The central banks stay the course despite the war

Redacción Mapfre

Although it’s still too early to anticipate developments, there are some indications that the negotiation of an end-of-war pact in Ukraine is closer than was thought a few days ago. However, it should be assumed that this process will take longer than desired. In the meantime, some risks (inflation, interest rates or energy prices, to name but a few) remain active and will have to continue to be taken into account by central banks. Both the Fed and the European Central Bank have held their first meetings since the outbreak of the war and, despite the fact that the convulsive context could have led to a more abrupt change of direction or even maintained the monetary laxness of recent months, both institutions have stuck to the plan foreseen by analysts for this year. What have they done specifically?

The Fed in the spotlight once again

One of the most eagerly awaited events on the part of experts was undoubtedly the Federal Reserve meeting, at which many anticipated that there would be news regarding inflation forecasts, but above all, on interest rate movements, initiating a new phase of US monetary policy.

Jerome Powell, chairman of the Federal Reserve, advanced a 0.25% rise in interest rates, the first rate hike since 2018 (when he raised them from 2.25% to 2.5%). In addition, a forecast was included which envisaged a total of seven hikes of 25 basis points each, to reach around 1.75-2%.

In this way, the dot plot of the Federal Open Market Committee (FOMC) - in which the interest rate path is analyzed - has accelerated the additional rises in rates that are expected for this year. As in previous meetings, the FOMC had supported the central bank's decisions from an accommodative approach, to the benefit of closing the output gap and recovering employment figures at the expense of high inflation, toward a stricter line that is more focused on price stability. But the outbreak of the conflict has exacerbated its position regarding the effects of the second round which, although they generate a more limited impact than in Europe, given greater energy independence, "does not exempt the economy from a certain contagion effect", MAPFRE Economics clarifies.

This scenario was however already discounted, according to Alberto Matellán, chief economist at MAPFRE Inversión, by both analysts and the market, assuming that "the aggressive tone will be maintained during 2022". Along these lines, Ismael García Puente even stated that many experts had previously included up to "seven rises of 0.25% each over the course of the year" in their forecasts.

Despite the fact that the impact of the war on the American economy is, for the moment, more limited than in Europe, it is expected that US inflation, given its current clip of 7.9%, will end up having repercussions on domestic economic activity. The measures announced by the Federal Reserve are in line with controlling price levels that, as per the Fed’s own estimates, are expected to be, on average, 4.3% for this year, very far ahead of the December forecasts (2.7%), which had not yet factored in the Ukraine conflict.

MAPFRE's research arm foresees "a stricter monetary policy" as the disruptions in inputs transfer across to the rigidities in the supply curve. "These adjustments are expected to continue progressing toward monetary neutrality, which could cause some additional volatility, amplified by the flow of geopolitical news and a certain permissiveness in terms of receiving adverse macroeconomic data", adds MAPFRE Economics.

However, the consensus view regarding the long term is that the current mismatch between supply and demand in the US economy will come to take on a more consistent structure, "normalizing the current inflation figures and enabling the neutral interest rate to consolidate around at 2.5%." Although this figure was still above the Federal Reserve's target, the downward trend evidenced after the tightening of policy "would provide the institution with some wiggle room both in terms of interest rates and balance of payments," commented the research experts.

Lagarde sticks to the plan

On Thursday, March 10 -one week before the Fed meeting-, markets had their eyes set on the European Central Bank meeting. For some, it was the most important since March 2020, mainly because of the war situation in Ukraine and the impact it could have on the European economy. As it happens, Christine Lagarde has already warned that, since the beginning of the conflict, “risks to the economic outlook have increased substantially.” The latest macroeconomic data show that the current backdrop will stay with us for a while: estimated inflation for this year in the Eurozone has risen from 3.2% in December to 5.1% this month; while growth for 2022 will be 3.7% compared to 4.2% in the last revision. Accordingly, and recalling Mario Draghi's 2012 statement that “we will do whatever is necessary,” the bank has said that it “will take whatever action is needed to fulfill the ECB’s mandate to pursue price stability and to safeguard financial stability.”

Although this scenario of inflation of more than 5% estimated by the central bank may come to pass, Gonzalo de Cadenas Santiago, director of macroeconomic and financial analysis at MAPFRE Economics, believes that it may have been underestimated due to “the erratic nature of previous forecasts, the implications of the escalation in the conflict between Russia and Ukraine and the rise in prices that is already spilling over to other components.”

There have been many months of accommodative policies and reassuring messages from the central banker since the outbreak of the pandemic. However, the return to growth heralded a change in bias: experts expected that the bank could hit the brakes of monetary policies in 2022. The December and February meetings (when Russia had not yet entered Ukrainian territory) did not close the door to this possibility and already brought into clearer view the end of stimulus measures.

However, no one anticipated that the diplomatic crisis in Eastern Europe would turn into a conflict of unexpected dimensions. Almost automatically, the international pressure translated into an economic war, with direct sanctions against Russia that makes us wonder to what extent its economy will be able to hold out. But beyond that, economists anxiously awaited the ECB's March meeting, which seems to have set a precedent amid the storm going forward.

Despite the convulsive environment (in which the initial data is now emerging for Europe in terms of recovery and inflation), Lagarde's plan to stay the course set at the last meeting in February remains in place: reduction of the purchase program and maintenance of interest rates (for the time being):

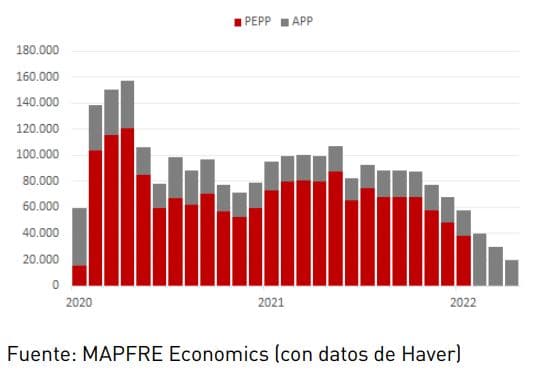

- Specifically, the monetary authority announced a downward resizing of the purposes by the APP program: they will go on to buy 40 billion in April, 30 billion in May and 20 billion in June and definitively end purchases in the third quarter (provided that economic data and prospects do not weaken).

- In addition, the Pandemic Emergency Purchase Program (PEPP) ends this month: it has so far totaled 1.677 trillion euros to purchase corporate and sovereign debt, although this figure could reach 1.85 trillion euros. However, reinvestment at maturity will continue at least until the end of 2024.

- Regarding interest rates, Lagarde did not want to hint at measures that could be precipitous, but she did not close the door to them happening before the end of the year. At this time, interest rates will remain constant (0% on main refinancing operations and -0.5% on the deposit facility).

- As for targeted longer-term refinancing operations (TLTROs), they remain on schedule in their third series, with completion scheduled for June, ensuring that their maturity does not hinder the smooth transmission of monetary policy. Finally, in view of “the highly uncertain environment caused by the Russian invasion of Ukraine,” the ECB decided to extend the Eurosystem repo facility for central banks (EUREP) until January 15, 2023.

Chart 1: PEPP and APP monthly purchases

Overall, and looking ahead to the upcoming meetings, the ECB is expected to be more “hawkish” than previously anticipated. In fact, MAPFRE Inversión is pointing out that, after the adjustment in growth and inflation forecasts for this year, the market is already discounting a rate hike in September.

Even so, the ECB's bond issuing would not have fully come to an end. Starting from an inflation outlook that was not good before the conflict, and now with the disruption in the oil and at least part of the natural gas supply, oil and natural gas prices have gained new momentum in world markets as supply has been reduced. MAPFRE Economics, in its monetary policy update suggests that many countries are seeking to strike a new balance in their mix of energy sources. This pressure on demand is being passed on to prices, to the benefit of producing countries. As a result, the European Union hinted at a possible massive bond purchase to finance higher defense spending and energy products to mitigate the most negative effects.

What can we expect in the coming months?

The director of macroeconomic and financial analysis warns that the rise in prices and the downward revision of economic activity “hinders not only the ECB's timetable, but the very imperative of price stability.”

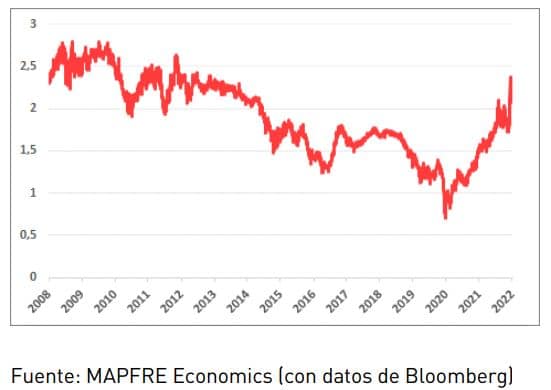

Chart 2: Inflation expectations

Gonzalo de Cadenas-Santiago further explains that "the line in monetary policy would lead to tighter financial conditions under the umbrella of a fiscal policy that is still lax.” However, he stresses that the exit from such policies “would continue to be accommodative,” while “global monetary tightening” would occur in the near term.

However, and back to “a Trichet moment” the possibility of bringing both the balance sheet and interest rates into neutral territory throughout the current normalization cycle could lead, according to MAPFRE Economics, "to a fiscal dominance event that could quite possibly put an end to the proposed roadmap.”