ECB cuts rates for the eighth time, closing in on the limit of its ability to take action

Redacción Mapfre

Eduardo García Castro, expert economist at MAPFRE Economics

At its June meeting, the European Central Bank (ECB) announced, for the eighth consecutive time, a cut in interest rates of 25 basis points (bps), placing the rate at 2.15% for the marginal lending, 2.40% for main refinancing and 2.00% for the deposit facility. Regarding its balance sheet, no additional guidance was provided beyond the December outlook, meaning it will continue to be managed on autopilot for the time being.

At the macroeconomic level, new projections were presented with few but positive changes. For GDP, the revisions were practically the same as in March, with estimates of 0.9% for 2025, 1.1% for 2026 (compared to 1.2% previously) and 1.3% in 2027. In inflation, the revisions were downward (0.3 percentage points for 2025 and 2026), and virtually unchanged for 2027, with the forecast for the three years being 2.0%, 1.6% and 2.0%, respectively.

After virtually confirming its previous forecasts, a clear narrative was presented: “the ECB is in a good position to navigate the current conditions and face the future.” Calibrating the next step will take some time and, therefore, flexibility and caution are maintained, given the margin of comfort from having achieved two milestones: returning inflation to the goal and simultaneously reaching a neutral interest rate as the basis for taking action in the future. In addition, this pause serves to gain time to decide how to respond to a potential shock which could be either negative or positive, depending on the outcome of the negotiations.

Assessment

The data for the last interest rate decrease were favorable. The recovery of economic activity remains fragile, inflation has exceeded the ECB's target and, in practice, tariff pressure as a catalyst for macroeconomic deterioration is now on pause. Looking ahead, the scope of action is starting to narrow, and is subject to discussions on the advisability of keeping monetary policy anchored to the neutral interest rate (1.75-2.25%), or taking small steps toward a slightly accommodative policy; considerations that perhaps should be put on pause until more up-to-date data become available.

With regard to economic activity levels, Eurozone GDP data showed an acceleration of 0.4% QoQ (1.2% YoY), with positive contributions both in terms of consumer spending and investment and, to a lesser extent, an increase in exports. Support for the private sector could be justified, at least in part, by the internal relief of lower interest rates, while that relating to trade may be atypical, influenced by external factors related to the bringing forward of imports in the face of the new US tariff framework (trend opposite to that of the US GDP).

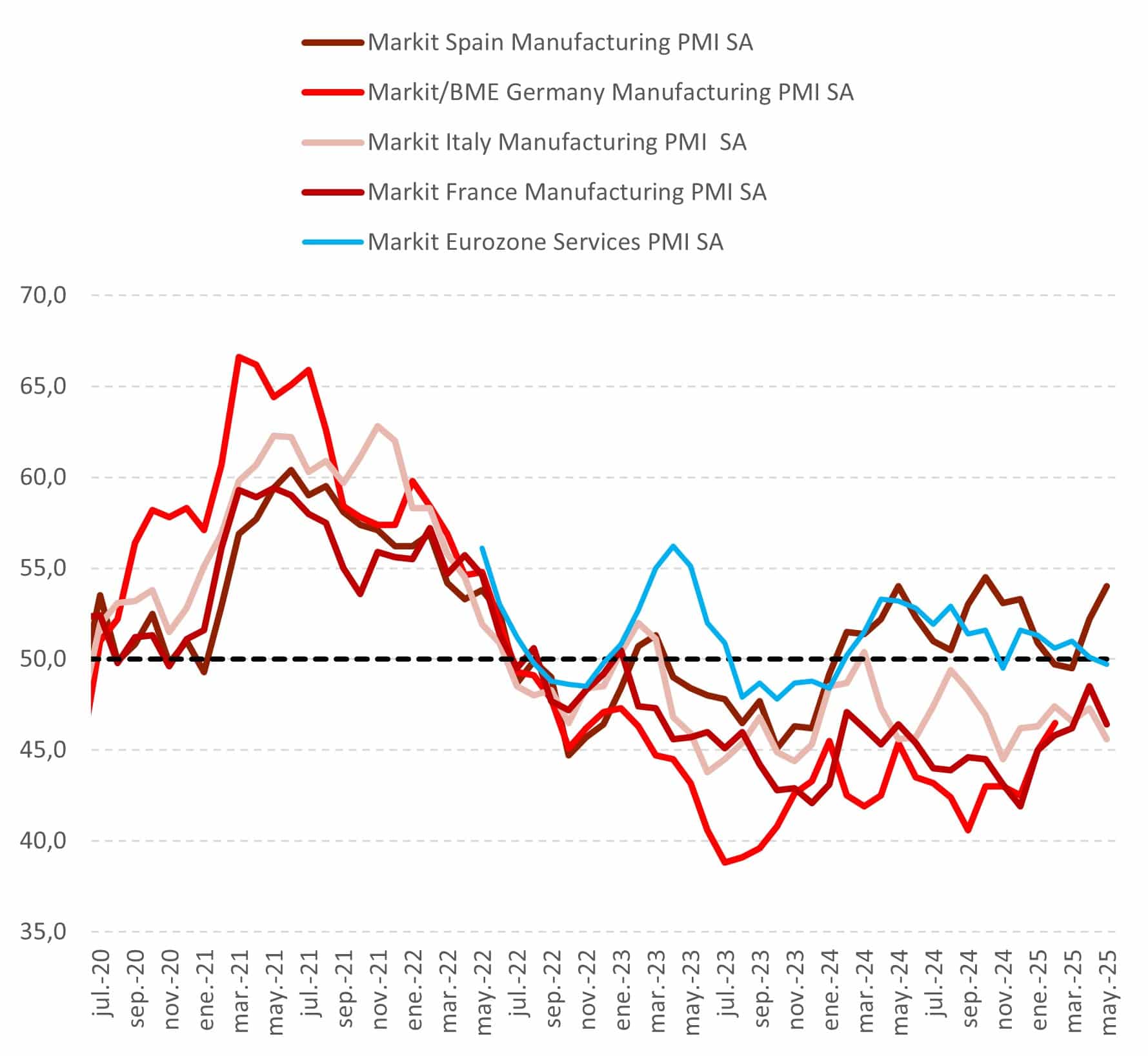

However, based on the most recent high-frequency data (see Chart 1), the PMI indicators prevented the onset of contraction, despite the deterioration of the service sector, thanks to the upturn in the manufacturing sector, which is beginning to materialize and showing signs of a more balanced recovery in the future. In support of this hypothesis, other consumer sentiment indicators (such as ESI and GFK) revealed a boost in confidence, which could lend support to this expectation.

Chart 1: PMIs in the Eurozone

Source: MAPFRE Economics (with Haver data)

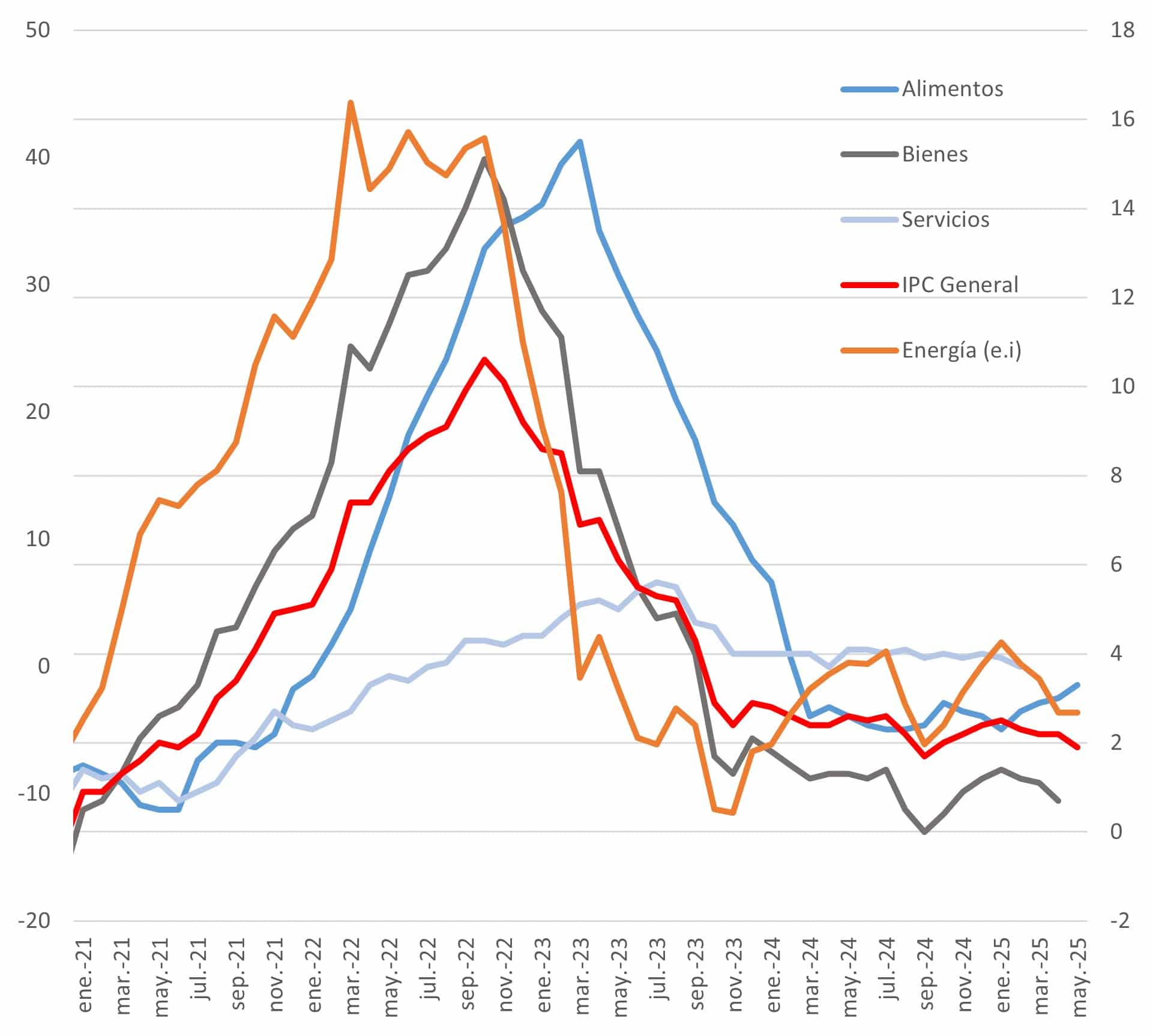

With respect to inflation (see Chart 2), the preliminary data for the last month confirmed a fall in the rate below 2.0%, thanks to steady increases in the goods sector (0.6% YoY) and a fall in service inflation, to 3.2% YoY. Core inflation also eased to 2.3% YoY (compared to 2.7% previously). This reflects the lower capacity of companies to pass on prices (seen in PMI surveys) and the influence of a stronger euro. However, and from a more neutral perspective, part of the decrease in services is due to the calendar effect of a delayed Easter vacation period and exchange rate behavior that appears to have eased.

Chart 2: Main CPI metrics

Source: MAPFRE Economics (with Haver data)

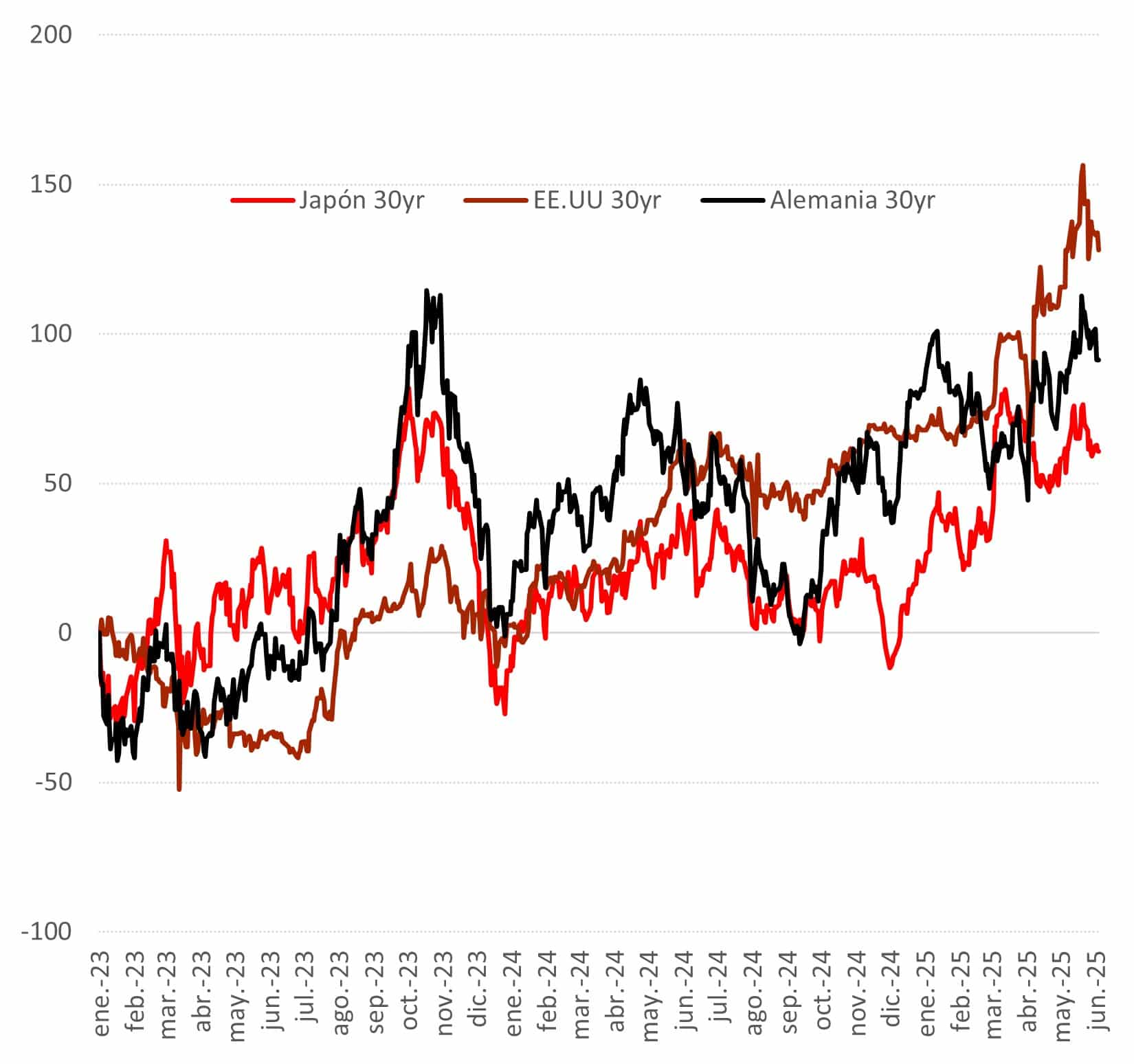

Another factor to consider is future fiscal guidance. After being slightly contractive in 2024, it could become expansionary with the activation of national escape clauses and renewed interest in strengthening the areas of infrastructure and defense. This shifts the risk to the side of the balance sheet of smaller interest rate cuts, given that, as can be seen in other parts of the world, there are signs that investment appetite is not quite as ready to finance new issues, at least not at the longest maturities (see Chart 3). As we noted at the beginning of the year in our 2025 Economic and Industry Outlook, these signals remain latent in bond markets and are reflected in the breadth and, to a certain extent, disconnection between the short and longest ends of the interest rate curves.

Chart 3: Variation in bps in 30-year bonds

Source: MAPFRE Economics (based on Bloomberg data)

There are also doubts about the tax multiplier that this spending will have, at least for the first few years. In addition, it is unknown what effects higher bond yields might have on private investment, as there is a risk of being crowded out: that is, a new level of public investment can raise the risk-free interest rate to levels that depress the private sector, but it can also promote a pattern of consumer spending that does not match the levels wished for by economic actors.

In short, the binomial of economic growth and inflation seems to be stabilizing due to the mix of more balanced growth and restrained price pressures. In addition, it opens the door to renewed fiscal stimulus, particularly focused on defense, infrastructure and industrial policy, to encourage public investment and consumption to actively participate in such expansion. With regard to the external environment, trade uncertainty remains high; with no clarifying signs (beyond the 90-day pause) or progress in negotiations, a clearer picture cannot be expected in the near term. Both these factors, both internal and external, are underpinning the ECB's current lack of commitment to follow the directionality that interest rates take.

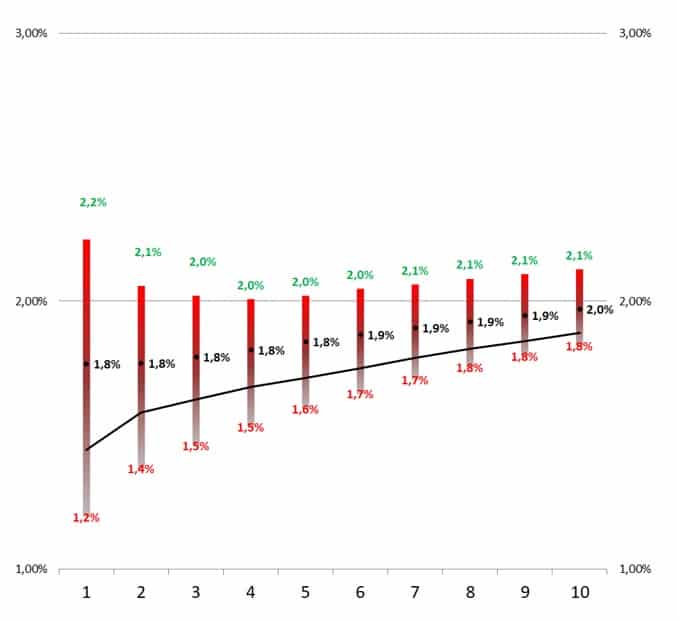

In the future, the arguments for undertaking additional rate cuts towards accommodative territory need to be more convincing. The path of economic growth is structurally low, but it has the umbrella of an expansionary fiscal policy, so an accommodative interest rate would, in part, be pro-cyclical. With regard to inflation, the odds of it falling below target are still insufficient to allay the risk of overshooting it (see Table 1), even more so since the tax multiplier also impacts the other side of the equation. In this regard, the differential factor that could anchor expectations would be to clear away the trade-related fog that is hindering visibility on inflation. This is shown by the wide range in which inflation swaps have fluctuated since the beginning of the year (see Chart 4).

Table 1: Probability forecast in May by SMA that average inflation in the eurozone will be below or above 2% in the coming years

Source: MAPFRE Economics (based on ECB SMA data)

Chart 4: Expected inflation on swaps for the next 10 years, maximum, minimum band, average and most recent data for 2025

Source: MAPFRE Economics (based on Bloomberg data)

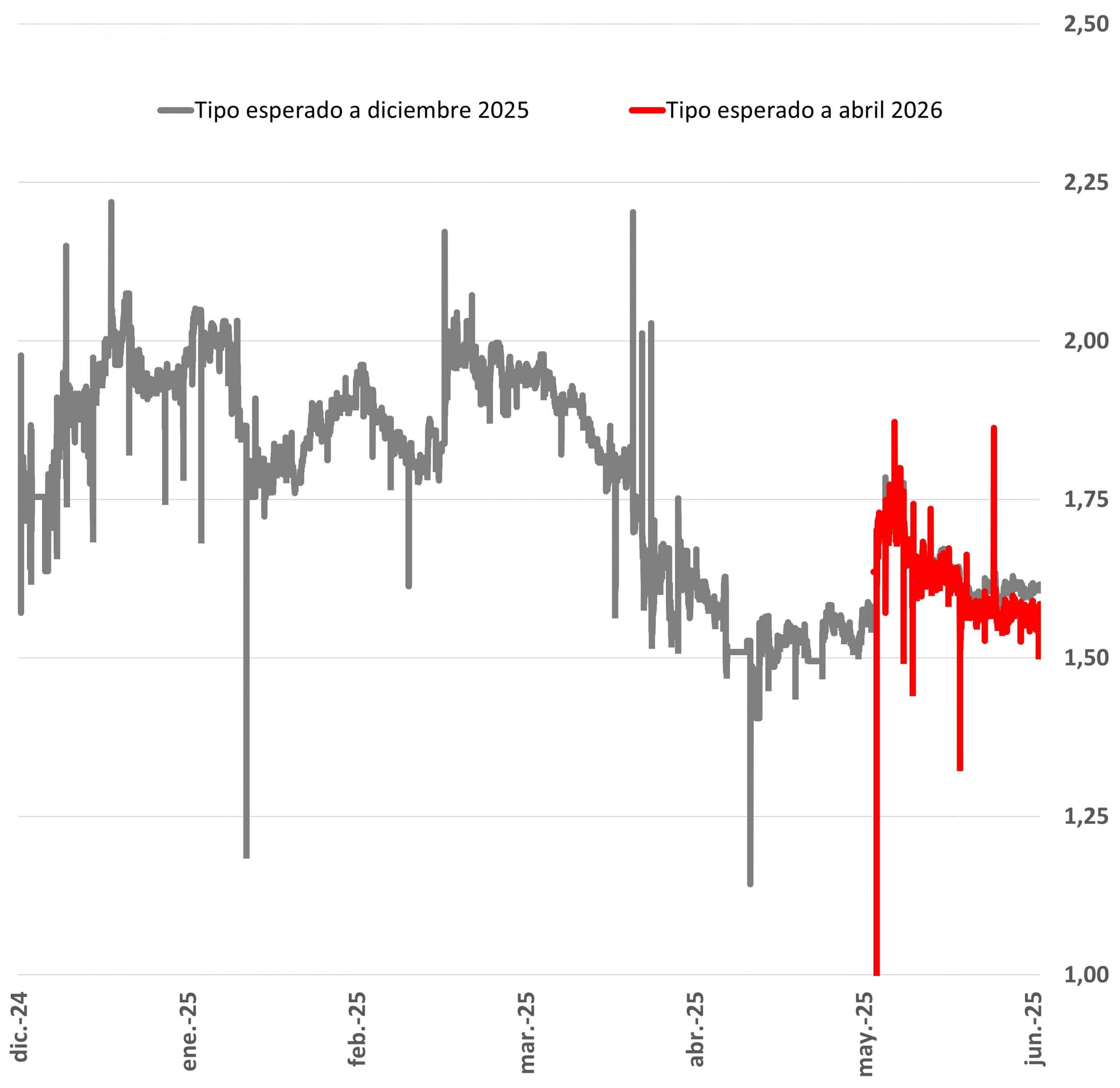

Therefore, and with a view to future meetings, the ECB will have to analyze the data as a whole, that is, both in terms of macroeconomic developments and how trade policy is absorbed, and/or its potential impact. In the expectation that this uncertainty will be temporary and for the green light to come allowing for the adoption of a more flexible monetary policy, the current stance of neutrality may be appropriate for waiting to see how events unfold in the coming months, and to lend credence – or not – to current expectations that point to two further rate cuts in the second half of the year (see Chart 5).

Chart 5: Rates discounted by swaps

Source: MAPFRE Economics (based on Bloomberg data)