Transition risk: what is it and how does MAPFRE AM manage it?

Redacción Mapfre

Javier Miralles, MAPFRE AM mutual fund manager, explains that climate risk is divided into two groups. On one hand, there are physical risks, which are the most obvious when speaking of climate change, such as droughts, floods, rising sea levels in coastal zones or large migratory movements, among others. On the other, there are what are called transition risks. These are a bit more subtle and less obvious, but no less important. They are related to a company's capacity to adapt to change.

Adaptation to the climate challenge is associated with a series of technological changes, changesin consumption trends, even regulatory and legal changes companies must confront. The capacity of these companies to adapt, to be more efficient, to develop the necessary technology will make the difference when analyzing risk, and therefore when selecting the investments we make.

Not all companies are exposed to transition risk in the same way. One important factor will be established by the industry in which they operate. Obviously, the most emissions-intensive industries will be the most vulnerable. Those with higher greenhouse gas emissions would be transportation, industry, utilities, mining and the energy sector, and therefore, regulations intended to facilitate the transition will have the most direct impact on them. Within each industry, companies may be better or worse situated for this transition.

“The uncertainty caused by changes in investor preferences, technological disruption and the implementation of climate policies, especially abruptly, could cause a prolonged drop in the price of financial assets over time,” the Spanish National Securities and Exchange Commission (CNMV) argues in its latest quarterly bulletin.

In addition, the agency explains that these changes could increase financing costs, reduce the value of stranded assets and carbon-intense assets (brown assets),and impair the credit rating of issuers, “generating losses in financial instruments issued by companies vulnerable to the transition.” The greatest drops were in equity investments, on average 12.71%, followed by corporate bonds, with 5.61%, and sovereign debt, at 4.77%.

According to CNMV calculations, the average decline in Spanish mutual funds stands at 5.69%, which would mean a total loss of €17.5 billion, taking into account only the direct and first-round effects of the climate transition. However, the CNMV notes that the distribution of losses is highly asymmetric, and 1% of the funds with the worst performance experienced an average loss of 21.34%.

Spanish sustainable funds, despite having a higher proportion of variable income, have less loss potential, of 5.7% versus the 5.92% they would have if the portfolios had comparable asset classes.

Protection from transition risk is key for investment firms, who must protect their portfolios from any type of climate risk. In the case of MAPFRE AM, Miralles explains that like the others, it considers this and continues with the same process: identify, categorize, and then, work to resolve this risk. In addition, he adds that the results of this report published by the CNMV are very revealing, as “according to this report's conclusions, Spanish funds with a sustainable bias are the best tool to face transition risk in the investment world.”

He also recalls that more regulatory pressures are being exercised in the European Union (EU), well ahead of other geographies like the United States or China. “The EU is the most advanced region, with emission reduction goals, pertinent portfolio management legislation.. In Europe, you can't avoid this,” he states.

The importance of measuring the carbon footprint

Measuring carbon footprint and environmental, social and governance impact in general becomes necessary in a context in which transition risk continues to grow. Thus, in recent years, various formulas have been created to measure emissions of the carbon footprint and drive its reporting.

This calculation “serves to characterize and monitor the risks associated with climate change and helps companies prepare an emissions reduction strategy,” Miralles explains.

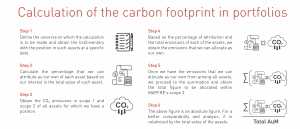

MAPFRE AM has its own methodology to calculate the carbon footprint in the investment portfolio, intended to complement the calculations already established at the regulatory level, and establishes different types of carbon footprint measurement on investments based on the information to be reported, and its purpose. To put it briefly, calculations can be established in absolute, relative, or intensity-weighted terms.

“This methodology helps us protect ourselves from both physical and transition risks,” Miralles notes.

This project is part of the company's 2022-2024 sustainability plan, which has more than 20 ambitious and measurable objectives which add to #PlayingOurPart.