Fed holds rates steady; remains vigilant on evolving risks

Redacción Mapfre

Eduardo García Castro, senior economist at MAPFRE Economics

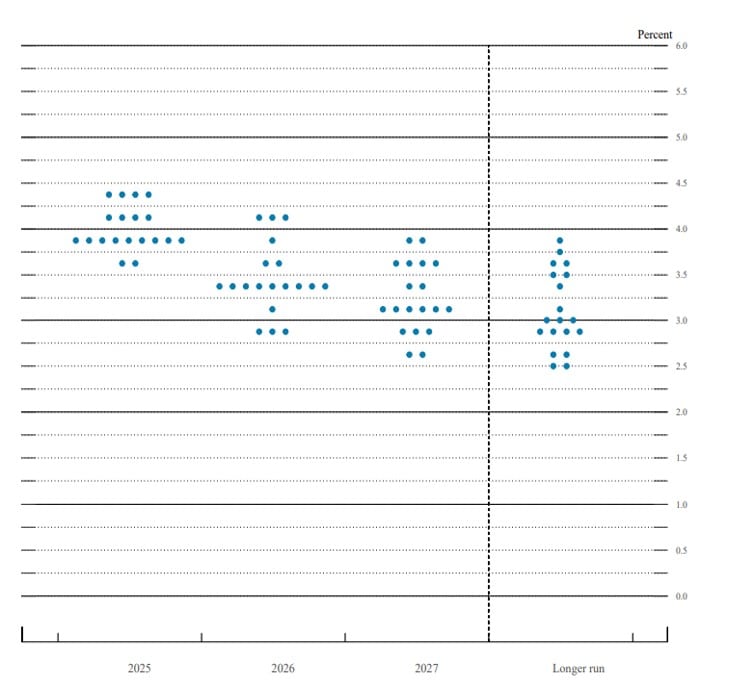

The U.S. Federal Reserve decided to keep the benchmark interest rates unchanged at the range of 4.25%-4.50% for the second consec-utive time. Regarding the outlook presented through the dot plot, the Fed maintained its projection for a 50 basis point (bps) rate cut in 2025 and 2026, followed by a 25 bps cut in 2027, with a long-term rate around 3% (see Chart 1). On the balance sheet front, it was announced that, starting April 1st, the pace of reduction (QT) would slow from $25 billion in monthly sales to $5 billion. This shift will be driven by a decrease in Treasury bond sales, while the pace of adjustments in Mortgage-Backed Securities (MBS) will remain un-changed.

Chart 1: Dot Plot

Source: MAPFRE Economics based on Fed data

In addition to the rate decision, the Fed presented updated macroeconomic forecasts, which included a downward revision to economic growth projections (now 1.7% for 2025 and 1.8% for 2026, down from 2.1% and 2.0% previously), along with higher inflation forecasts (2.8% and 2.2%, respectively, compared to 2.5% and 2.1% before). This revision was attributed to the potential impact on consumption and investment from the heightened uncertainty surrounding trade, immigration, fiscal, and regulatory policies, assuming that these changes will have a transient effect.

In line with its communication from Decem-ber, the Federal Reserve adopted a cautious stance to address recent concerns about rising inflation and the renewed risk of recession. This caution is reflected both in its explicit mention of monitoring these risks and in its reliance on past experience, suggesting that the most prudent approach at this time is to remain patient and maintain the current mon-etary policy.

Assessment

Amid renewed concerns over the macroeco-nomic outlook and the significant uncertainty surrounding current forecasts, the Federal Reserve decided to maintain its December roadmap and continue waiting for clearer conditions before making any decisions. The Fed emphasizes the importance of distin-guishing between “signals and noise” before reacting to a complex mix of economic activity and price movements that point in contradic-tory directions.

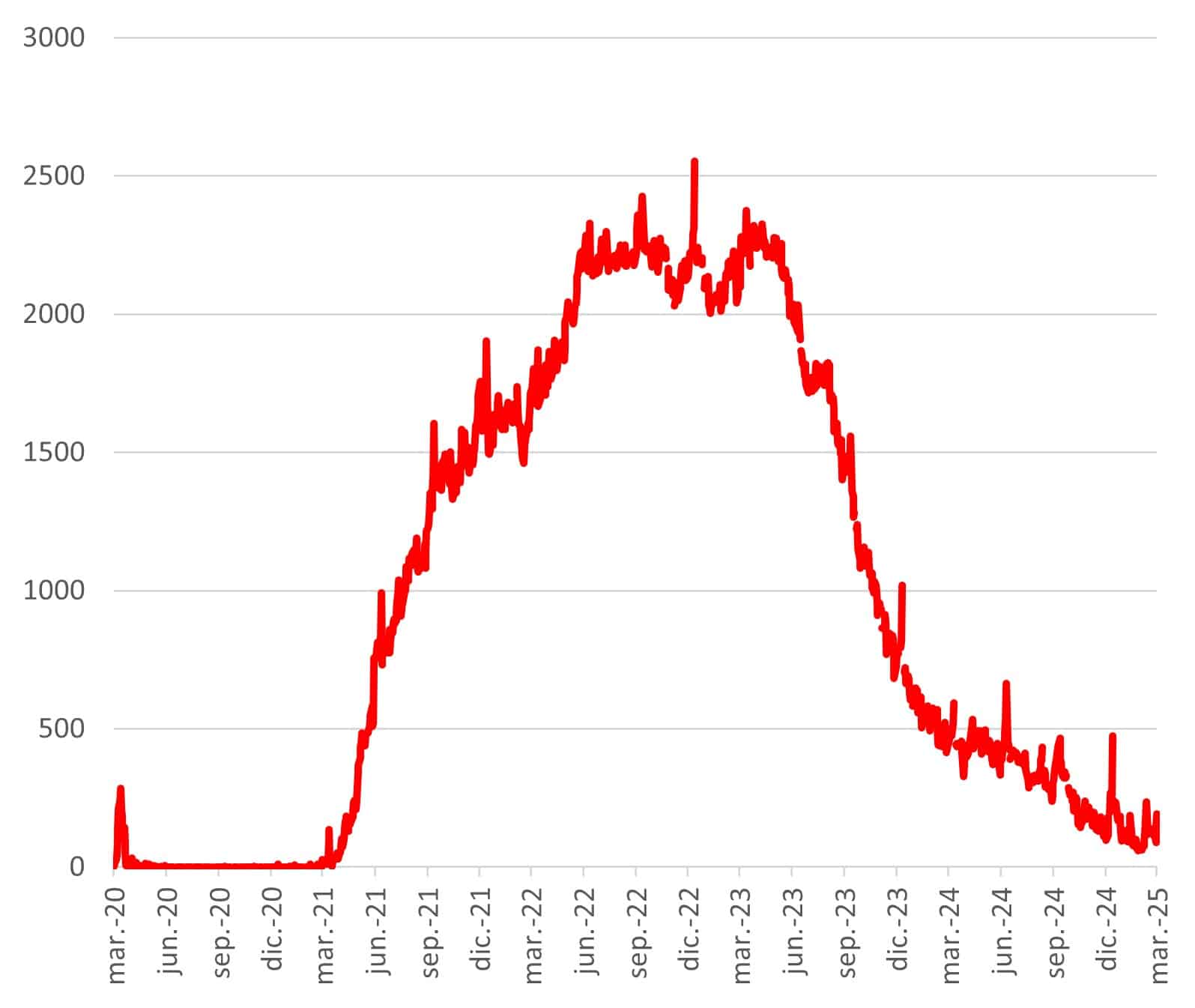

Regarding the gradual pace of quantitative tightening, this measure is seen as preventive. No tensions have emerged in the interbank market yet, and the decision is technically grounded in the need to monitor the current environment of lower liquidity (see Chart 2). While the action may seem moderate due to its effect on financial conditions, it still indi-cates the Fed’s commitment to continuing the reduction of its balance sheet.

Chart 2: REPO operations

Source: MAPFRE Economics based on Bloomberg data

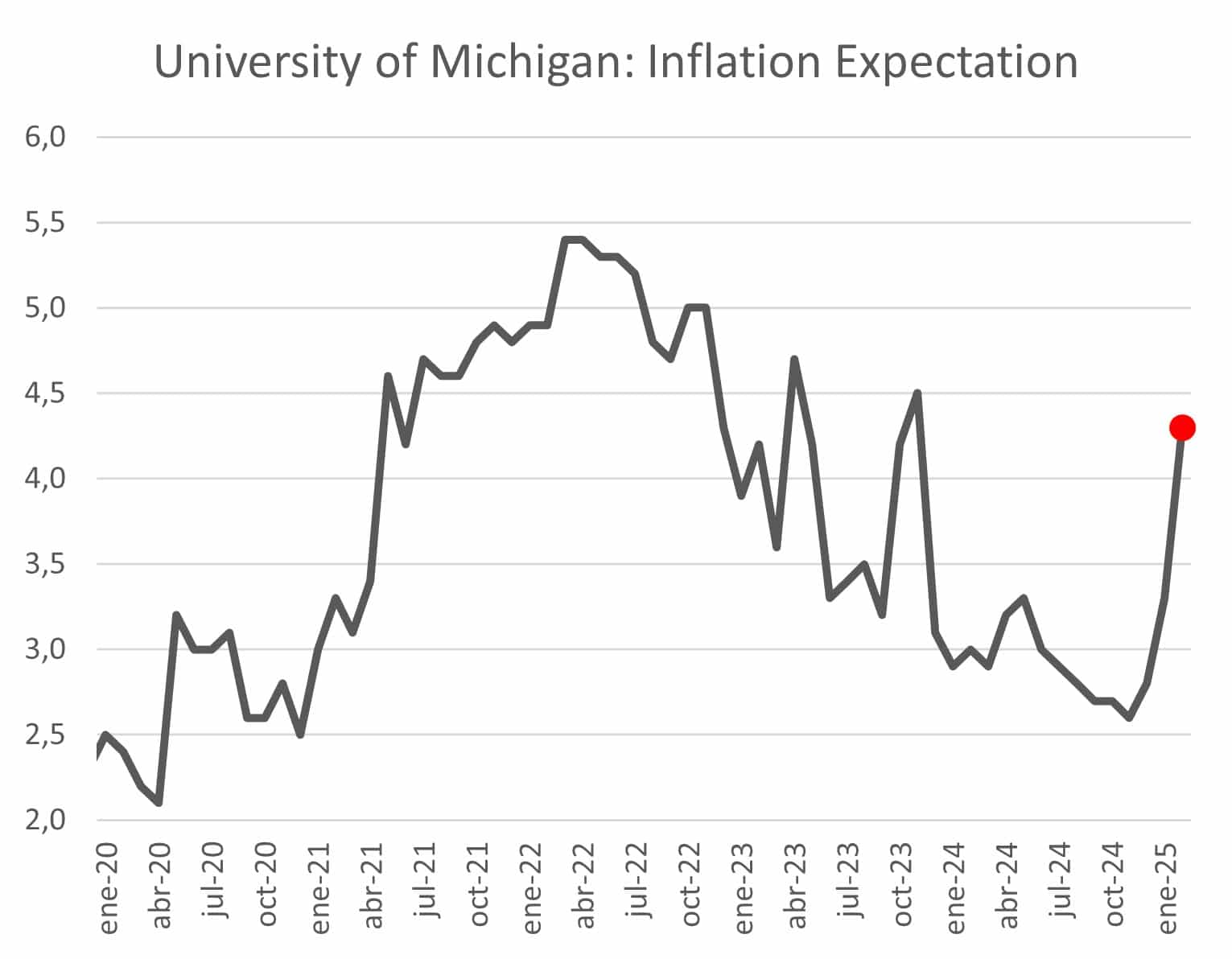

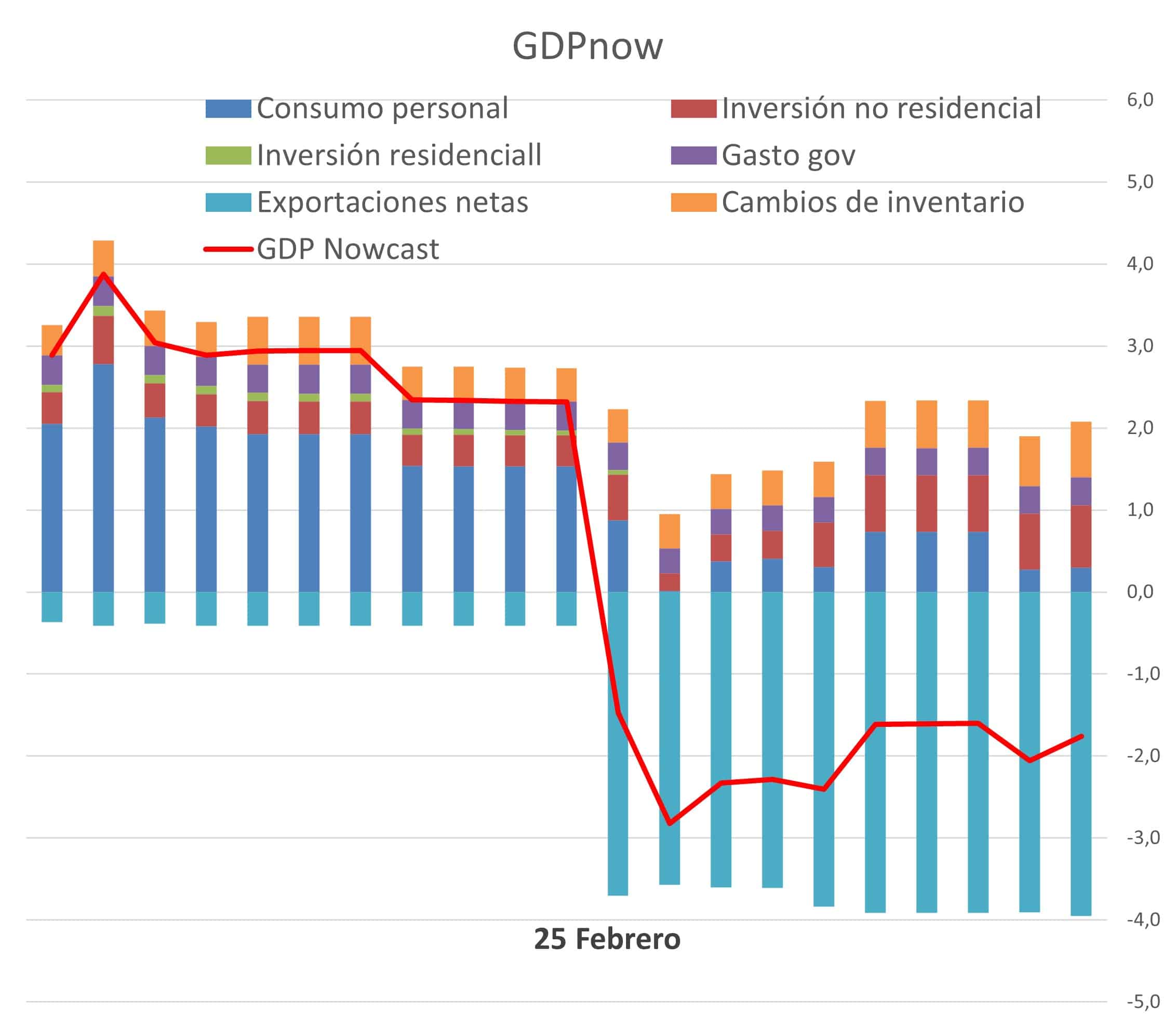

From the perspective of the Federal Reserve’s dual mandate (economic activity and prices), both variables remain aligned with a return to their long-term trends. However, they have faced a shift in expectations since the begin-ning of the year, leading to a deterioration in inflation projections and concerns about weaker economic growth (see Charts 3 and 4).

Chart 3: Inflation expectations

Source: MAPFRE Economics based on Haver data

Chart 4: Federal Reserve Growth Model (Atlanta)

Source: MAPFRE Economics with Haver data

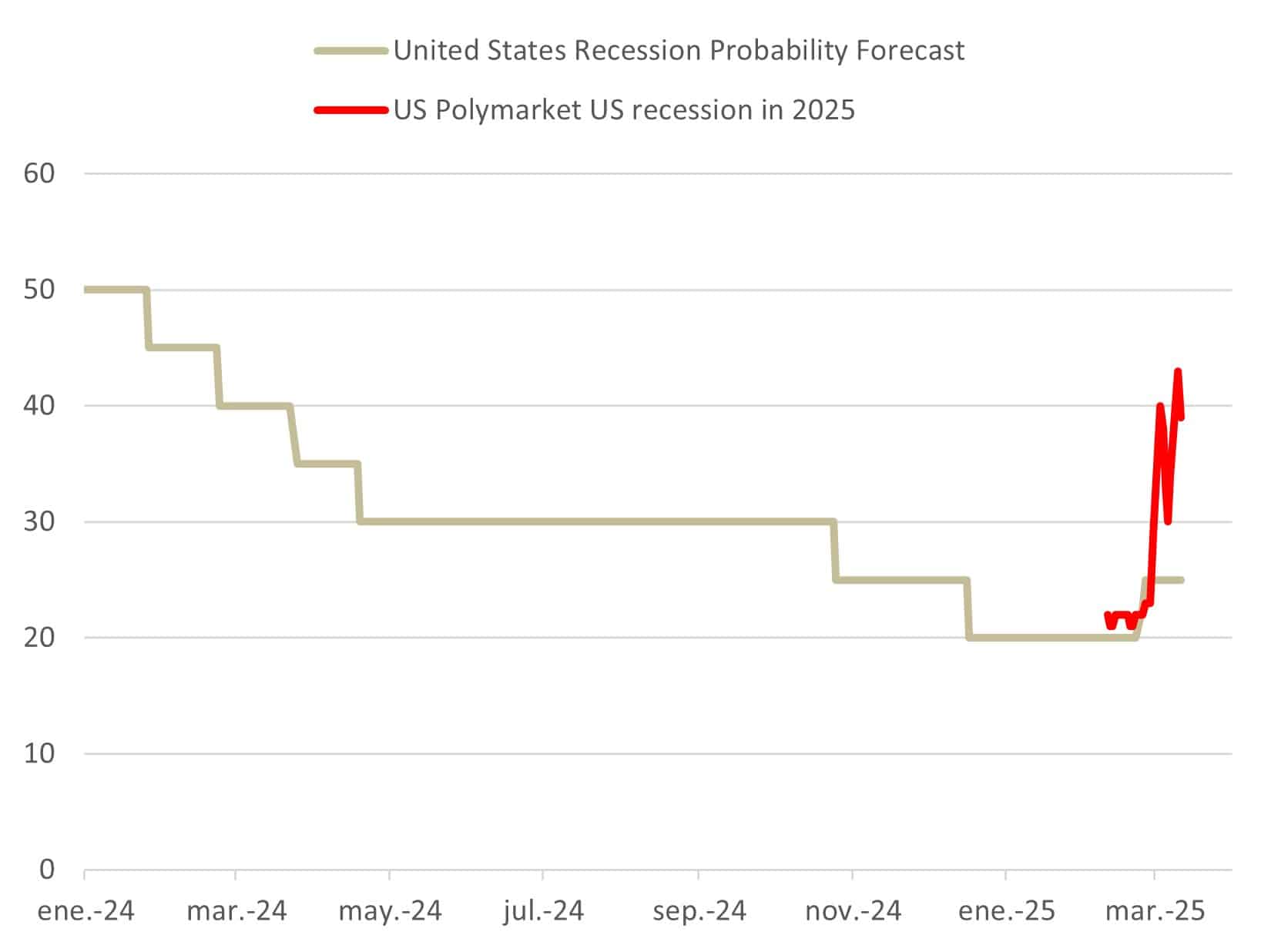

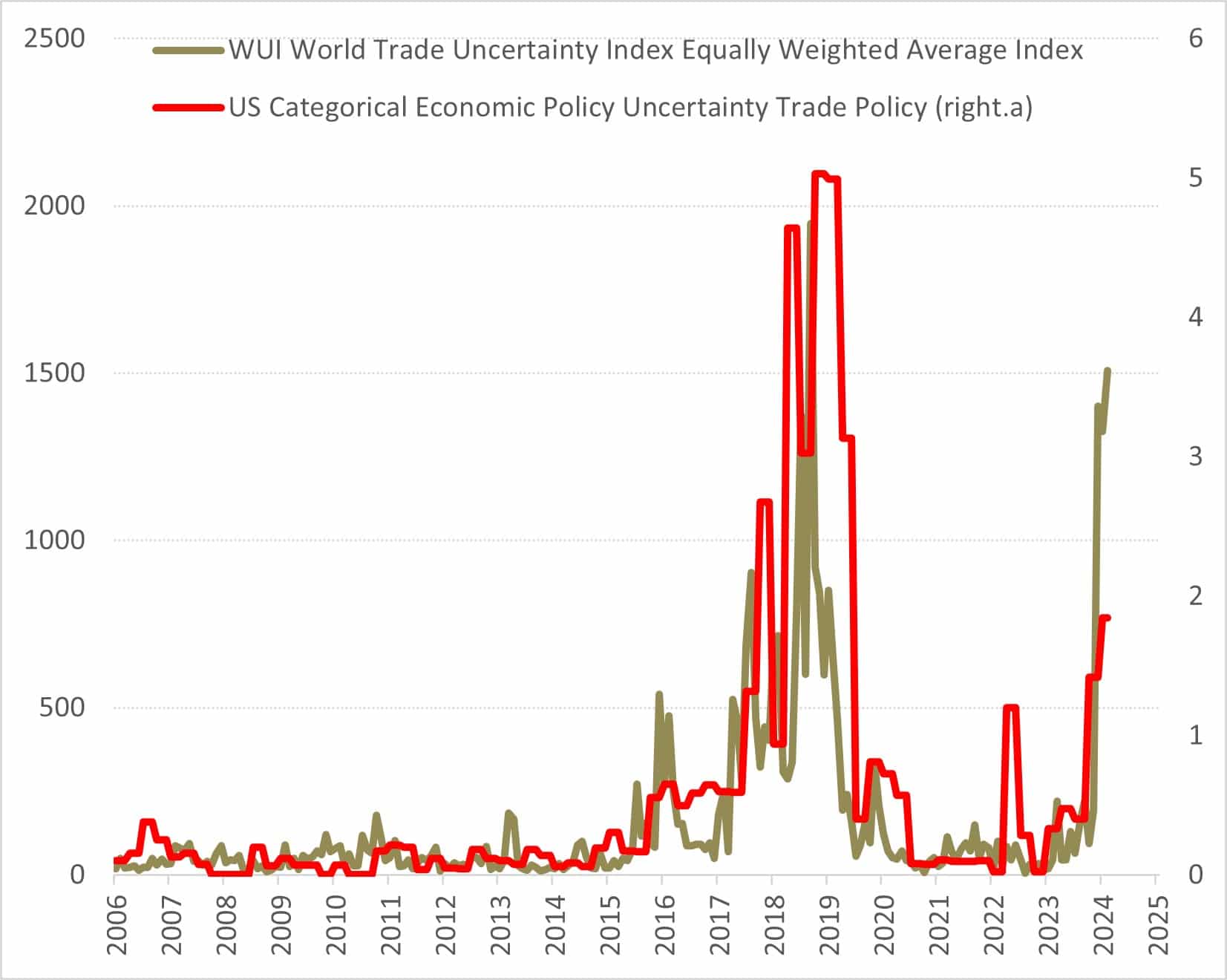

As a result, these developments have contrib-uted to a renewed fear of recession risks (see Chart 5), though somewhat distorted by an unusually high level of uncertainty (see Chart 6). This environment has made the Federal Reserve more focused on its mandate and more inclined to reinforce its existing strategy, shielding it from background noise and avoid-ing overreaction in the absence of clear sig-nals.

Chart 5: Likelihood of recession

Source: MAPFRE Economics based on Bloomberg data

Chart 6: Uncertainty indicators

Source: MAPFRE Economics with Bloomberg data

Although these factors suggest lower con-sumer spending, reduced business invest-ment, and potential additional negative im-pacts from the wealth effect of falling asset values, it’s important to note that these ef-fects can change quickly. Therefore, the men-tion of transitory seems more fitting in this case. Furthermore, in the absence of data suggesting a shift, it’s difficult to identify an alternative path that balances both risks and justifies making changes before the movement of expecta-tions fully plays out.

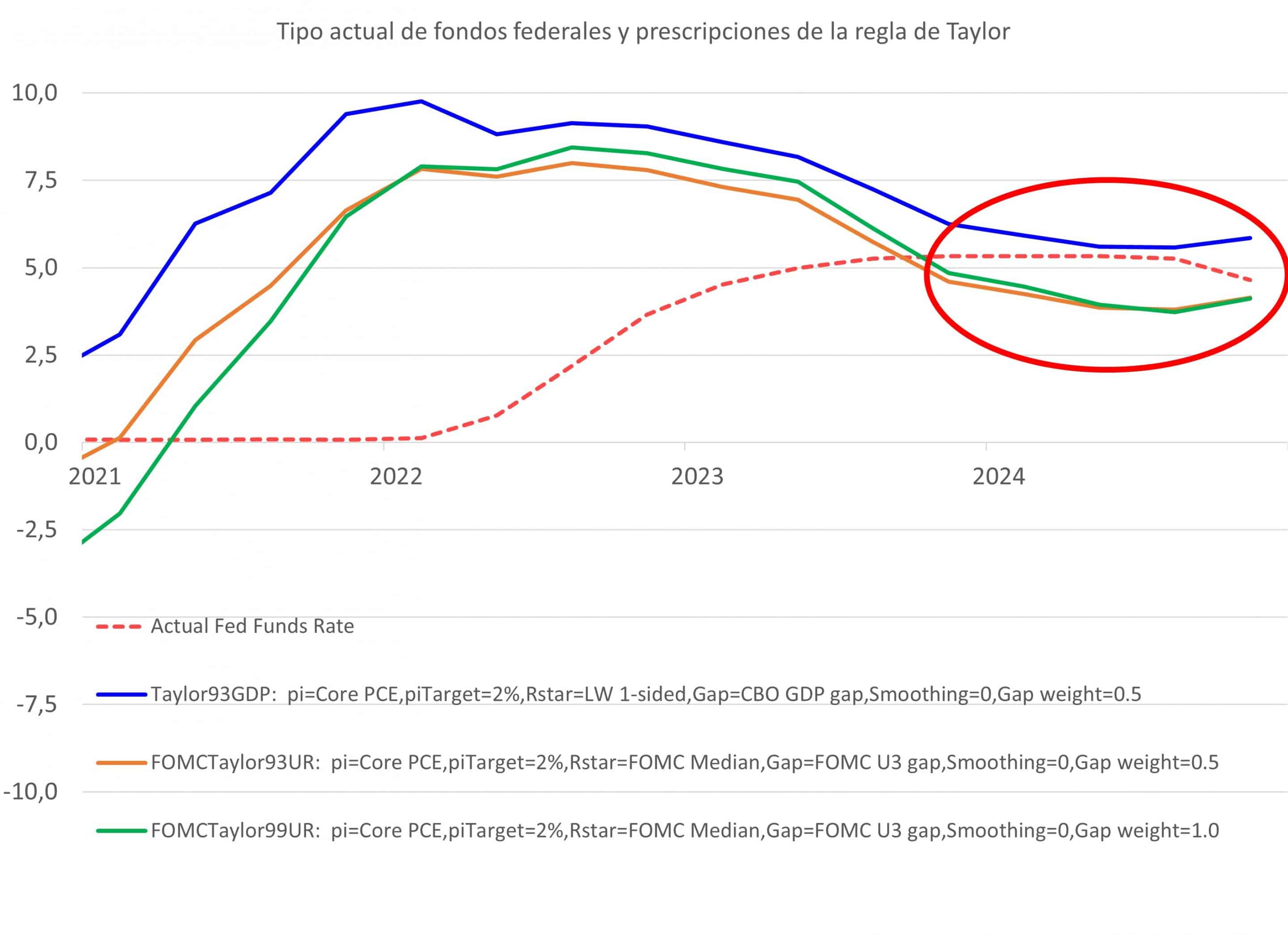

Turning to interest rates, and given that the current range remains anchored at the level dictated by economic theory (see Chart 7), the decision to maintain rates at their current level strengthens the Federal Open Market Com-mittee’s (FOMC) stance. In fact, should eco-nomic growth weaken significantly or inflation risks materialize, the room for action remains substantial. Additionally, if both economic growth and inflation evolve according to the baseline scenario, institutional confidence will likely strengthen, making it easier to follow the anticipated course.

Chart 7: Current and theoretical interest rates (Taylor Rule)

Source: MAPFRE Economics

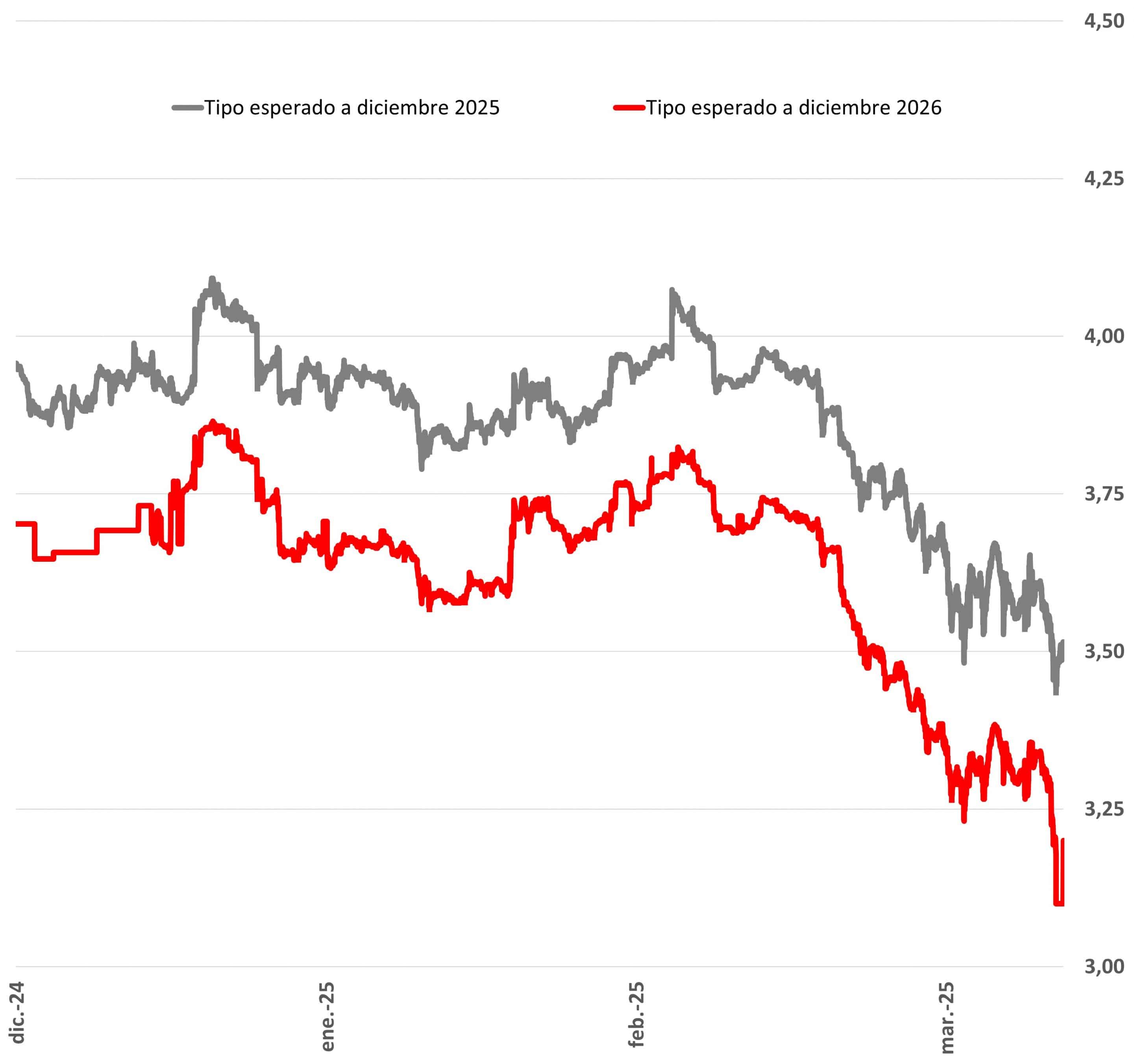

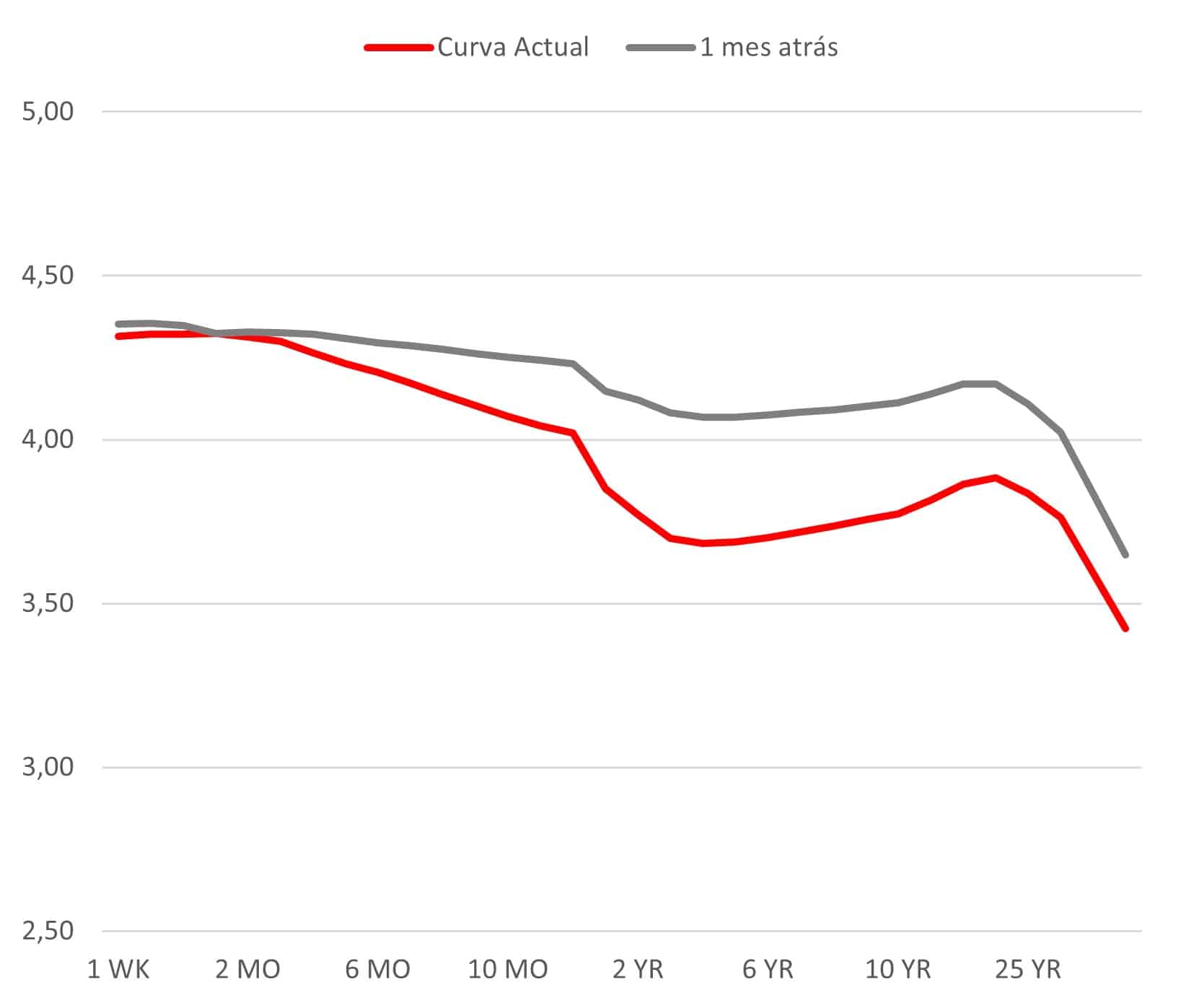

Therefore, the Fed’s plan to continue pro-gressing toward a neutral interest rate in the second half of the year remains the most reasonable option among possible scenarios. However, given the elevated risks, it is also likely that these risks will persist in the future. Consequently, continuing to defer decisions while waiting for clearer signals should not be ruled out, which may involve extending the current impasse until the full impact of vari-ous factors better aligns with the longer end of the yield curve, as we outlined in our 2025 Economic and Industry Outlook report (see Charts 8 and 9).

Chart 8: SWAP-discounted interest rates

Source: MAPFRE Economics based on Bloomberg data

Chart 9: Interest rate curve movements

Source: MAPFRE Economics with Bloomberg data