Currency Risk: Is Now a Good Time to Bet on the Dollar?

Redacción Mapfre

By Javier de Berenguer Viota, analyst and fund selector at MAPFRE Inversión

What drives exchange rate movements?

First, it’s important to understand that, as long as the exchange rate is floating—that is, not subject to direct intervention by a government or central bank—it’s the result of supply and demand in the foreign exchange market. There are numerous factors that influence this market, many of which are interconnected, making it difficult to reliably predict future exchange rate levels. Some of the most influential include: inflation, interest rates, the balance of payments, and monetary policy. But there are other important variables to watch as well, such as public debt, market expectations, political and institutional stability, and economic growth.

Based on these variables, several theories have been developed to try to explain how currencies might behave in the future. These theories often rely on oversimplified assumptions, typically holding all other variables constant and ignoring how they interact in the real world. Still, they can offer useful frameworks for understanding how exchange rates are determined. The most relevant theories include:

- Purchasing Power Parity (Relative PPP)

This theory holds that the exchange rate between two currencies should equalize the purchasing power in both countries, allowing the same basket of goods and services to be bought in each. If one country experiences higher inflation than the other, its currency is expected to depreciate to offset the price difference.

- Interest Rate Parity (IRP)

This theory links the exchange rate to benchmark interest rates. It states that if a country offers higher interest rates, its currency should depreciate to eliminate arbitrage opportunities—ensuring that investors have no clear advantage in choosing one currency over another.

This theory also underpins the rationale for using hedging instruments to manage currency risk. It explains the cost of hedging between two currencies. For two bonds with comparable risk—most commonly illustrated by a U.S. Treasury and a German Bund—the cost of hedging should offset the difference in yields, effectively equalizing returns. For example, if a Treasury offers a 4% yield and a Bund offers 2%, the hedge cost should be around 2%.

The “carry trade” is a widely known exception to this theory. It involves borrowing in a low-interest-rate currency and investing in a higher-yielding one. If the exchange rate doesn’t adjust as IRP suggests, investors effectively earn a risk-free return. This mismatch happens because, in practice, the assumptions behind these theories don’t hold—especially the idea that all other variables remain constant. A key example is the yen carry trade: the Bank of Japan’s ultra-loose monetary policy has kept the yen undervalued for years, making the currency an attractive source of cheap funding and preventing the IRP mechanism from functioning as expected.

- Real Interest Rate Parity

This theory builds on the previous two by adjusting nominal interest rates to account for inflation in each region. It’s essentially a combination of Purchasing Power Parity and Interest Rate Parity, but without adding any new insight.

These initial theories don’t seem to fully explain the sharp and rapid movement of the U.S. dollar this year—at least not entirely.

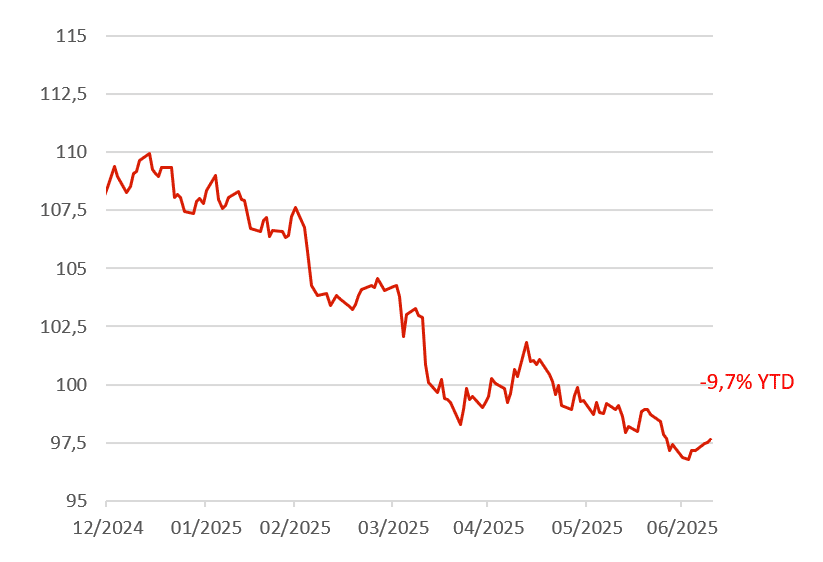

Chart 1: Dollar index performance in 2025

Source: Own analysis. Data as of Wednesday, July 9, 2025.

It is at this point that a new attempt to explain these variations comes into play: the ‘Expectations Theory’.

4. Exchange Rate Expectations

This involves another way of explaining movements in the value of a currency, introducing the role of the expectations of market participants as a fundamental factor in exchange rate variations. This theory is a less ‘scientific’ and more short-termist way of valuing a currency, in which the aim is to anticipate the future variation of the currency on the basis of events that are taking place in the present and which could have an impact on the variables that influence the exchange rate.

However, they may currently offer the clearest explanation for the dollar’s recent depreciation—a move that appears to have been triggered by Donald Trump’s repeated interventions in economic (tariffs), monetary (interest rates), and even geopolitical (sanctions) matters, though the latter was already underway. The issue is that the U.S. president has undermined the credibility of American institutions and cast doubt on the exceptionalism of the U.S. economy, prompting international investors to begin seeking alternatives to the dollar.

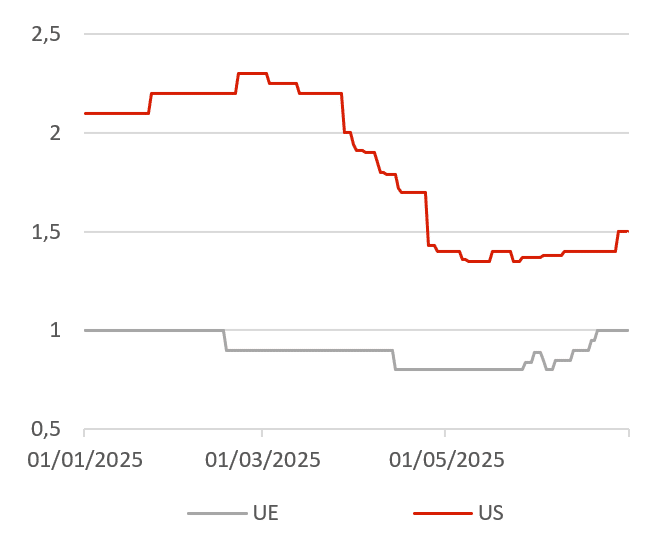

Chart 2: Growth expectations for 2025

Source: Own analysis. Data as of June 30, 2025.

Is there any valid alternative to the dollar?

Now that this “diversification” trend has begun, it currently seems unlikely that any currency could realistically replace the U.S. dollar, either as a medium of exchange or as a reserve currency.

There are several reasons why, in the short to medium term, no realistic alternative exists. The most important include:

i. Depth of U.S. capital markets.

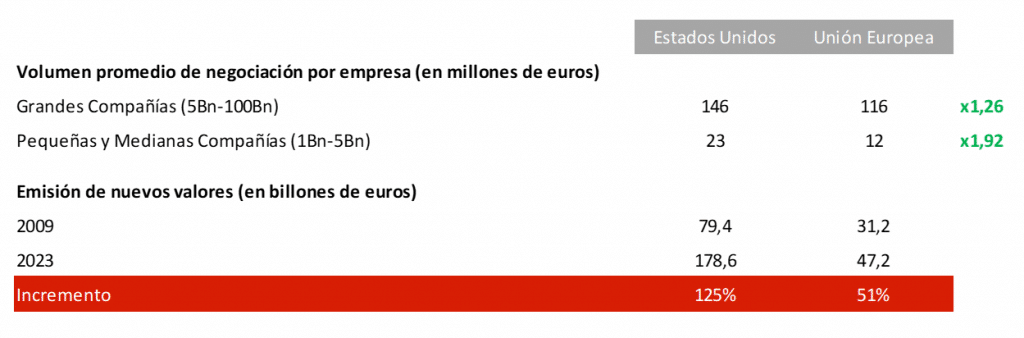

Table 1. Liquidity and depth of equity markets

Source: Euronext (trading volume).

ii. The dollar’s global importance: The dollar plays a dominant role as a reserve currency, in global trade, and in international payments.

Figure 1. Percentage share of the U.S. dollar across various global categories

Source: Atlantic Council.

iii. The role of the United States as the world’s leading economy, representing roughly 26% of global GDP.

This brings us to the million-dollar question: to hedge or not to hedge currency risk?

When we’re dealing with strong currencies (e.g., the dollar and the euro), exchange rates tend to fluctuate cyclically, maintaining a certain long-term balance. This cyclical behavior makes sense if we consider the core variables that determine a currency’s value—monetary policy, inflation, interest rates, and balance of payments—which, in the case of the U.S.–EU comparison, are fairly balanced and largely offset one another (e.g., stronger growth in the U.S., but a trade surplus for the EU).

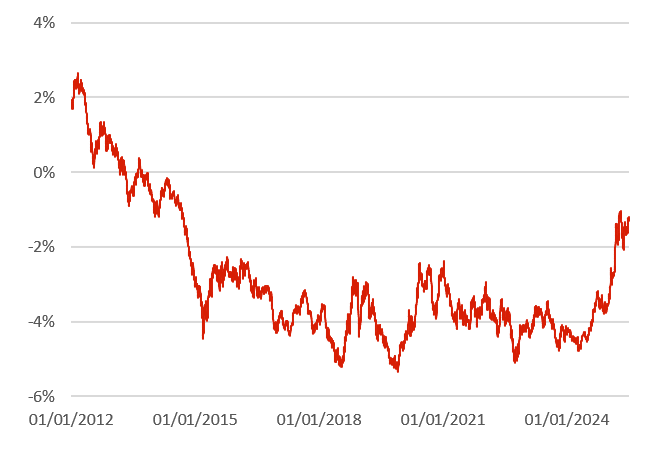

Based on this, over time horizons greater than 10 years, the cost of hedging the exchange rate, as shown in Chart 4, tends to be just that: a cost. Once this hedge is introduced into the equation, there's little chance it will improve portfolio returns.

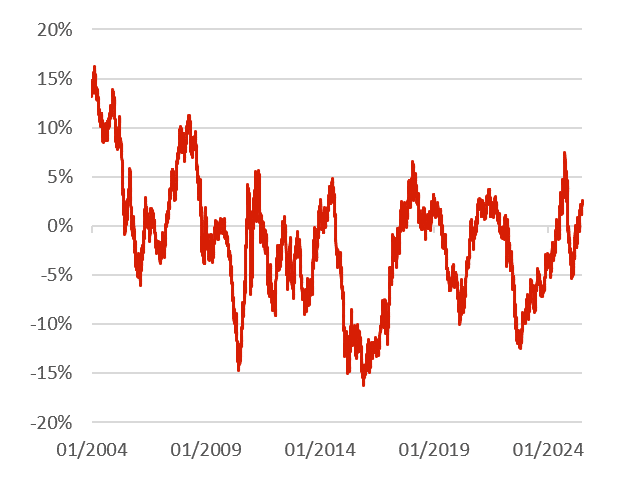

Chart 3: Annualized excess return, S&P 500 (10-year periods, hedged to euros)

Source: Own analysis. Data as of June 30, 2025.

Average hedging cost over the past 10 years (1.78%).

Over shorter timeframes—less than 5 years—hedging currency risk may indeed make sense. That’s due to the exchange rate cycles mentioned earlier, as well as potential fluctuations in the key variables already discussed. Both of these factors could derail the client’s target returns, which is why we recommend hedging fixed income strategies within the portfolio.

Currency hedging isn’t the only option to mitigate this risk. Another way is to minimize exposure to assets denominated in foreign currencies. However, this latter approach can negatively impact portfolio diversification. For that reason, especially in more conservative portfolios, we would advocate for a combination of both strategies.

Chart 4: Annualized excess return, S&P 500 (2-year periods, hedged to euros)

Source: Own analysis. Data as of June 30, 2025.

Average hedging cost over the past 10 years (1.78%).

Conclusion

As we’ve seen, countless variables influence exchange rates, making them, ultimately, extremely difficult to predict. So when we’re dealing with major currencies—which should, in theory, be less volatile than others—factoring in both the cost of hedging and the challenges of forecasting future exchange rates, the investment time horizon should be the key factor in deciding whether or not to hedge. Rather than engaging in the futile exercise of trying to understand how all these variables interact (or worse, attempting to predict their evolution) it’s better to let the time horizon guide our decision.