Is the return to normal we're seeing in the markets real or an illusion?

Redacción Mapfre

Monthly market report prepared by the team of MAPFRE Inversión

At the end of the second quarter of this year, it is safe to say that the financial markets have once again been operating with apparent normality. It was a very turbulent quarter that began with the so-called Liberation Day on April 2, and ended with the US stock indices at new record highs, lower rate levels and tighter credit spreads.

In the meantime, a stream of news items, posts on social media, political uncertainty and geopolitical uncertainty have ensued. But as is often the case, the usually complex but also efficient system of capital markets adapts to the new environment and focuses on what is really important.

And what is really important is the mix of economic growth, inflation and monetary policy. In this regard, the most significant news in the past month is the upturn in macroeconomic figures in the United States, which has served, at least, to ensure that the growth expected for this year has ceased to erode owing to the resilience of the US economy.

In addition, this improvement in expectations has been accompanied by an additional dose of enthusiasm as inflation has yielded positive surprises in both the United States and Europe, which has fed expectations of seeing, during the year, as many as two rate cuts by the Fed and one more in the case of the ECB. Hence, we entered the summer period with a favorable macroeconomic environment, or at least better than it appeared at the start of the second quarter.

To add a touch of caution, the market may have focused entirely on the short-term and is ignoring the important structural changes that may occur if we focus on a longer term horizon. We are speaking of the depreciation of the dollar and the possible loss of its status as the reserve currency and the sustainability of an ever-growing public debt. We will dedicate the rest of the report to these two major challenges.

The fall of the dollar

As we noted previously, neither the quarter nor the year are going badly in terms of returns, as long as we look at the different indexes in their local currency. Otherwise, the year may not be going as well, especially for portfolios with greater exposure to US assets for investors whose base currency is not the USD.

Of the major financial assets worldwide, only oil and USD have seen negative returns so far this year. These value losses are also occurring in a difficult environment of economic uncertainty (which would have traditionally been good for the USD) and geopolitics (which would favor the price of the Brent barrel and the USD). Although the fall in the price of crude oil is due to an excess of supply over demand, the loss in value of the USD deserves deeper analysis.

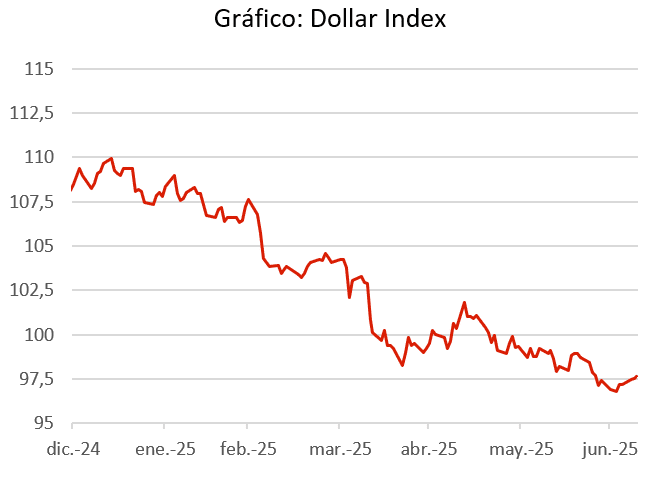

Trends in the Dollar Index, which tracks the performance of the USD against a wide basket of currencies, show an accumulated decline of approximately 10% in the year. This loss in value has occurred in three phases.

The first of these occurred in March, when it began to price in nearly three interest rate cuts by the Fed. The second fall occurred in the early weeks of April after very high tariffs were announced for fifteen countries; and the third has been occurring gradually and less abruptly since May as a result of a loss of credibility of American assets among foreign investors.

It is true that the combination of fiscal and trade deficits has always put downward pressure on currencies. But this situation is not new for the United States, as it has been causing this “twin deficit” for several decades. So the fall in the USD is probably more influenced by the political deterioration of its institutions, with constant pressure to break the Fed's independence by President Trump and the calling into question of the US economy as an international leader.

While these events do not happen overnight and it is difficult to identify the moment when they fully materialize, it does seems clear that international investors are seeing a deterioration of the USD as a safe haven asset and currency, which has lead many countries to accelerate the process of diversifying their reserves. Lower engagement by international investors in US markets further complicates the second of the major problems facing the United States.

Debt sustainability

Today, this is the biggest problem facing the market, given that it is not only a US issue, but many other important countries such as France, Japan, Italy and the United Kingdom suffer from a level of debt that shows no signs of letting up. And it cannot be ignored that fixed income markets, although they capture fewer headlines than their equity siblings, play a key role in the proper functioning of financial markets and act as a safeguard against governments that are highly ambitious fiscally.

In this regard, the recently approved tax reform in the United States (One Big Beautiful Bill Act) poses a major challenge for the sustainability of U.S. debt, given that the fiscal deficit is expected to increase by two trillion US dollars (data from the U.S. Budget Office) over the next three years, as tax cuts will take effect immediately, while cost cuts will not occur until 2028.

This huge volume of new debt will have to be absorbed by fixed-income investors who have ever less appetite for duration risk and who have recently raised the country’s risk premium as shown by the trend in credit default swaps. In fact, at current levels, investors would have to pay the same amount to cover a default in the United States as countries with a much lower credit rating, such as Italy or Greece.

Tariffs may work for Mr. Trump given the large increase in revenues it provides, but it is a short-term solution. In the long term, debt sustainability could only be maintained by reducing expenditure (a very unappealing solution for politicians), inflation (the easiest route but with a social cost) or through default (which would have very serious consequences).

In the case of Europe, the situation varies from country to country, but fiscal plans have also been growing in recent years, especially in 2025, as Germany has launched an ambitious infrastructure spending plan and the European Union as a whole will have to undertake greater defense spending.

Unquestionably, a lot of debt to absorb without the support (for now) of central bank purchases. At least the higher defense spending can serve to refute the theory of the English historian Niall Ferguson, who argues that when a country spends more on covering its debts than on defense, it is no longer a great power.

What do these challenges mean for assets?

In conclusion, we can say that, in the short term, the macroeconomic picture is more favorable for equities than for fixed income, given that the fundamentals are not as bad as expected just two months ago.

Although it is true that we are entering summer period characterized by a lower trading volumes, which magnifies the reaction to any event, and that the environment is still fragile. In the long term, we expect debt to be the main concern of the market given the large volume of issuances to be absorbed by more selective demand among investors, and not at any price.

There is more debate on whether or not to cover the high exposure to American assets that most investors have. In the long term, currencies tend to follow a fluctuating pattern, and returns on different assets tend to even out in solid currencies such as the euro and/or USD. But this cost of coverage may be necessary for more conservative portfolios that aim to avoid greater volatility.