ESG Commitment

Sustainable societies are built by creating mutual funds that are both profitable and responsible. At MAPFRE, we invest in assets that meet ESG (Environmental, Social and Governance) criteria, meaning our investments are socially responsible. In practice, this model means that we can help build a more sustainable world without sacrificing long-term profitability.

Also in 2017, MAPFRE AM took a 25-percent stake in La Financière Responsible (LFR), a French fund management company with more than 10 years experience in sustainable investment, and in 2023, the insurance company acquired another stake to reach 51%.

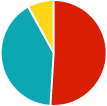

Yet MAPFRE's commitment goes further than this: we apply the philosophy of socially responsible investment to the Group's entire balance sheet. MAPFRE has its own ESG analysis framework that is reviewed periodically in the light of the surrounding context. Currently, around 90 percent of the assets in our portfolio have high or very high scores in their ESG measurements.

All this effort has been recognized internationally. At the end of 2020, after passing a rigorous due diligence process, MAPFRE AM received the prestigious European SRI LABEL, becoming the first Spanish asset manager to receive it.

LEARN ABOUT MAPFRE'S RANGE OF ESG FUNDS

La Financière Responsable is an investment management company that has forged its reputation based on the good results obtained from the application of its own methodology IVA ® - Integral Value Approach.