The impact of a close US election on the markets

Redacción Mapfre

Article by Jonathan Boyar, principal of the Boyar Value Group and Advisor to the MAPFRE AM US Forgotten Value Fund:

The U.S. midterm elections took place on November 8, and though not all the votes have been tallied, the Republican “wave” that some in the GOP predicted does not appear to have materialized. According to Bloomberg News, President Biden (despite his low approval ratings) will be able to claim the best midterm performance for an incumbent president’s party in over 20 years.

As of this writing, the Republicans do seem poised to take control of the House of Representatives by a slim margin (with some races still too close to call, a Democratic victory is theoretically possible but highly unlikely), but control of the Senate (currently in Democratic hands) might not be decided until early December. (Republicans will need to win two of the three contests in Nevada, Georgia, and Arizona. In Nevada, counting of mail-in ballets will continue for several days, in Arizona the race is still too close to call and Georgia is headed for a runoff election on December 6, as no candidate received more than 50% of the votes.)

Regardless of the outcome, we believe that investors should not make significant changes to their portfolios based on election results. David Dubofsky wrote in Barron’s that the stock market has historically been strongest under a Democratic president with a divided or Republican Congress, but by his own admission, his sample size is incredibly small. Of the 19 presidential elections since the end of World War II, only 10 brought a change in the party occupying the Oval Office. Likewise, the 38 Congresses during that same period saw only 8 changes in control of the House and just 14 in control of the Senate. So no matter how high emotions run over politics, investors would do well to keep their emotions in check and focus instead on the fundamentals of the companies they own or would like to buy.

One of the outcomes of this narrowly divided government is that both parties will have difficulty advancing their agendas (which, depending on whom you ask, could be a positive or a negative). The positive, from the market’s perspective, is that fiscal spending could decrease significantly, giving the Federal Reserve a reason to pause or at least slow the pace of its interest rate hikes. However, divided government could cause future stock market volatility, potentially through a government shutdown or a debt ceiling showdown, which in 2011 led to a credit downgrade of U.S. sovereign debt and an accompanying stock market swoon. Hopefully members of Congress still remember that unfortunate episode, in which both sides of the aisle were chastised for their inability to compromise.

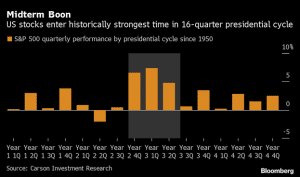

Either way, we are now in the most bullish period of the 16-quarter U.S. presidential cycle, according to data from Carson Investment. Since 1950, the fourth quarter of midterm years and the following two quarters have historically been the strongest, delivering respective average gains of 6.6%, 7.4%, and 4.8% for the S&P 500. What’s more, according to data from Bespoke Investment Group, since World War II, year three of the presidential cycle (2023 in the current cycle) has been by far the strongest, with the S&P 500 advancing 14% on average and ending in positive territory 83% of the time.