Financial markets start 2026 with optimism and forecasts of sustained growth

Redacción Mapfre

December was a quiet month for the financial markets, as they entered the final stretch of the year with positive returns for practically all assets. Certain doubts about the sustainability of the gains made by companies most closely linked to Artificial Intelligence (along with a traditional bout of profit-taking in the last month of the year) led to a rotation toward more cyclical sectors. This weighed on the performance of the S&P 500, which fell by 0.73% over the month.

However, the rest of the stock indices continued the positive trend the market has shown since the April lows, and global equities closed December with a gain of 0.73% (+19.5% in 2025 in USD), driven by the strong performance of European and Asian stock markets, with stellar performances from the Ibex 35 and South Korea’s Kospi.

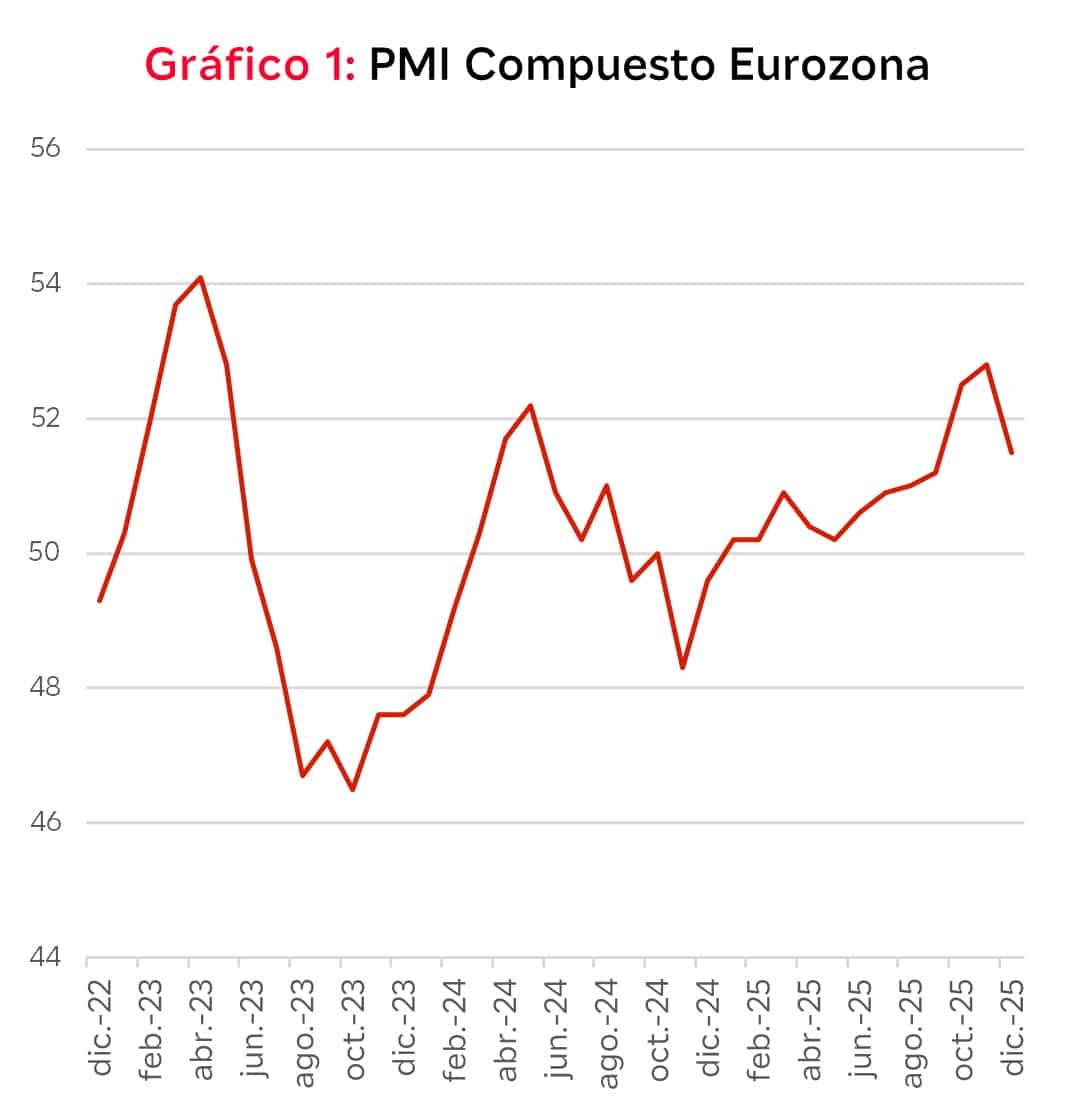

Another factor that positively contributed to the performance of European markets was the preliminary PMIs for December. Although they decreased slightly, the composite index ended above 50 for the first time since the year 2020.

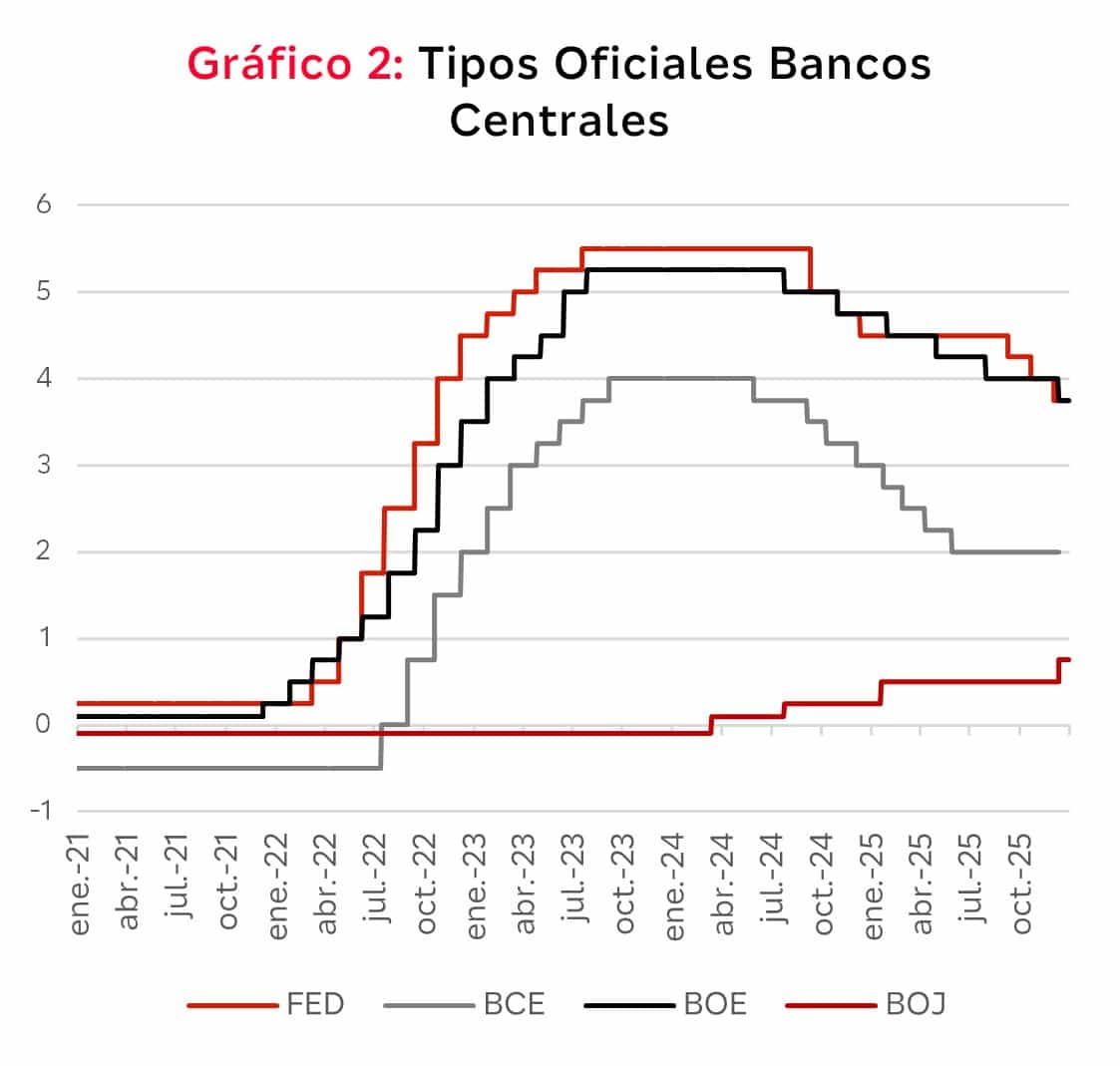

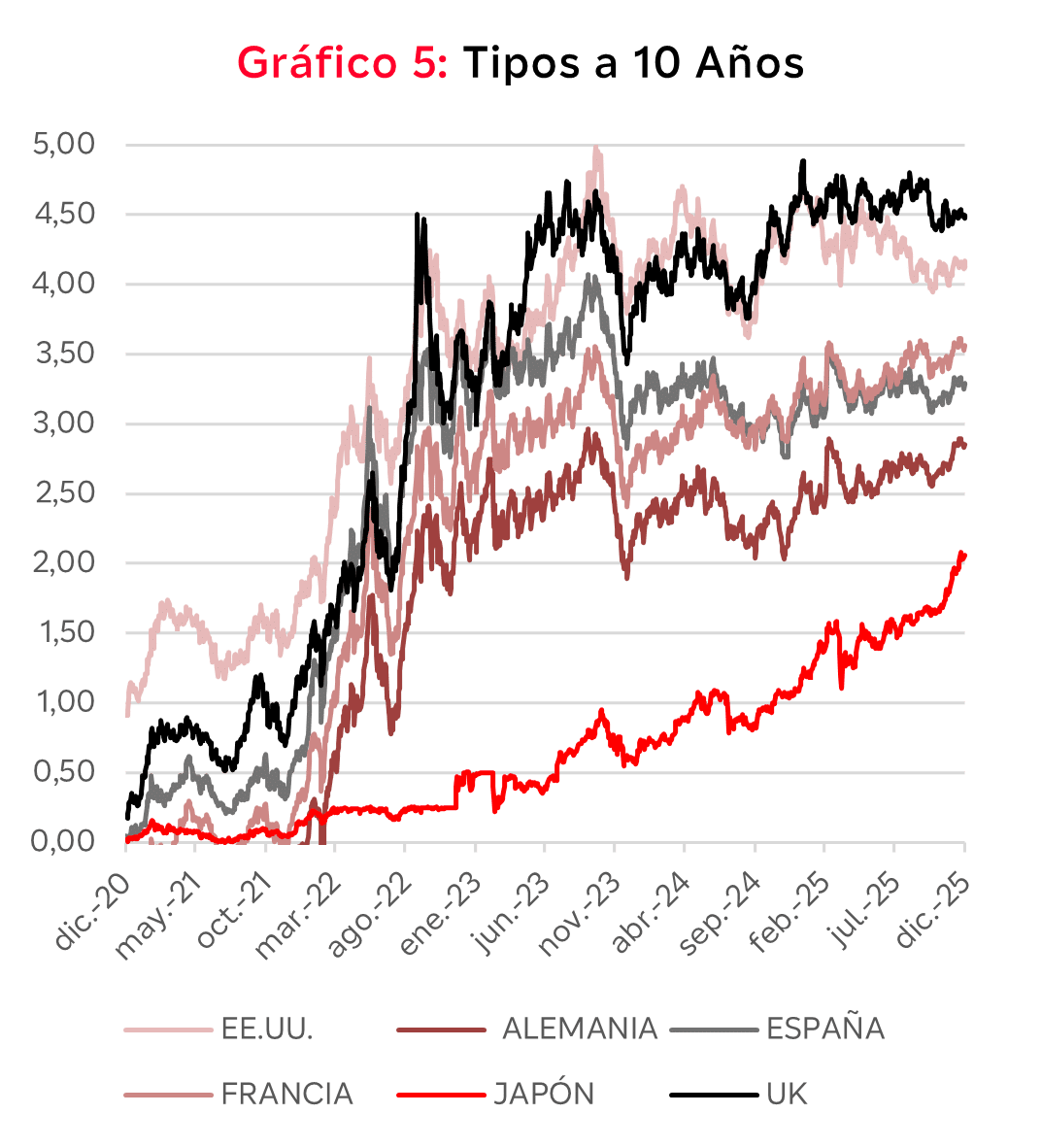

The month was not as positive for fixed income, in a December marked by monetary policy decisions from the Fed, the ECB, the Bank of England, and the Bank of Japan. Starting with the Fed, the U.S. Federal Reserve cut interest rates by 25 basis points for the third time this year and will likely take a pause in the rate-cutting cycle it began in September 2024. As has been customary, the decision was a divided one, accompanied by a sharp upward revision to expected growth for 2026 (2.3% vs. the previous 1.8%) and a downward revision to inflation (2.4% vs. the previous 2.6%). The tone of J. Powell’s message was less hawkish than expected, perhaps because he announced that the Fed will once again increase its balance sheet by around $40 billion per month, mainly through the purchase of Treasury bills, which will undoubtedly increase liquidity in the system.

In the case of the European Central Bank, interest rates remained at 2%. As C. Lagarde said, “the European economy remains resilient.” Evidence of this was the upward revision to growth that the ECB now expects for 2026 and 2027 in the Eurozone (1.2% and 1.4%, respectively). Following the Fed’s lead, the Bank of England decided to cut interest rates by 25 basis points, bringing them down to 3.75%, also in a very close vote (five members voted in favor of the cut and four against), and its governor warned that the path of rate cuts from this point onward is far more uncertain. Of the four major central banks, the only one that decided to raise interest rates was the Central Bank of Japan. Despite placing them at the highest level in 30 years, the official interest rate remains very low (0.75%) when compared to the rest of its more developed counterparts. However, interest rates in the market continue to rise, and the 30-year bond offers an IRR close to 3.5%. This decision resulted in no significant movements for the Yen, which remains at very weak levels against the Euro and the USD, and it also did not generate an episode of volatility like the one experienced in August 2024

Oil ended the year at USD 60 per barrel, down 3.7% in December, while gold rose above USD 4,200 per ounce, making it the best-performing asset of 2026.

What's our take?

Risk assets have finished a stellar 2025 despite the episode of extreme volatility we experienced in early April with the announcement of tariffs by the United States on its trading partners. This is the second consecutive year with double-digit returns for global equities, and one might wonder if the bull market that began on October 12, 2022 will continue in 2026.

If we analyze the markets from a model based on four pillars: macroeconomics, monetary policy, profits, and multiples, everything points to 2026 being the third consecutive year with positive returns.

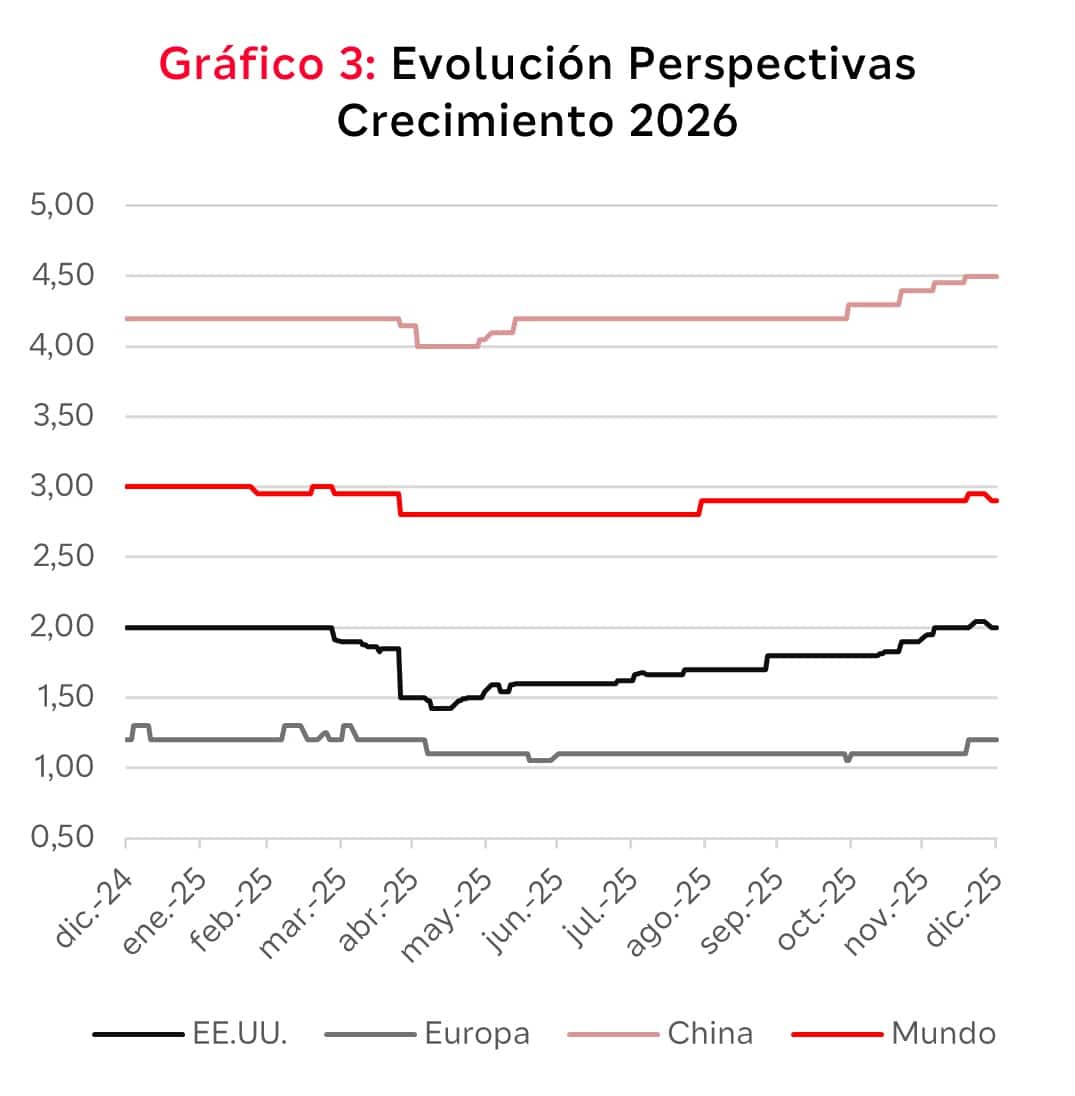

On the macroeconomic front, forecasts point to sustained growth that, in the worst-case scenario, could slow slightly from the 3% global growth rate we expect. In other words, unlike what has been happening in recent years, there is no fear of a recession, despite the fact that U.S. employment data have been weaker than expected in recent months or that Chinese growth has been gradually drifting away from the levels seen just a few years ago. We could even see higher-than-expected growth if Germany’s stimulus plans begin to materialize and/or a preliminary agreement is reached between Ukraine and Russia that allows the reconstruction of the areas devastated by the war in the European country to begin.

Inflation remains the main risk from a macroeconomic perspective because the combination of sustained growth, ambitious fiscal stimulus programs in the U.S., Europe, Japan, and China, and loose monetary policy could overheat economies that do not seem to need a boost.

Regarding monetary policy, the divergence among the major central banks encourages us to be very active in managing duration as well as in positioning within each yield curve. The Fed and the Bank of England are on the more accommodative side (the market is pricing in between two and three rate cuts), while the ECB remains on pause.

Thus, with the sole exception of the Bank of Japan (which will likely raise interest rates again in 2026), we could say that monetary policy will also provide support to financial markets. Even more so when the market has the support of the Central Banks to inject liquidity into the system if any episode of volatility requires it. This will also help governments, which in 2026 will need to issue a significant volume of debt to finance deficits and new fiscal stimulus programs.

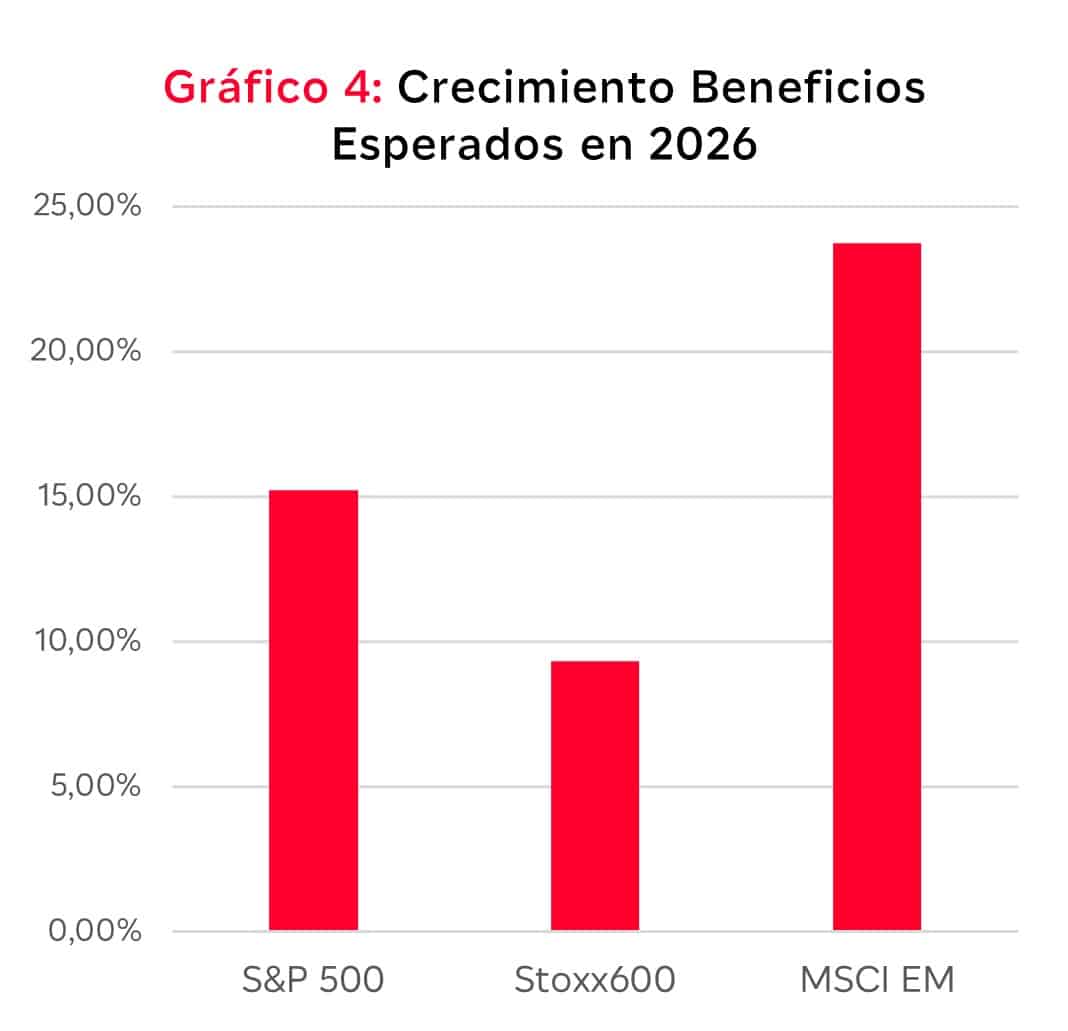

Corporate earnings are also expected to reach double-digit levels in 2026 and will be the main driver of returns for equity indices. This growth will be driven by a favorable macroeconomic environment, the adoption of Artificial Intelligence, and, as a result, productivity gains in other companies.

Volatility may come from the valuation side. Concerns about the development and implementation of Artificial Intelligence could affect companies that trade at higher multiples and occupy the top positions in equity indices. Nvidia, Apple, and Microsoft make up 20% of the S&P 500, and in Asian markets, companies such as Tencent, Alibaba, and Taiwan Semiconductors dominate the top positions due to their ability to consistently generate earnings growth, which has driven increases in their stock prices. Although valuations are generally high (especially in the United States), they do not reflect bubble levels, as we have noted in previous reports, since in many cases they are supported by strong fundamentals. In fact, loose monetary policy in a growth environment could help sustain valuations at these levels, but the potential for further appreciation through multiple expansion appears limited.

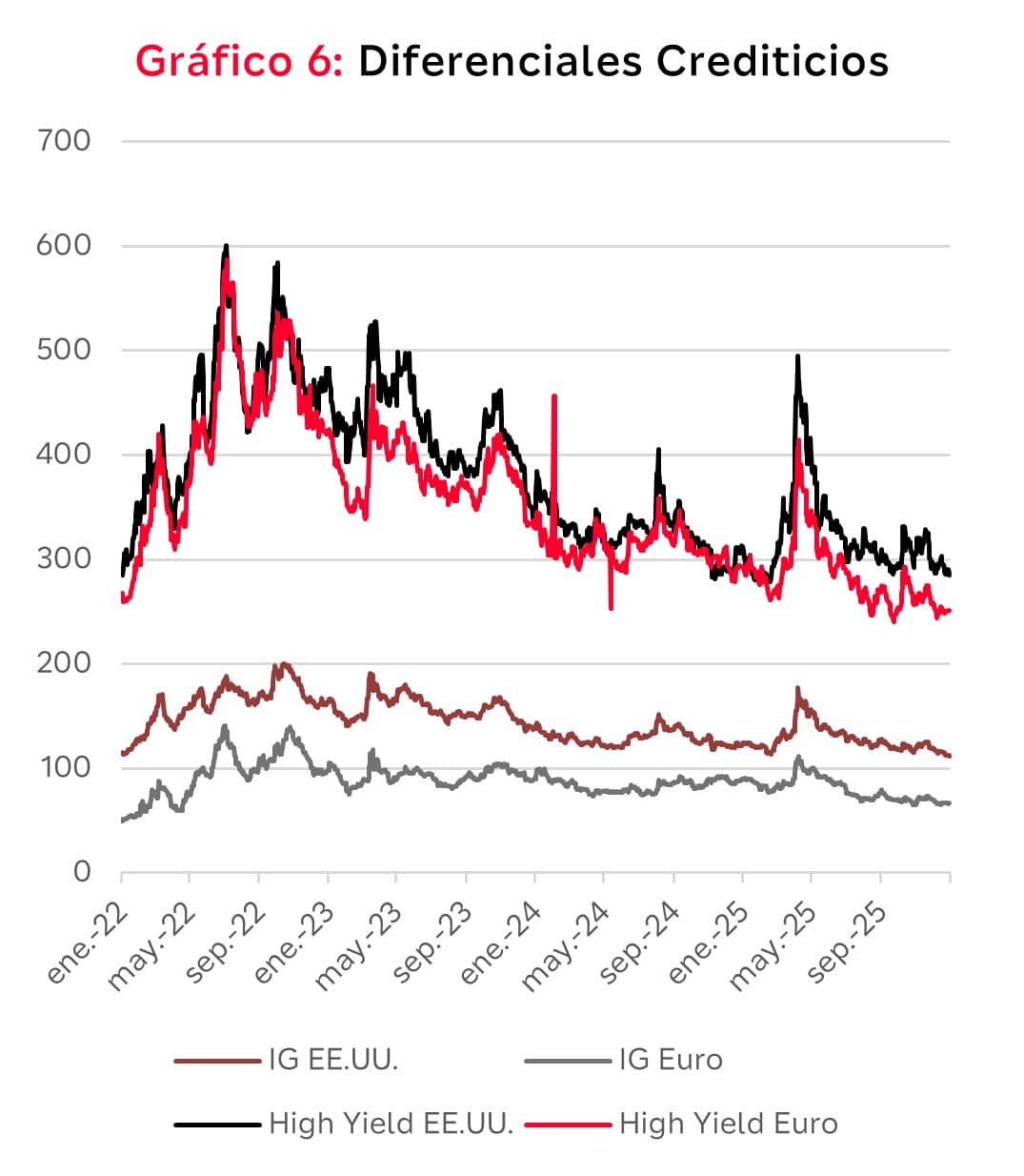

Thus, we start the year with a positive outlook for equities and a somewhat more cautious view on fixed income, as the medium- and long-term interest rate trend is upward, with steeper yield curves. The high financing needs of governments create a negative environment for duration, even though the average maturity of new issuances has been decreasing alongside a decline in investor appetite. That said, there will be opportunities to generate returns in fixed income, as 2026 is expected to be a favorable year for year-on-year inflation readings due to base effects from lower oil prices and a turbulent geopolitical environment, which could lead to periods of safe-haven demand (especially if the promising results of Artificial Intelligence adoption are called into question), with a greater number of central banks looking to cut interest rates.

In the corporate debt markets, the strategy continues to focus on seeking coupon income. It will be difficult to find significant opportunities in terms of bond price appreciation, given how tight credit spreads remain relative to government debt due to the strong financial position of companies. Although the overall outlook is positive, the issuance of new debt to finance Artificial Intelligence projects could again lead to supply exceeding demand (U.S. companies are expected to issue USD 1 trillion in 2026 vs. USD 650 billion in 2025).

What are we doing?

In line with the investment strategy discussed, we have been quite active with duration, even though interest rates have moved within fairly narrow ranges over the past month. We have set new levels on the 10-year German bond to increase duration in anticipation of the large volume of issuances expected during January. In shorter-term funds and portfolios, commercial paper has been added, offering an extra yield of around 30 basis points over overnight interbank rates.

In equities, we are maintaining investment levels in both multi-asset funds and portfolios, as it is difficult in this low-volatility environment to reduce risk without a catalyst prompting a more cautious approach.