Markets showing signs of doubt before year end but are still at record levels

Redacción Mapfre

RoadMAP: monthly market report prepared by the MAPFRE AM team

What happened over the past month?

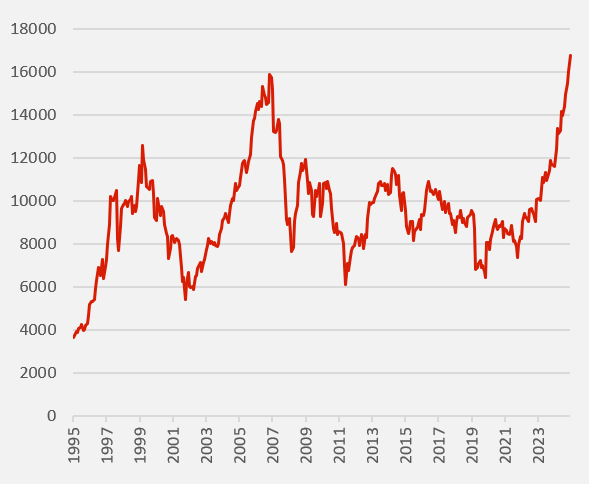

November was a volatile month for financial markets, as they dealt with the longest U.S. government shutdown in history, concerns about the valuations reached in companies linked to Artificial Intelligence, and sudden changes in the expectation of a further interest rate cut by the Fed. Returns were flat or slightly positive in equity markets with the exception of the IBEX 35, which rose by more than 2% during the month and continues to reach all-time highs.

Figure 1: IBEX 35 performance

The Nasdaq 100 was one of the indices most affected by volatility; at one point during the month it fell more than 6% from its highs. This happened as news piled up about major investors such as Warren Buffett and SoftBank liquidating part or all of their positions in the largest index-weighted companies like Nvidia or Apple. Nvidia’s earnings, which exceeded all expectations, restored some optimism among investors. However, this nervousness at times helped to correct some excesses and reduce the strong pro-risk positioning that some investors were maintaining. This was reflected in the results of Bank of America’s monthly survey of fund managers, in which the average liquidity weight in portfolios reached 3.7% (something that has only occurred 20 times since 2002).

It was not a positive month for Asian markets either, as macroeconomic signals coming from China continue to show a cooling of domestic consumption and a heavy reliance on exports, which have had to seek new destinations following the imposition of tariffs by the United States. There were also significant sell-offs in the Korean stock market, likely the result of profit-taking after its stellar performance so far this year.

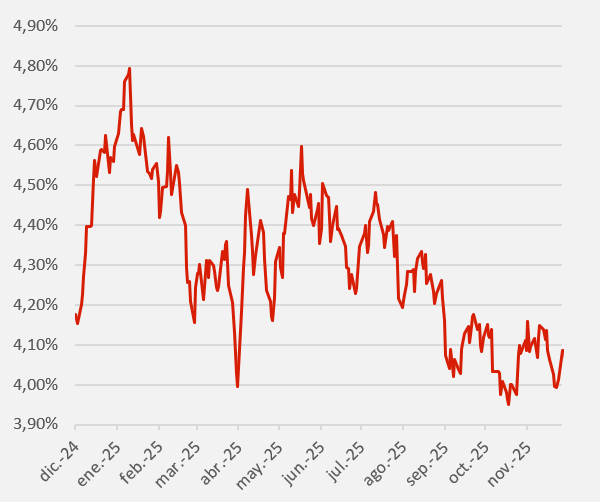

The yield required on the U.S. 10-year Treasury fell to below 4% at the end of the month, following macroeconomic data releases that had been delayed due to the U.S. government shutdown, which had left many of the government agencies responsible for collecting and preparing these public statistics without funding.

Figure 2: U.S. 10-Year Yield Trend

The most striking development was the drop in consumer confidence, as it heightens fears of a two-speed U.S. economy: on the one hand, higher-income households that continue to maintain strong purchasing power thanks to the solid performance of financial markets in recent years and the ongoing rise in housing prices; and on the other hand, lower-income households that must contend with inflation close to 3%, uncertainty over the impact of tariffs, and an uptick in layoffs by small and medium-sized companies.

In Europe, bonds ended the month with yields rising (and prices falling), without a clear catalyst other than a slight improvement in leading macroeconomic indicators. However, the data continue to point to a pronounced growth divergence between Southern European countries (such as Spain) and those in the North. An important event for the market was the presentation of the budget in the United Kingdom, as it could have increased volatility in the British bond market, as happened in October 2022. This time, the budget was presented without surprises, although it has raised doubts about its real viability.

Regarding raw materials, gold shone again with a revaluation close to 6%, while oil fell by 2.8%.

What's our take?

The good earnings season both in the United States and in Europe, a monetary policy that continues to support growth with an accommodative bias, and the ample liquidity in the pent-up system in monetary funds, leads us to maintain a moderately high level of risk in our portfolios.

Equity valuations remain demanding, particularly in the United States, although they are largely supported by strong corporate earnings and healthy profit margins. The excessive positioning seen earlier in the year has been partly unwound over the past month, and we do not detect any worrying levels of leverage. As a result, the positive momentum in equities could continue through year-end.

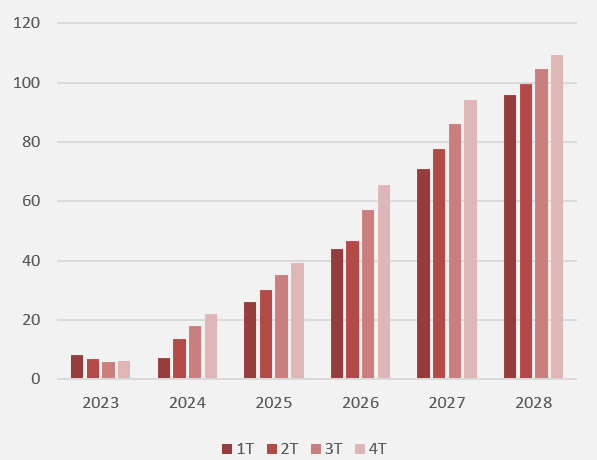

This does not mean that there are no significant risks that invite us to rethink our positioning, such as the evolution in the coming months of the U.S. labor market. Recent data point to weakening hiring momentum among small and medium-sized companies, while major technology firms have announced layoffs driven by increased adoption of artificial intelligence in certain areas. As we noted last month, we do not believe this reflects a bubble. Capital investment is being undertaken mainly by cash-rich companies, and only a limited number are turning to debt markets to finance the infrastructure required for AI deployment.

The key question for the future performance of equities is whether the second phase of this “industrial revolution” will translate into genuine monetization for service-oriented companies, rather than remaining solely a source of profits for semiconductor manufacturers.

Figure 3: Nvidia Quarterly Revenue in billions of USD (past and expected)

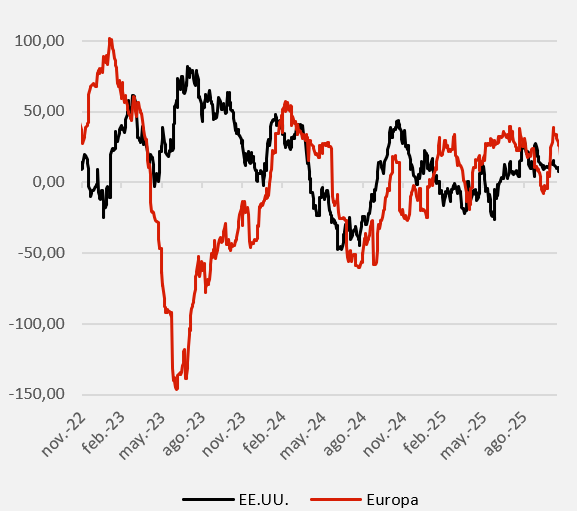

In Europe, our long-term positioning remains neutral; however, from a tactical standpoint, the risk-return profile has improved thanks to the recent strengthening in macroeconomic data and the accompanying rise in expectations. In fact, the macroeconomic surprise index—which moves above zero when data come in better than expected—has recently surpassed that of the United States and now stands firmly in positive territory.

Figure 4: Macroeconomic Surprise Index

Strategically, we continue to view the United States as the main driver of equity returns, with the Asian region serving as a potential diversifier. In Japan, the new Prime Minister, Sanae Takaichi, has unveiled a highly ambitious spending plan aimed at strengthening an already relatively solid level of domestic demand. The key will lie in the Bank of Japan’s ability to maintain monetary discipline while keeping the economy in balance. Moreover, ongoing initiatives to improve corporate efficiency and governance remain a long-term incentive for investors, both domestic and international. In other Asian regions, the polarization of geopolitics into two clearly defined blocs is driving a greater need for self-sufficiency across all areas (e.g., technology, healthcare, energy, defense, etc.), which is why we also see opportunities in these sectors.

While we previously highlighted the risk of a weaker labor market in the United States, inflation and the fiscal situation in many countries remain a concern, particularly regarding the future performance of various fixed-income assets. We continue to observe significant pressure on the long end of government yield curves in countries such as the United States, the United Kingdom, Japan, and France, which limits our appetite for duration risk. This is particularly relevant amid uncertainty over the policy direction of the incoming Fed Chair and the lack of consensus on the ECB’s next move, given the wide divergence of forecasts among market analysts.

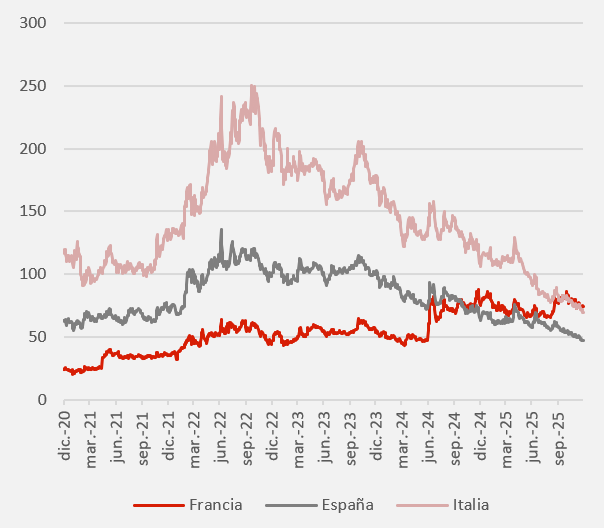

The strong performance of peripheral debt is underpinned by robust growth relative to the “core” countries and by recent credit rating upgrades for countries such as Italy. However, we must not overlook the fact that the fiscal situation in France remains precarious. If the market refocuses on France and the risk premium rises above a certain level, the contagion effect could weigh on other curves—particularly the peripheral ones that have performed exceptionally—potentially dampening fixed-income performance across the Eurozone.

Figure 5: Evolution of Risk Premiums (in basis points)

Regarding corporate bonds, and considering their performance so far this year, we expect investor appetite to be lower, which will likely result in profit-taking through the remainder of December. This is particularly true as many managers tend to slim down their portfolios ahead of January, a month traditionally marked by a surge in new primary market issuances. We continue to believe that fixed-income returns will come primarily from coupon income rather than price appreciation, given the challenging fiscal situation in developed countries, uncertainty over upcoming central bank moves, and risk premiums (and credit spreads) trading at levels well below their historical averages.

What are we doing?

During the month, we tactically took advantage of volatility spikes to establish positions in both equities and fixed income. Regarding our fixed-income funds, Belgium’s rating remaining unchanged led us to purchase some Belgian bonds while taking profits in other countries, such as Spain. Additionally, although French bonds are not particularly attractive to us, short-term French bills offer an extra yield that we decided to capitalize on. We have also been active in managing duration, given the volatility in interest rates driven by shifting expectations around the Fed’s upcoming December meeting. Finally, most of the recent corporate bond issuances have had maturities longer than we prefer, so we have not participated.

In our multi-asset funds and portfolios, we have maintained our equity allocation, while taking advantage of the November rotation from high-beta names to more defensive, high-quality companies to adjust some positions that had performed excellently. We have also tactically increased our exposure to European equities, although our central scenario still anticipates stronger performance from U.S. equities.

Chart of the month

Limitations for the large-scale implementation of AI:

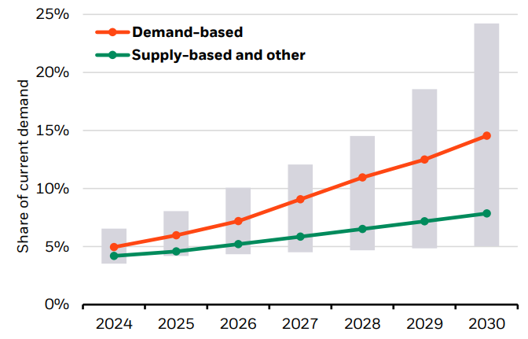

Source: BlackRock Investment Institute based on sources from BloombergNEF.

- As we mentioned last month, major technology companies have committed substantial capital to develop AI technology. Their main constraint is not access to capital, as they have ample cash on their balance sheets and open doors to financing in the capital markets.

- The limitations are expected to come primarily from the energy side, as data center electricity demand in the United States is projected to account for 15% to 20% of total consumption by 2030. Expanding energy capacity also faces political hurdles, since permits to connect these new generating centers to the power grid are slow to obtain.

- Consequently, these capital investment plans could be constrained by energy limitations.