Fragile growth and emerging threats: the Eurozone’s economic outlook for 2025

Redacción Mapfre

Uncertainty still clouds the horizon as the Eurozone heads into the second half of the year, showing only tentative signs of recovery. Progress remains slow, hindered by longstanding structural challenges and global tensions that refuse to fade.

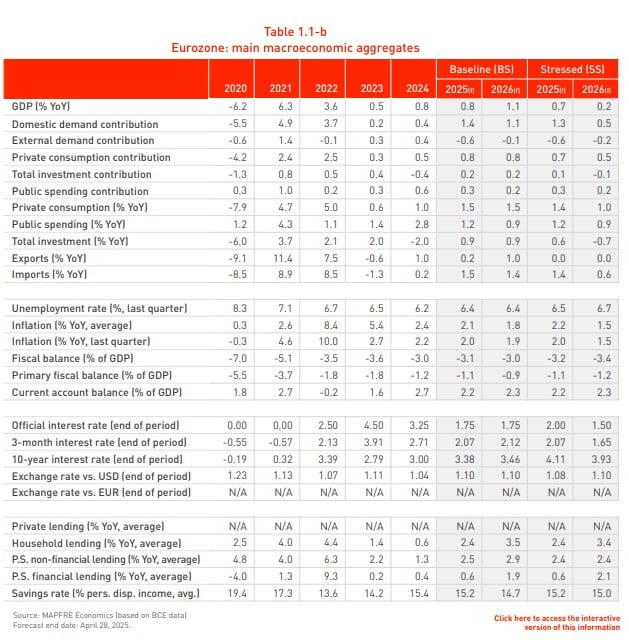

The latest report from MAPFRE Economics, MAPFRE’s research arm, "Economic and industry outlook 2025: forecast update for the second quarter," projects growth of 0.8% for this year and 1.1% for next year, figures largely in line with their earlier forecasts.

"We're maintaining our forecasts for the Eurozone virtually unchanged, as economic activity is expected to remain weak. The manufacturing sector’s rebound is starting to take shape, just as we predicted. However, the services sector seems to have lost momentum. This pattern points to a somewhat more balanced growth outlook, but realistically, we must acknowledge that downside risks have increased, especially on the trade front,” states Eduardo García Castro, Senior Economist at MAPFRE Economics.

In its April 2025 forecast, the World Trade Organization (WTO) noted that global trade prospects have “deteriorated sharply,” due to “a surge in tariffs and trade policy uncertainty.” The organization projects a 0.2% decline in world merchandise trade but warns that this could deepen to a 1.5% contraction “if conditions worsen.”

Trade policy is especially important for the Eurozone because the European Union is the world’s second-largest importer. However, the WTO notes that the regions most likely to be affected are North America, Asia, South America, Central America, and the Caribbean, in that order, with the Eurozone being impacted to a lesser extent.

This assessment aligns with MAPFRE Economic Research’s perspective. "At first glance, the most significant effects will be felt in the United States, where a sharper economic slowdown and stronger inflationary pressures could hinder the Federal Reserve's efforts. In the Eurozone’s case, the slowdown in economic growth could be less severe, especially if inflation remains relatively contained. Combined with the substantial fiscal stimulus packages already in motion (up to €800 billion at the EU level and €500 billion in Germany), this could contribute to a somewhat less bleak economic outlook,” the report highlights.

However, if US trade policies become more restrictive, Eurozone growth forecasts could be revised down to 0.7% in 2025 and just 0.2% in 2026, MAPFRE Economics warns in its alternative scenario.

“In a context of heightened trade tensions for the Eurozone, we could see a pullback in both consumer spending and business investment. A loss of confidence would likely lead households to increase precautionary savings and prompt companies to delay investment decisions. On top of that, there’s a further risk of escalation that could trigger retaliatory actions under the EU’s anti-coercion mechanism, setting off a negative feedback loop that clouds the planning horizon for consumers and businesses alike," explains García Castro.

Inflation is expected to continue moving toward the target, ending the year at 2.1%, while by 2026 price growth is expected to slow to 1.8%. In the meantime, the European Central Bank (ECB) has continued to lower interest rates.

Major structural challenges

Beyond the current headwinds, the European Union as a whole is grappling with deep-rooted structural issues, such as sluggish productivity growth, declining competitiveness, energy costs that exceed those of China and the United States, and a heavy reliance on external partners in key areas like defense, among other problems.

Several in-depth reports on the region's structural challenges have been published over the past year. On September 9, 2024, Mario Draghi, the former president of the European Central Bank (ECB), published The future of European competitiveness, while earlier that year, in April, former Italian Prime Minister Enrico Letta published a similar study titled Much more than a market.

"One example of these structural issues is the EU's ambitious rearmament plan. However, there are questions about the fiscal multiplier effect of that spending, at least in the early years. It’s also unclear how rising bond yields might affect private investment, as there’s a real risk of crowding out,” García Castro adds.

Opportunities for investors

While the growth outlook for the Old Continent may not be spectacular, stock market performance across the region has been positive (and is expected to remain so). A Bank of America survey of mutual fund managers revealed strong optimism about European equities: 81% believe the market will continue to rise over the next 12 months, and 44% expect corporate earnings to improve as well.

That said, these investments aren't without risk. “European companies are operating in a more challenging environment, shaped by slower economic growth, geopolitical uncertainty, and the high costs of the energy transition. This makes them less dynamic than their U.S. counterparts, who continue to be driven by large tech firms with strong growth and robust profits,” explains Manuel Rodríguez López de Coca, Manager of Equities, Collective Investment Schemes (CIS), and Pension Funds at MAPFRE AM.