Are there symptoms of a possible recession scenario?

Redacción Mapfre

It is nothing new that experts are placing all their cards on the table and shuffling through all types of macroeconomic scenarios in their analyses, including the most pessimistic, but this time it is the European Central Bank itself that has given a glimpse of a more complicated context than normal. Andrea Enria, president of the body's oversight counsel, has acknowledged that “the macroeconomic projections are, for the first time, hinting at a possible recession scenario.” The last emergency meeting of the ECB gave signs that the situation was starting to spiral out of control (the debt spreads of the member countries are widening), ringing alarm bells throughout the European economy. According to Alberto Matellán, head economist at MAPFRE Inversión, these sings point to weakening growth for the second half of the year.

This sentiment, however, is not isolated in Europe. On the other side of the Atlantic, despite symptoms of strength (very close to full employment and high growth), more and more experts are predicting a sharp slowdown in the third and fourth quarters of the year. In fact, the investment bank Nomura has estimated that by the end of the year, the United States will already have entered into economic recession. The most pessimistic view of an imminent global crisis, however, is not present in the consensus of experts; Alberto Matellán does not anticipate a possible recession, but he does recognize that “growth will be impaired by the end of the year.”

The outlook, therefore, has not become a doomsday scenario (at least for the moment). This perspective is shared by Ismael García Puente, fund selector for MAPFRE Equity Management, who believes that the situation has not changed and that the central banks, despite the unanticipated reaction of recent days, will not make a sudden change of course. Because, he explains, the key question remains how far they will go to calm inflation: “the United States has it easier, because the nature of inflation in Europe is not corrected with rate hikes which, moreover, have arrived just as risk premiums have risen.” Even so, the head economist at MAPFRE Investment believes that “the central banks are prepared for this situation.”

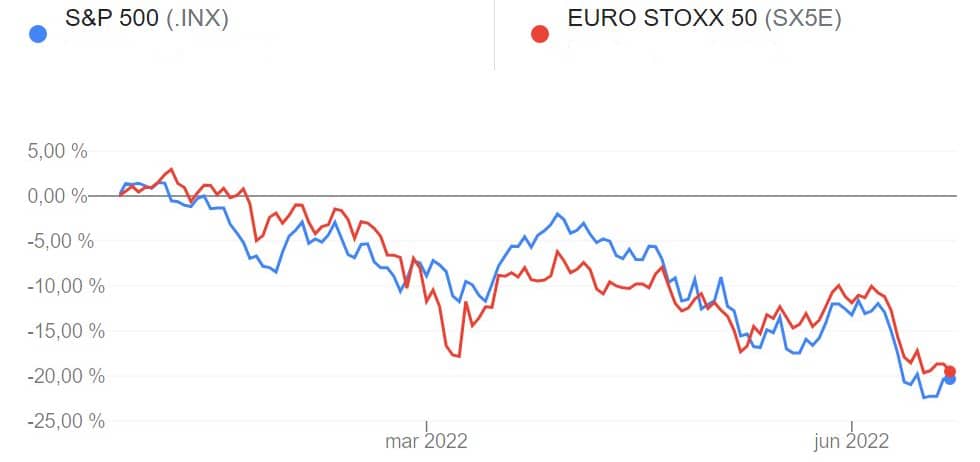

Unfortunately, the financial markets are not outside of this climate of uncertainty: American equities have recorded their worst quarter since 1962, proving that investors are immersed in a bear market. However, Matellán believes it has bottomed out: “we will continue to see drops, but the worst has already passed.”

With this “snip” in the markets, Matellán believes that rationality is returning to the market: “when the problem is that future growth will be lower, the way to confront it is more direct: the defensive will hold their own, while the cyclical will suffer.” This, in his view, is a good thing for analysts, as it “restores agility in management.”

Thus, defensive positions could be very interesting right now, with special attention to fixed income that until now had suffered from generalized dips in the markets and which “could bring some joy” moving forward.