The de-dollarization myth: why the dollar won’t lose its hegemony in the short term

Redacción Mapfre

Now, a number of countries, including Brazil, Russia, India, China and South Africa (known as BRICS), want to do away with this hegemony and are studying the creation of a new currency to trade with.

The renminbi, the legal tender of China, is positioned as the frontrunner to replace the dollar. It has already significantly boosted its presence in commercial transactions, in parallel with the Asian giant strengthening its role as an economic powerhouse in recent years.

Gonzalo de Cadenas Santiago, director of Macroeconomic and Financial Analysis at MAPFRE Economics, doesn’t believe that the U.S. dollar will cease to be used massively in the short term and explains that de-dollarization must be analyzed from three different viewpoints: foreign exchange reserves, global trade and international financial transactions.

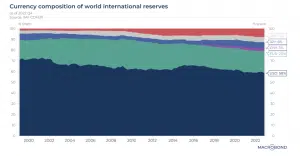

With regard to the former, the data show that, although the dollar is still by far the currency of choice for transactions, it has been steadily losing share and relevance as a component of central banks' global foreign exchange reserves, dropping from 70% to 58% in the last 20 years, as can be seen in the accompanying chart.

MAPFRE Economics' director of Macroeconomic and Financial Analysis explains that this decline may also be due to the rapid rise in interest rates: reserves in many countries are through public debt, so as rates rise “the discounted present value goes down.”

“It's not that bonds have been disposed of, but that they are worth less,” he points out, adding that at times of monetary tightening in the United States, some countries whose currencies have depreciated against the dollar get rid of their reserves in this currency to try to boost their own. “However, this doesn’t always work,” he says.

As far as global trade goes, the dollar remains the predominant currency. “Using dollars for invoicing is the most typical scenario because it's the most stable currency, and that's why it's the most used currency to agree contracts,” he says.

One exception could be seen in Eastern countries in terms of raw materials and energy. For example, the launch on March 26, 2018 of renminbi futures for crude oil and gas was seen as a clear threat to the petrodollar’s supremacy, although in 2023, the U.S. currency remains the main instrument for exporting oil and gas.

However, as international oil economist and global energy expert Professor Mamdough Salameh noted in an article, the country's economy is not purely market-based, so the government would have asked a number of national companies to carry out their transactions in renminbi. Five years later, “the amount being negotiated in this way is still much lower than the dollar-denominated volume,” says De Cadenas Santiago.

The last viewpoint to consider is international financial transactions, and the conclusion here is in line with the first two aspects: more than 95% of cash flows passing through the Swift system are denominated in dollars. There are exceptions with a country that has trade cash flows in renminbi, such as Argentina, which in the opinion of De Cadenas Santiago, could pose a significant risk.

De-dollarization in the current geopolitical environment

Deglobalization is a phenomenon that has been developing for a few years now, and it would seem to have gathered steam in the last three years, spurred on by the pandemic and the outbreak of the war in Ukraine, and its impacts can be felt across the board, especially in economics.

De-dollarization is only one of its consequences. Although this topic has been on the table for some time now, it has come to fore in recent weeks on the back of rumors that some countries were in talks to create a common currency that would enable them to transact among themselves.

De Cadenas Santiago pointed out that more than deglobalization per se, there would appear to be a change taking place based on the relocation of value chains, which would in turn more clearly define the sphere of influence if individual currencies. For example, if the European Union manages to complete the unification of capitals, the euro would be strengthened in the eurozone's border areas.