s decline in interest rates. We do not expect further rate cuts from the ECB in the coming months, but we do anticipate a sharp increase in bond issuance next year. Where we remain most constructive is in corporate debt, especially financial sector bonds, given the strength of their balance sheets and the expected rise in mergers and acquisitions that could lead to higher revenues. We have also recently taken some tactical positions in bonds from sectors that have been under pressure, such as automotive and components.

Chart of the month

Projected annual capital investments

Expectations for capital investment are rising by another $200 billion over the coming years. This implies lower free cash flow, as already-committed investments account for nearly 60% of companies’ FCFs, raising doubts about whether technology firms can still be considered “asset-light.”

These large investments will have to generate future cash flows. Otherwise, these companies’ valuations could come under pressure, although we expect productivity gains that could help ease margin stress.