The tariff war is relaxing, but it has left profound changes in the world economy

Redacción Mapfre

*By MAPFRE Gestión Patrimonial.

The abrupt changes that occurred during the month of April have resulted in nearly flat returns in the major stock indices for the entire month, but they have brought about significant modifications in the way the global system operates.

It is still too early to assess whether these new mechanisms will lead to a better system, but what we have observed is that such a major change generates considerable uncertainty due to all the underlying movements it triggers. Uncertainty hinders decision-making (especially in the economic aspect), and it had been growing throughout the first quarter of the year regarding the imposition of tariffs.

This uncertainty exploited the famous ‘Liberation Day’ with significant falls in a wide range of assets, including U.S. public debt, forcing President Trump to reverse his idea of imposing tariffs immediately and offering a period of 90 days to negotiate bilateral agreements. A joint fall in the price of government debt and the currency of the country is more typical of emerging countries than of a country like the United States, which is considered a safe haven asset and has been a safe and profitable destination for a high percentage of available capital worldwide.

Thus, this paradigm shift has come with much uncertainty about its future functioning and damage to the dollar, which has not recovered despite the pause in tariffs. Its trend seems to continue declining, becoming the only objective that Mr. Trump would achieve (devaluing the USD to make exports more attractive and imports more expensive). The remaining economic objectives that accompanied Mr. Trump during his campaign (tax cuts, lower regulation, and lower energy costs) are still be far from being achieved, given that he needs greater support from Congress and Senate.

What has changed at the macroeconomic level?

The first significant modification is related to growth forecasts and the significant reduction in expectations for the U.S.

Chart: Growth forecasts for the U.S.

The uncertainty caused by political decisions has affected the sentiment of consumers and companies, which has begun to translate into downward sentiment surveys. Although lagging indicators such as unemployment, retail sales, or corporate profits have not yet shown such a clear weakness, it is not surprising that this pessimism takes time to be reflected in the macroeconomic data.

Moreover, a significant portion of the high growth experienced by the United States in recent years was closely tied to the growing public spending following fiscal aid related to the post-pandemic recovery and the plan to fight inflation. However, in recent quarters the contribution of public spending has been shrinking; in fact Mr. Trump assigned Elon Musk the task of reducing the size of the state and reducing public spending.

All of this, and due to the foreseeable impact of tariffs, has lead economists to rethink the concept of American exceptionalism, and the probabilities of recession in the different econometric models have risen.

Also noteworthy is the stability of the outlook for the Eurozone as a whole, since neither Germany's fiscal stimulus plan (on the positive side) nor the possible imposition of tariffs (on the negative side) have altered the expected growth figures.

It is possible that both effects have been offset, but the optimism perceived within the Eurozone is greater than a few months ago and is helping many capital flows find a refuge in Europe amid a loss of confidence in the United States.

Expected inflation has also changed and is further away from the target level of 2% in the United States. If everything consumed in the United States has to be covered by domestic production, this will inevitably lead to a rise in prices since the disruption of supply chains and the lack of both productive specialization and international competition will at least cause an increase in costs. This, in turn, may lead companies to pass on that increase through higher prices to avoid eroding their margins.

On the other hand, an American consumer who stops consuming goods from abroad could cause a fall in prices in the rest of the world given that this would reduce demand. In this scenario, Europe will probably emerge the best stop in this regard, as it is an attractive destination for many producers who will have to look for new markets.

What role will Central Banks play?

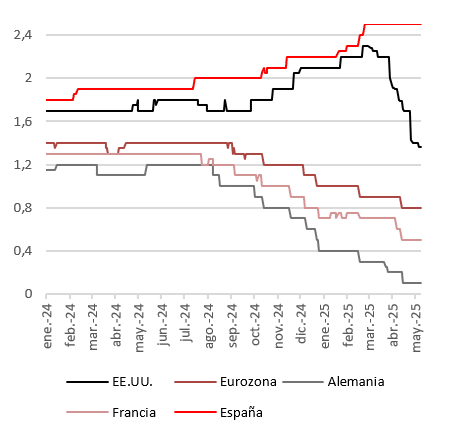

While the European Central Bank has continued lowering interest rates to 2.25% and is expected to reach 1.5% in December of this year (illustration 6), the Fed is in pause mode. Uncertainty about economic projections has continued to increase, while the risks of higher inflation and unemployment are now higher despite the fact that the labor market remains solid. The most repeated word in recent weeks by Fed members is to “wait.”

And from our point of view, the Fed is right to “wait and see,” since tariffs will raise prices not due to an increase in demand, but because of a supply shock. In this case, the usual tool of central banks—interest rates—will be very ineffective.

What the Fed has been doing is injecting liquidity, which has helped stabilize a debt market that experienced a near financial accident when the yield on the 30-year bond spiked to 5%. It has had to coexist during the second half of the month with statements from Mr. Trump regarding the possibility of removing Fed Chairman J. Powell before his term expires next May.

We don't know if the market reaction to these attacks on the independence of the Fed prompted Mr. Trump to retract, but calm has returned to the market, and financial conditions have returned to being relaxed in the Eurozone and nearly neutral in the United States.

Conclusion: uncertainty means that we have to continue protecting ourselves

Although the worst in terms of growth could already be discounted, the price of assets does not fully reflect the risks that still exist. Or, in other words, the volatility we have had during the month of April has opened very small windows of opportunities to reposition portfolios or take positions strategically.

Although the growth expectation could improve as the year progresses and the Trump administration focuses on the pro-growth part (deregulation and lower taxes) for next year's mid-term elections, uncertainty remains high and the variability in results of all the decisions that have been made is still very high.

The appetite for longer-lasting fixed income remains low in the United States, while in Europe it is more neutral in the face of opposing forces: on the one hand, a higher volume of emissions from Germany and other countries that have to finance ever greater deficits would increase the required profitability, but demand could also increase as their role as refuge in the United States that have decided to change gear has improved.

With regard to equities, it is time to maintain caution and protect ourselves through diversification and commitment to quality.