These are the main risks to the economy over the next two years

Redacción Mapfre

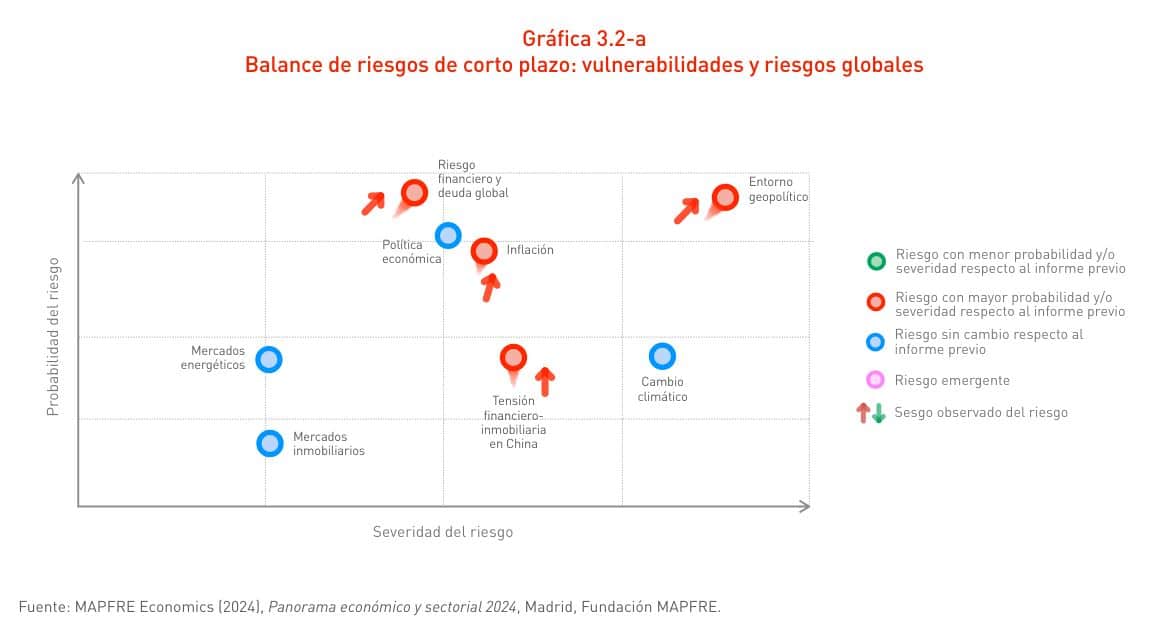

The Economic and Sector Outlook produced by MAPFRE Economics sets out a framework of risks for the next two years, focusing primarily on the global economic slowdown, uncertainty in monetary and fiscal policy, moderate but persistent inflation, and the influence of geopolitics and international markets on the global economy. The likelihood and impact of these risks vary, but they all present significant challenges for the global economy in the coming years.

Present since 2018, these risks have evolved and demonstrated their interconnectedness over time, underscoring the need to address economic and geopolitical challenges holistically. The historical analysis provides a contextualized view that highlights the changing dynamics of the global environment and the importance of effective risk management for global economic stability.

Energy markets

There are several risks that underscore energy markets’ impact on the economic landscape: fluctuations in oil and gas prices, heightened tensions in the Middle East, the conflict in Ukraine, and production cuts by OPEC, among others. As a result, the intertwining of supply shocks and inflation has persisted throughout 2018, 2019, and 2020.

These elements make up a complex network of challenges that directly affect the dynamics of energy markets and, consequently, the global economy. Currently bearing significant subjective prevalence, these economic risks are intricately aligned with MAPFRE Economics’ risk balance.

The baseline scenario of MAPFRE Economics’ most recent analyses envisage some stability in energy costs, despite existing regional tensions. Nevertheless, the volatility of energy costs hinges greatly on geopolitical tensions, with a more stressed scenario looming if certain conditions arise: the conflict in Ukraine escalates or becomes entrenched amidst diminished cooperation from the West, LNG contracts are restricted to preserve winter stockpile stability, or the Middle East conflict expands regionally involving dominant powers in the area.

Inflation

Inflation, considered and mentioned since 2020, is linked to past monetary policy, the spike in energy prices, and wage renegotiations. It emerges as a persistent risk rooted in factors identified as early as 2018, such as the trade war initiated by the Trump Administration, among others. Furthermore, it has contributed to the complexity of the global economic scenario, influencing monetary policy decisions and financial stability.

As with the foregoing, it is a risk with maximum validity, probability, and cost in the short-term. At present, the baseline scenario envisions that inflation will remain contained, with core inflation continuing to moderate globally and subject to relatively muted (energy) volatility shocks. For the time being, there are no signs of second round effects or de-anchoring of inflation expectations.

However, a challenging governance landscape giving way to populist demands for price controls, intensifying wage negotiations in central Europe, labor market tightness in the United States, and the rapid escalation in the cost of certain essential items for households could readily reignite inflationary pressures. This comes at a time of heightened vulnerability due to the aforementioned conflicts.

Financial risks and global debt

Global debt, rising interest rates, balance sheet reduction policies, and geopolitical conflicts form a set of risks in place since 2018 and 2019. These intricately interrelated elements have shaped the trajectory of global financial markets and pose challenges to global economic stability. Their validity and prevalence is high.

There are four verticals through which this risk is perceived to manifest, each potentially resulting in financial stress due to liquidity and/or solvency concerns: public and private indebtedness, liquidity in the system, the solvency of certain segments in families and companies, and “exuberance” in the valuation of certain assets.

Real estate market

Risks related to rising interest rates, construction, and real estate development (especially in new commercial construction) have been significant since 2018. These elements highlight the sensitivity of real estate markets to economic and financial factors, contributing to global risk dynamics. Their high likelihood and significant severity — albeit less severe than the 2008 crisis — represent a current economic risk that could impact the restructuring of the financial system and household finances.

Economic policy

On the economic policy front, the combination of tight monetary policy, government stimulus policies, access to credit, and real estate risks has been relevant since 2018 and 2019. These variables have defined governments' response to economic challenges and have impacted risk management at a global level.

At present, economic policy appears to be succeeding in “manufacturing a soft landing.” Inflation is approaching the monetary policy target in general, and while the output gap is slightly below desirable, it is not alarming. The economic policy risk is anticipated to emanate from the monetary sphere, arising either from a prolonged delay in interest rate normalization, which could trigger a financial crisis, or from a misalignment in transmitting expectations to the market, potentially igniting a new cycle of volatility akin to that of a few years ago.

Financial and real estate tension in China

Financial and real estate tension in China, linked to economic growth, monetary policy, and real estate risks, has been a persistent concern since 2018 and 2019. This phenomenon highlights the importance of the Chinese economy on the global stage and its influence on financial stability. It’s a big and probable risk with a considerable real cost, but its central role isn’t as great as our intuition would seem to indicate, given that the Chinese economy is relatively isolated from the world, financially speaking. The risk involved relates more to its impact on activity and credit flows to emerging countries.

Climate change

The risk associated with climate change, manifested in extreme weather events, energy transition, and impact on competitiveness, has been present since 2019. This risk highlights the need to address environmental vulnerabilities and their connection to global economic activity. Despite having an enormous implicit cost and being a proven fact, the global psyche perceives it as a distant and, therefore, relatively minor risk.

Global governance and geopolitical environment

The ramifications of geopolitical conflicts are innumerable and act through various channels on the economic, political, social, governance, and even health levels. The significance of these risks has surged notably above others since 2019, a year marked by a hardening of North-South rhetoric.

Geopolitical risk entails not only short-term transitory costs, but also permanent ones. The transformation of value chains, technological dominance, military superiority, and coercive power are long-term expressions of these risks.